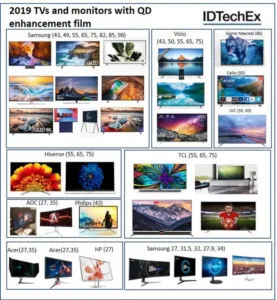

Quantum dots (QD) are a success story in displays. The diagram attached shows various QD display products released so far in 2019. The current incumbent mode of integration is film type (enhancement film). The value chain for this is well-established. The technology can be integrated in large displays (TVs) from 27” to 98”.

The improvements in cost of QD enhancement films – brought about thanks to lower barrier requirements, lower QD costs, and higher coating yields, have made possible a wide range of prices from $370 (55inch) to $3k (82-90inch). Some are now beginning to even argue that the net cost of QD enhancement film implementation can be near zero if highly bright QDs help make brightness enhancement films redundant.

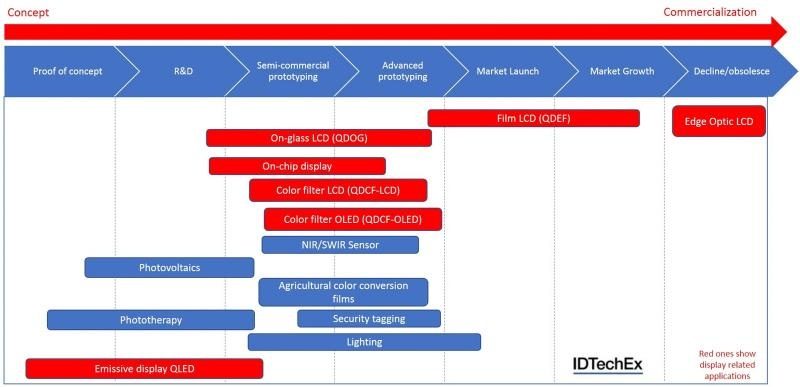

The technology, however, is experiencing rapid change. As analysed in our report “Quantum Dot Materials and Technologies 2019-2029: Trends, Markets, Players” the technology roadmap for QDs in displays include on-glass QDs, in-pixel (or color filter) QDs on LCD or OLEDs (inkjet or photopatterned) as well as emissive QLED. The QDs are also finding applications beyond displays in lighting, NIR/SWIR QD-Si hybrid photosensors, agriculture color conversion films, security tagging and so on.

Examples of QD-enhanced displays released thus far in 2019. The list for 2018 is also available upon request. Note that the supplier in all cases is Nanosys. The QD displays cover a wide range from monitor-size to 98 inches. Source: IDTechEx

In this article we provide a brief look at multiple key applications. This analysis is extracted from our report “Quantum Dot Materials and Technologies 2019-2029: Trends, Markets, Players”. This report provides a detailed technology analysis and roadmap. It provides market forecasts, in mass and value, segmented by 11 applications. It provides an overview of all the key players in the industry. It also offers a critical assessment of existing and emerging material options, material challenges, and material innovation and development opportunities.

Quantum dots in displays: roadmap

The way QDs are integrated into displays is changing. Some are seeking to evolve QD films into QD-on-glass implementation. Here, the QD is coated directly on the light guide plate and is, on one side, thin film encapsulated. This will reconfigure the value chain at the expense of roll-to-roll (R2R) film makers. It will lead to thinner solutions since the additional substrate is eliminated and the QD layer itself can be made thinner. Not everyone will adopt this in-house solution.

The next evolution is for QDs as in-pixel color converters (often referred to as QD color filters or QDCFs). The red and green QDs can be applied on sub-pixels by inkjet or via photolithographically-patterned QD photoresist. This will require high blue absorbance to ensure color purity and thin layers. It will also require good dispersion at high loading levels into the resin.

The QDs must also survive the process. In the case of photopatterned resists, the QD must survive the soft bake, the etching, the hard bake, and so on with little or no quantum yield, FWHM, or emission wavelength change. In the case of inkjet, the QDs should be formulated into printable-inks, must print well within the black matrixes, and must survive the curing (most likely thermal) process. Progress here is strong. Material suppliers, in close collaboration with QD suppliers, have developed good QD photoresists and inkjet inks. This is in an advanced stage. To learn more, please visit www.IDTechEx.com/QD

The QDCF can be applied both to LCD and OLED. In the case of the former, system-level challenges exist. In particular, the need for an in-cell polarizer is a major challenge requiring technology development and new process adaption. For the latter, the red and green QDs are to be inkjet-printed atop a continuously-applied (un-patterned) blue OLED (now fluorescent but might change in time to TADF for efficiency gains if and when TADF or hyper TADF becomes commercial). The use of printing here may give a cost-effective process for achieving high-quality large-sized QD-OLED hybrid displays that exceed the performance and cost of WOLEDs which utilize standard color filters. The use of printing will also represent a critical strategic learning towards the ultimate goal of solution-processed emissive QLEDs.

QLED: ultimate display?

Indeed, QLEDs are a major long-term topic of R&D. They can enable thin/flexible high-contrast, efficient, and wide color gamut displays. The challenges on the way, however, are still many. As such, it will be some years before we see full-color commercial products. A new QD toxicant-free chemistry is likely to be needed for efficient blue at the desired wavelength. The green and red InP QDs will likely require better shell coverage and graded alloying to eliminate internal CTE mismatches. The right organic HTL with sufficiently deep valence band will be needed to ensure good charge balance. The ETL, likely based on a printable metal oxide nanoparticle, will need to be optimized. And, of course, all production and scale-up process will be engineered too.

