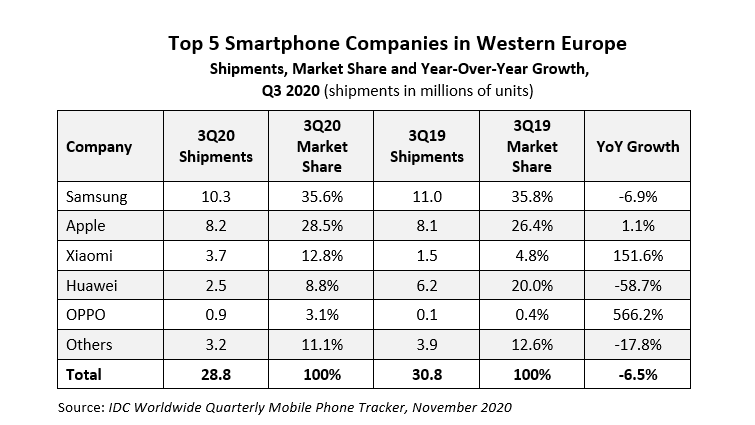

The smartphone market in Western Europe continued to be impacted by lockdowns in the third quarter of 2020, as shipments declined 6.5% year over year to 28.8 million units, according to data from International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker.

Although lockdown restrictions were lifted across Europe, the smartphone market continued to be impacted by the economic environment. While consumer spending on smartphones improved slightly, sales of smartphones to enterprises dropped 11.5% year on year as enterprises shifted spending from smartphones to notebooks.

“The consumer segment was more resilient in Q3 2020 than the commercial segment, as consumers returned to stores to buy new smartphones,” said Francisco Jeronimo, associate vice president at IDC EMEA. “Although sales online exploded in the last two quarters, the reopening of brick and mortar stores proved to be particularly important for the latest devices, as four out of the ten most sold devices in Q3 2020 were devices launched in the previous quarter. The store continues to be the place where consumers learn and test the latest novelties from vendors. Without that physical experience, consumers tend to choose the products they already know when buying online, making it harder for new brands and new products to succeed.”

Among the top five vendors, Apple, Xiaomi, and OPPO were the stars in the third quarter, delivering the strongest growth in the region. Apple benefited from strong sales of the newly launched iPhone SE (2020) and the continuous performance of its iPhone 11 portfolio. The iPhone 11 and the iPhone SE (2020) were the two best sellers in the quarter.

In the midrange, Xiaomi and OPPO continue to gain share from Huawei. Xiaomi became the third largest brand in Western Europe for the first time, while OPPO grew its market share and consolidated its fifth position.

Shipments of 5G devices reached 3 million units, up 123.1% from the previous quarter to represent 10.4% of the total number of smartphones.

IDC’s Worldwide Quarterly Mobile Phone Tracker® fills the demand for detailed and timely information on the total mobile phone and smartphone markets for handset vendors, software developers, service providers, component suppliers, and investors. It provides insightful analysis through quarterly market share data by region. This IDC tracker product delivers a quarterly web database that details the performance of the market’s individual players and answers important product-planning and product-positioning questions.

IDC’s Worldwide Quarterly Mobile Phone Tracker® fills the demand for detailed and timely information on the total mobile phone and smartphone markets for handset vendors, software developers, service providers, component suppliers, and investors. It provides insightful analysis through quarterly market share data by region. This IDC tracker product delivers a quarterly web database that details the performance of the market’s individual players and answers important product-planning and product-positioning questions.