In the evolving landscape of the advanced TV market, a resurgence is anticipated in the wake of a pandemic-induced slump, according to the latest insights from DSCC. After a challenging period in 2023, where both unit shipments and revenues took a hit, a positive shift is expected to commence in 2024, with unit growth resuming and revenue growth on the horizon for 2025.

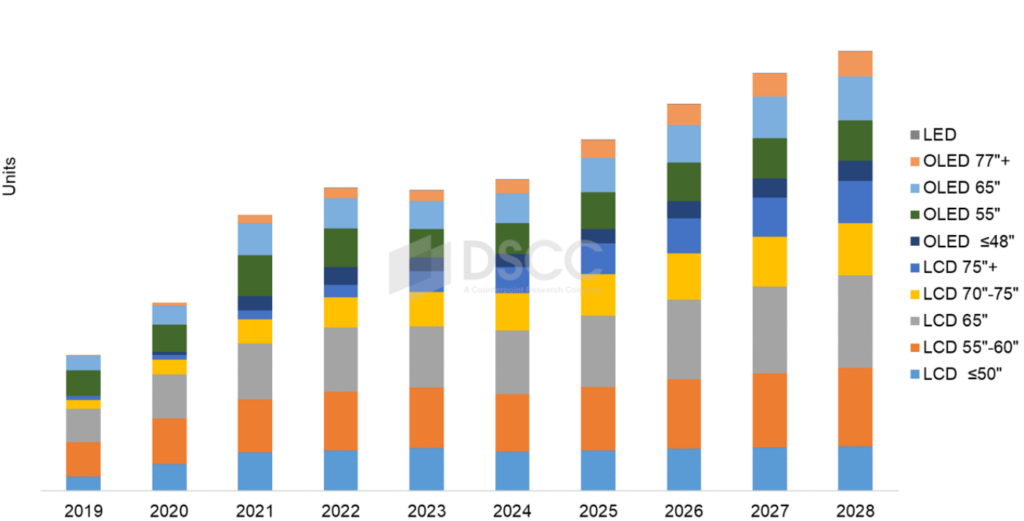

The forecast for 2024 suggests a modest yet significant recovery, with advanced TV shipments projected to increase by 4% year-over-year. Despite the overall growth in shipments, revenues are anticipated to dip by 3% year-over-year in 2024, with declines observed across both OLED and Advanced LCD TV segments. However, the longer-term outlook remains optimistic, with an 8% compound annual growth rate (CAGR) predicted for total advanced TV shipments from 2023 to 2028.

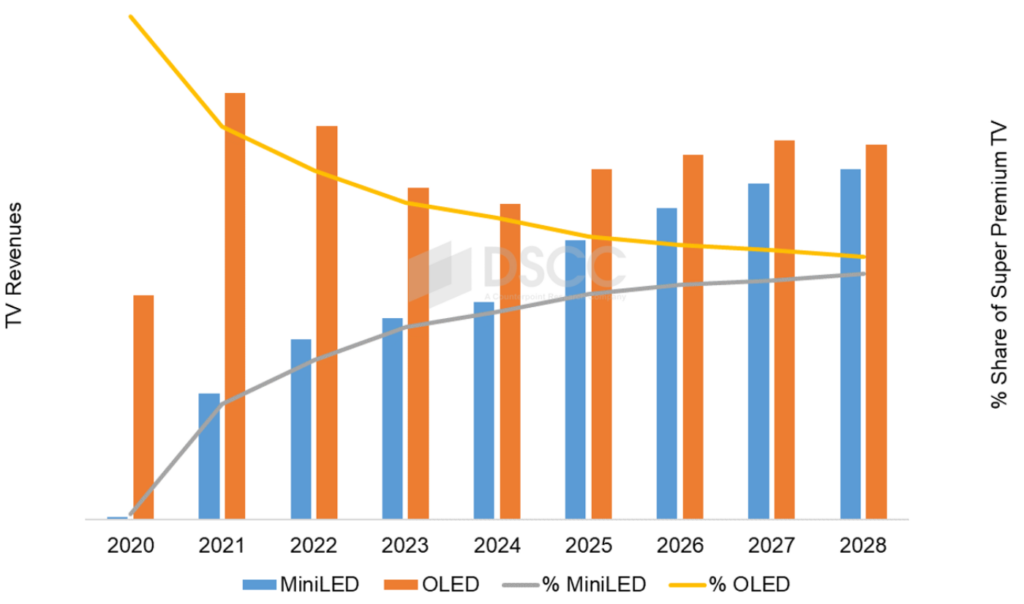

The market dynamics between OLED and MiniLED technologies have been a focal point, especially in the super premium segment. While OLED has maintained its premium positioning with higher prices and stronger brand recognition across various screen sizes, MiniLED has emerged as a formidable contender, particularly in the 65”/75” segment, attributed to its cost-effectiveness and lower production costs for panels exceeding 75 inches.

MiniLED’s market share within the premium category (encompassing both MiniLED and OLED TVs) has seen an upward trajectory, reaching 40% in 2023. Moreover, forecasts indicate that MiniLED unit shipments could potentially overtake OLED by 2027, underscoring a significant shift in consumer preferences and technological advancements.

Revenue trends further illuminate the competitive landscape, with OLED TV revenues experiencing a decline after peaking in 2021, whereas MiniLED has witnessed growth. The revenue share of MiniLED TVs within the premium category rose to 38% in 2023, and this upward trend is expected to continue, even as OLED TV revenues are projected to rebound starting from 2024.