Today, most display firms are active. The rate at which champion results are improving on all fronts (blue EQE, luminance, lifetime at reasonable nits, etc) is high. This is an area to closely watch as it represents extensive innovation and development opportunities. To learn more please see the IDTechEx Report “Quantum Dot Materials and Technologies 2019-2029: Trends, Markets, Players”.

A snapshot of the readiness level of various QD applications. Source: IDTechEx Research

A snapshot of the readiness level of various QD applications. Source: IDTechEx Research

Image Sensors

Lead sulphide QDs can be tuned across a wide range of wavelengths, enabling NIR (near infrared) or SWIR (short-wave infrared) sensing. Interestingly, they can be integrated with a silicon ROIC (read-out integrated circuit) to create a hybrid QD-Si NIR/SWIR image sensor. This can potentially give a pathway towards high-res small-pixel silicon-based NIR/SWIR sensors, thus doing away with the need for heterogenous hybridization of GaAs sensors with Si ROIC.

The first generation of products is already on the market. A leading consumer electronics company was also active in this area. It had made significant acquisitions and was understood to have commission a UK QD supplier to scale up its production. This company has reportedly recently pulled the plug.

The promise of this technology remains strong. The challenges are notable too. Stability is a critical issue. Some QD- or device-level encapsulation will be required. The photostability is even more of an issue. Today, sensors can handle low light-level indoor conditions, but going outdoors in applications such as automotive will require further developments and potentially breakthroughs.

Furthermore, product optimization will be required. QD supply with high batch-to-batch consistency will be needed. The QD film will need to be cast and probably patterned. The curing is likely to be important to ensure good carrier transport but not the loss of yield due to too much compactness. This will likely require some in- or ex-situ ligand exchange. Nonetheless, this remains an exciting area with promising roadmap for future development and improvement. To learn more please visit www.IDTechEx.com/QD.

Lighting

Lighting is a high-volume and promising application. The focus has mainly been on red QDs because an efficient narrowband red at the right wavelength can boost the CRI without compromising efficiency.

The challenge has been to develop QDs with sufficient heat, humidity, and light stability to survive conditions close to the LED. It will also be very helpful to render the QD as much of a drop-in solution as possible. This will mean enabling it to be mixed with other color converters, e.g., phosphors, and to be processed using existing tools and procedures.

Today, early products are already on the market. These are probably Cd-based and are made stable using a silica shelling procedure. Some have also demonstrated sufficient stability with InP for low light level conditions and remote on-chip phosphors, but these are not yet commercially ready.

Note that on-chip types can also be useful in displays. This is because they could replace the phosphors which are used in today’s LED-lit displays. The challenge here too is ensuring good humidity, heat and light stability. In displays, both green and red QDs might be required. To learn more please see the IDTechEx Report “Quantum Dot Materials and Technologies 2019-2029: Trends, Markets, Players”.

There are many other applications in the pipeline. Some are positioning QDs as color conversion films targeted to agriculture. The idea here is that the film will modify the sun’s spectrum in a way that will boost growth and yield. Here, there is a debate as to whether narrow or broadband emitter will be best-suited, and the answer is likely to be plant-specific with no universal one-size-fits-all solution. The first generation of products is close to being launched. These are likely to be based on broadband CIS QDs. Multiple field trials have been conducted to quantitatively demonstrated the RoI and value proposition.

Note that the QD stability challenge, as ever, is present, especially as high sun exposure is expected. The QDs will be put amongst other layers in the film. Nonetheless, additional encapsulations layer may be required. The competition here includes dye-based films and LED, e.g., magenta, lights. The former can be lower cost, but its spectrum is linked to chemistry and not particle size. To learn more please see the IDTechEx Report “Quantum Dot Materials and Technologies 2019-2029: Trends, Markets, Players”.

Another application is in security tagging. Companies are developing broadband graphene or carbon QDs that can be added, in very small traces, to liquids, including petroleum products, to act as liquid-level security taggants. Some are proposing the use of QDs in phototherapy. The idea is to use the QDs to modify the color spectrum to meet a specific medical need. This technology could lead to comfortable, portable, and wearable phototherapy solutions. There is still also work on QD solar cells. This, however, remains a difficult value proposition in the medium term unless there is a major breakthrough.

The QD market is changing. The use in displays is rapidly evolving. These transitions will enable many material innovation opportunities. There are many other non-display applications in the pipeline too. This will sustain a strong market for years to come. To learn more please see the IDTechEx Report “Quantum Dot Materials and Technologies 2019-2029: Trends, Markets, Players”. This report provides a detailed technology analysis and roadmap. It provides market forecasts, in mass and value, segmented by application. It provides an overview of all the key players in the industry. It also offers a critical assessment of existing and emerging material options, material challenges, and material innovation and development opportunities.

To find out more about Printed Electronics research available from IDTechEx visit www.IDTechEx.com/research/PE or to connect with others on this topic, IDTechEx Events is hosting: Printed Electronics USA, the World’s Largest Event on Printed & Flexible Electronics, November 20-21 2019, Santa Clara, USA www.IDTechEx.com/PEUSA