Automotive display shipments have reached record levels in 2024, with revenues and display area growing significantly faster than unit shipments, according to a new report from Counterpoint tracking the industry from Q1 2022 through Q4 2024.

While display unit shipments grew modestly alongside vehicle deliveries at just 2%, display revenues increased by 5% and total display area jumped by 12%, reflecting the automotive industry’s shift toward larger and more technologically advanced screens.

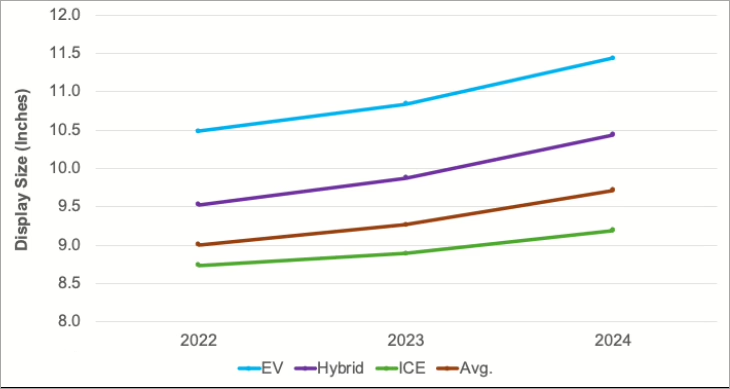

This growth disparity stems from the increasing prevalence of electric and hybrid vehicles, which typically feature displays 1-2 inches larger than their internal combustion engine counterparts. The average display size across all vehicles has grown from 9 inches to 10 inches during the reporting period.

“LTPS LCDs are gaining share for their higher mobility and smaller transistors, which translate to higher resolution, higher brightness, improved sunlight readability, lower power and lower surface temperatures,” said Ross Young, Vice President at Counterpoint Research.

The report, which covers digital information clusters (DIC) and center information displays (CID), shows that electric and hybrid vehicles have increased their share of display units from 23% in 2022 to 32% in 2024. Even more dramatically, these electrified vehicles now account for 43% of display revenue, up from 31% in 2022.

Display technology is also evolving rapidly. Traditional lower-performance a-Si TFT LCDs have seen their market share fall from 81% in 2022 to 74% in 2024, while higher-performing LTPS LCDs have grown from 19% to 26% of units. LTPS displays, which tend to be 3-4 inches larger than their a-Si counterparts, surpassed a-Si panels in revenue for the first time in Q4 2024.

LTPS backplane adoption is particularly high in electric vehicles as manufacturers seek ways to extend battery life. More premium display technologies like OLEDs and MiniLEDs represented just over 1% of units in 2024 but captured more than 8% of revenues, highlighting their use in higher-end vehicles.

Toyota maintained its position as the top buyer of automotive displays by revenue for at least the third consecutive year. China’s BYD showed the strongest growth among top-10 brands in both 2023 and 2024, overtaking Volkswagen for the second position in 2023.

Chinese influence in the automotive display market continues to grow, with six Chinese brands appearing in the top 20. They were followed by five from the United States, four from Europe, three from Japan and two from South Korea.

At the model level, Tesla’s Model Y retained its top ranking for display revenue, attributable to its large 15.4-inch LTPS LCD. BYD’s Song and Buick’s Envision followed closely behind. American-branded models dominated the top 20 with eight entries, followed by five Chinese models, three Japanese models, and two each from South Korea and Europe.