We were reasonably on time this week and we have plenty of news for you. A software glitch that we didn’t spot at the time meant that a couple of Display Daily articles didn’t make it into last week’s LDM, so we’ve included them this week. That, plus the report on the Technology Exposed event and the coverage from the Display Summit means a full issue for LDM.

There is quite a lot of coverage of different issues of microLED this week. It’s clear that a huge amount of work is going on ‘just below the surface’ on this technology and there are, I think, a number of reasons for this. First, Samsung and LG have adopted a different approach for OLED than they had for LCD. LCD developed so rapidly and drove out other technologies partly because everybody used much the same supply chain and technology in manufacture. Corning dominated glass, Merck ruled LC materials, 3M was top in films and everybody bought from the same equipment companies. That drove down cost very quickly, but it also meant that LCD has been too near to being a commodity and that has made it very hard to make profit.

To avoid this kind of problem, Samsung and LG (and especially the former) have really run their OLED businesses as unique and closed supply chains. They tried to stop anybody getting access to their technology and suppliers and tried to keep their know how in house. As we have reported in the past, the police in Korea have been involved in dealing with allegations of theft of intellectual property between the companies. The Korean government is also worried about OLED knowledge leaking into China. This ‘closed’ policy has worked so far, with Samsung totally dominating small OLED and LG doing the same for large OLEDs (although the conflict between the two keeps each in its own space).

The problem with this approach is that it leaves others out in the cold. That gives those without access to OLED secrets and closed supply chains a huge incentive to develop alternatives and that is, I think, the first reason for the interest in MicroLED.

The second reason for the interest in MicroLED is that it is fundamentally very attractive in what it should and could deliver in terms of brightness, lifetime, efficiency, colour, response time and viewing angle. What’s not to like in that list?

The third reason is that the Chinese regard LED displays as a technology that can be owned by that country. LCD and OLED are seen as Japanese and Korean, but there is a motivation to make LED the technology of the Chinese industry.

Finally, of course, it is a different technology and every time we see a new technology come onto the scene, we see significant numbers of companies that feel that they can use the disruption of a new technology arrival to jump into the market, “catching the new wave”. It helps if the technology is significantly different from the incumbent technology. Of course, most of those companies that want to jump in will fail, but that doesn’t stop a lot from trying. One of the attractions of microLED is that it is pulling in companies that have skills, such as in LED making and printing, that have no possibility of getting into the LCD or OLED business.

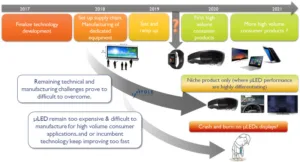

As we report from the Display Summit, there’s no guarantee, yet, that microLED will make it, although, if I was a gambling man, I’d bet on it.

Bob