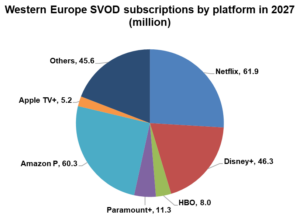

Western Europe will have 238 million SVOD subscriptions by 2027, up from 165 million by end-2021. Six US-based platforms will account for 81% of all SVOD subscriptions by 2027. Netflix will have 62 million subscribers by 2027 – 3 million more than 2021.

Subscriptions are flat for 2022 due mainly to increased competition. Netflix’s share of the total will fall from 36% in 2021 to 26% by 2027.

Disney+ will have 46 million subscribers by 2027 – 20 million more than 2021. Newcomer Paramount+/SkyShowtime will add 11 million subscribers and HBO Max will bring in an extra 5 million.

Western European SVOD revenues will total $25 billion by 2027 – up from $16 billion in 2021. The UK will remain the SVOD revenue leader.

Simon Murray, Principal Analyst at Digital TV Research, said: “Netflix will slowly lose SVOD revenues as we assume that it will convert its cheapest tier to a lower-priced hybrid AVOD-SVOD tier. Any SVOD revenue shortfall will be more than covered by its AVOD revenues. Netflix will remain the SVOD revenue winner, although its share of the total will fall from nearly half in 2021 to a third in 2027.”

Murray continued: “We do not expect many more price rises due to the intense competition. We assume that Disney+ will follow its US example by converting its present tier to a hybrid AVOD-SVOD one and charging more for an SVOD-only tier.”