The investment was announced by Telangana Industries Minister KT Rama Rao and the fab investment will take advantage of a $10 billion Semicon India programme, designed to boost high tech industry in the country. As Bruce Berkoff was fond of saying “Engineering beats science and economics beats engineering, but politics beats economics”. (although Paul Gray of Omdia has pointed out that in the very long run, economics beats politics – see the fall of the USSR).

The investment was announced by Telangana Industries Minister KT Rama Rao and the fab investment will take advantage of a $10 billion Semicon India programme, designed to boost high tech industry in the country. As Bruce Berkoff was fond of saying “Engineering beats science and economics beats engineering, but politics beats economics”. (although Paul Gray of Omdia has pointed out that in the very long run, economics beats politics – see the fall of the USSR).

In the big picture of things and very long term, it seems almost inevitable that something like this would happen. The Chinese government backed the financing of the development of the display industry in China to ‘capture more value’ in China for, in particular, the TV market. Famously, it had learned the lesson from the success of the iPhone – where although it was built in China, little of the value, early on, stayed in the country. The money for the displays went to China, for the semiconductors to several countries including the US, Taiwan and Japan, for the software, design and marketing went to the US and very little was left in China – just a few dollars to Foxconn for the assembly. I remember reading data that the value of LCD imports to China was one of the most valuable commodities after oil and coffee. I reported on the start of LCD production (for smaller panels) in 2000 and by 2006, there were joint ventures being formed to start TV LCD production in China.

Nearly twenty years ago, NEC gave up LCD saying that the business was just about the willingness to invest and China became a source of ‘almost free’ investment in the display business, with funds coming from central and regional government and companies that had to raise capital and reward shareholders found themselves increasingly squeezed out of LCD. Samsung is right out of the LCD business now and LG is declining. Only SDP (started by Sharp and now controlled by Foxconn) still makes large LCDs in Japan and AUO and Innolux are increasingly looking for value added segments away from the commodity TV market. China dominates LCD.

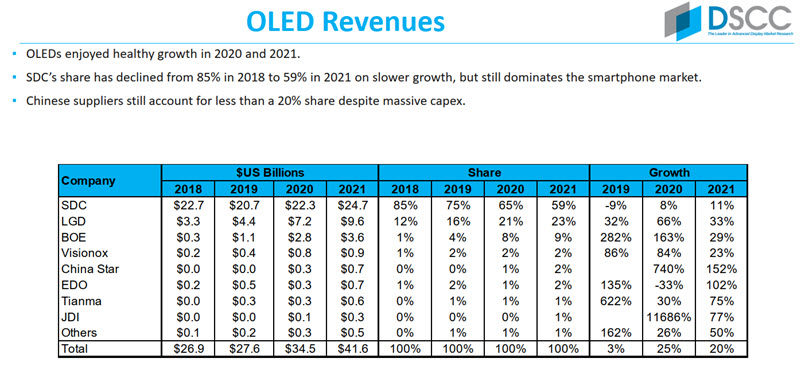

China has also tried to do the same with OLED. However, OLED displays are much harder to make and Samsung, in particular, has very jealously guarded IP and its supply chains to put ‘clear blue water’ between itself and the rest in terms of technology. All the others are playing ‘catch up’.

As was pointed out by Ross Young at the SID/DSCC Business Conference, despite huge investments in capex and huge local handset makers and markets, Chinese suppliers combined still have less than 20% share of the OLED market between them. Making good OLEDs in volume and cheaply is hard, and China had years of experience with TFT LCDs before it got started. Despite that experience and knowledge and a substantial semiconductor industry, China has struggled with OLED. (I remember hearing at SID a number of years ago that Chinese firms were offering huge sign-on bonuses to OLED engineers with experience in Korea)

OLED Revenues – Take out Samsung (SDC), LGD and JDI and the rest are Chinese, but have less than 20% market share. Source: SID/DSCC Business Conference

OLED Revenues – Take out Samsung (SDC), LGD and JDI and the rest are Chinese, but have less than 20% market share. Source: SID/DSCC Business Conference

So count me as somewhat sceptical about the venture in India. Although capex is a key factor, know how is going to be a big challenge. If there were already other India-based OLED makers with established fabs, it might be easier to lure experienced staff to the venture. Of course, the Indian makers can try to recruit from Korea and China, but with only one fab in the country, it’s hard to see that being appealing to engineers.

On the relatively positive side, the new fab is reported to be planning to be at G6. That’s not where all the new investment is elsewhere (it’s mostly planned at G8.X and aimed at newer IT applications) but at least with a G6 fab it shouldn’t be too difficult to get glass to the fab, although unless Corning or someone else decides to build a fab there, there will be significant logistic costs. (and nobody is going to build a glass fab for just one customer in India).

It’s not clear from the reports whether the investment will be to make rigid or flexible panels. At the SID/DSCC Business Conference, Ross Young listed all the new fabs that he is aware of and all the G6 fabs under development for smartphones are targeting flexible LTPS/LTPO. There are a couple planned for IT, but I would assume that the Indian fab will be looking at supplying local smartphone makers.

Rajesh Export at least seems to have a big business (reported turnover of $27 billion) and has some understanding of process industries and high technology (it’s main refining capacity for gold is in Switzerland).

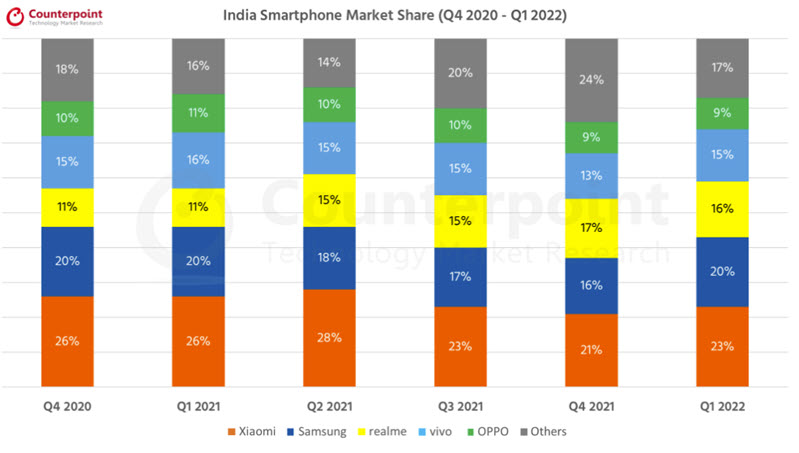

Although India is a substantial market for smartphones (39 million handsets in Q1), Counterpoint Research reports that the top five brands (Chinese & Korean) took 83% of the market in Q1. It’s not my area of expertise, but perhaps Rajesh is banking on local assembly of some of those phones as a potential market. (BR)