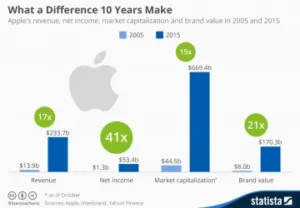

I was struck this week by a statistic highlighted by Statistica, that Apple has generated $53.4 billion in profits in the last year, making it the most profitable company of all time, with the biggest quarter of its year still to come. The growth should continue in the fourth quarter as Apple is still growing its sales because of its success in China. The company has so much cash that it’s hard to get your head around. Apple has been returning cash to shareholders by buying back shares and dividends. Despite huge spending on this, the company has $206 billion in cash (most of it held in its subsidiaries around the world to avoid triggering US corporate taxes on its profits).

I wrote some time ago, when there was talk of Apple wanting to become a key player in payments, that the company could easily buy Amex – it has enough cash to buy almost three times over based on the Amex share price at the time of writing. Just to give some scale here, $53.4 billion is close to the GDP of Croatia, Ethiopia or Bulgaria.

Of course, the success of Apple has been very largely built on the success of the iPhone and over the years I have only met one person that really didn’t like the iPhone and was looking to go elsewhere. I have met many that really loved the iPhone and the Apple “blanket of comfort”. Many of the biggest fans are non-techies that just want support and a simple life in technology. That, of course, is the mainstream and those customers are the majority in the classic technology innovation models. They will stay with the brands they trust and love for a long time. So, unless Apple does something very, very wrong, it should have a continuing long term position of strength.

There is plenty of growth left in China as the economy continues to develop, although Apple will have to continue to work hard to avoid the pricing of its iPhones coming down too much. The ASP of the iPhone in the last quarter was $670, and that is high in countries such as China where the average income is just $7,000. Given Apple’s branding, scale and control of much of its retail channel, it’s hard to see how the company could come under real threat. But where is the next opportunity?

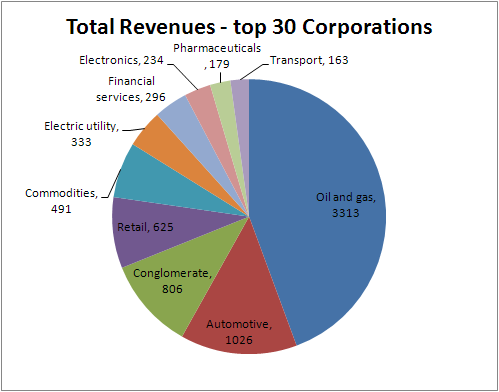

I looked at the top corporations by revenues based on the numbers at Wikipedia. These numbers effectively show why Apple is working in the automotive area and Apple Pay. If you look at the list of the top companies by revenue, it is dominated by oil & gas, and commodity companies. The biggest single company is Walmart, a retailer, and Apple is already in retail (CVS is the other retailer in the top 30). In the top 30 companies, half are in energy and commodities, where Apple’s ability to transform the user experience would have no impact. Four companies are conglomerates (including Samsung and GE) and Apple could head in that direction, although the culture of Apple has always been “to do a few things well”. Another four are in automotive (Toyota, VW, Daimler and Ford) and two are in financial services.

That’s why Apple is investing some of its huge cash pile in to automotive. It’s almost the only segment where there is a chance to transform the user experience (arguably the big Apple USP) that’s also big enough. That the market is enormously influenced by brand perception is also helpful to the firm.

Bob