There is not a day goes by where we or other analysts report on the latest development in the smartglass market. New devices and new software are released quite frequently. While there is no word on the success in the market, many see this development as the start of a new era for consumer electronics.

From a market perspective we see mainly two types of companies investing in augmented, and for that matter also virtual reality. There are the small companies that develop new technology to facilitate the needs of smartglasses and then there are the large companies that want to get a foothold in this potential market space. So far the large companies investing in this technology are Google, Microsoft, Sony and Epson. Small technology companies include Vuzix, Metaio, ODG, Meta, Atheer and others. Oculus started as a small company that was acquired by a large company (Facebook) to develop its hardware for consumer use. To a certain degree, this is also true for the purchase of IP from ODG by Microsoft, which may have also helped in the development of Microsoft’s HoloLens device.

When we look at the large companies, we see them entering a market early, fully knowing that it will take patience and a lot of money to eventually succeed in this new market. Smaller companies often do not have cash to continue the development of their technology unless they can raise funds in the financial markets or sell enough products to fund their growth.

Vuzix is a small technology company that focuses solely on smartglasses and their underlying technology. The company was founded in 1997 and is a publicly traded company. It holds over 48 patents and has won 13 CES show innovation awards. By any measure, it has been a very innovative company for a long period of time. It also just announced its 2014 financial results, which we reported on earlier.

According to its filing, the company managed sales of roughly $2.5 million and sales growth of 33% over 2013. At the same time the cost of goods sold also increased by 33% to $2.1 million leaving Vuzix with a gross margin of 31% versus 34% in 2013. Looking at the rest of the balance sheet shows a net loss of $7.9 million ($10.1 million in 2013).

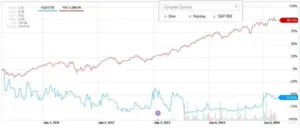

At the same time the company’s stock price shows relatively little movement (blue curve) over the last five years when compared to the NASDAQ in general (red curve). In other words, Vuzix is not a driver of technology stocks at all. At the same time its investors seem to have a lot of patience and ultimately also high expectations for the company.

When we look at revenue from goods sold of $2.5 million and assume an average of $1,000 per unit sold (they range from $500 to $1,500 and the M100 is sold for $1,000), this would lead to a number of 2,500 units being sold in 2014. Google sold far more Google Glass devices to explorer beta testers. Some may actually argue that the Google Glass Explorer program was the most successful sales of smartglasses so far. This is the reality of augmented and virtual reality devices so far.

Analyst comment

We write about and praise the technology, but no one is buying in volume yet. As a consequence, most hardware companies are focusing on the corporate and industrial markets instead of the consumer market. While volumes are small, prices are typically higher in these markets. Nevertheless, these applications often include real cost savings based on hardware and software cost. It would appear that augmented and virtual reality will not go away but grow slowly in these professional market segments. At some time in the future, the technology may also move over to the consumer world, the question is when. – NH