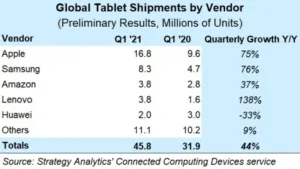

People are still working, learning, and playing from home, which has led to more demand for tablets than can be met right now, according to a new report by Strategy Analytics. Apple, Samsung, Lenovo, and Amazon all posted strong tablet results in Q1 2021 as COVID has reshaped how consumers spend time and where they get work done

Tablets are now able to meet this moment after years of productivity-focused upgrades.

Employers and employees have found key benefits in work-from-home (WFH) arrangements, which could bode well for longer term tablet usage and ownership trends.

Q1 2021 Preliminary Tablet Vendor Shipments Chart (Graphic: Business Wire)

The full report from Strategy Analytics’ Connected Computing Devices (CCD) service, Preliminary Global Tablet Shipments and Market Share: Q1 2020 Results can be found here: https://www.strategyanalytics.com/access-services/devices/tablets-and-pcs/connected-computing-devices/market-data/report-detail/preliminary-global-tablet-shipments-and-market-share-q1-2021-results-290421

Eric Smith, Director – Connected Computing said, “To find this kind of growth, we have to go all the back to Q1 2013, which is just incredible to think about. One thing to keep in mind is a favorable comparison to the dire environment the world was facing in Q1 2020. Still, continued work-from-home activity has baked in the need for real computing power in the home for each member of the household. Our surveys are showing that attitudes toward WFH are net positive even as people look beyond COVID restrictions lifting.”

Chirag Upadhyay, Industry Analyst added, “Apple had very strong performance last quarter, but so did many of its Android rivals like Samsung, Lenovo, and Amazon. Productivity is a part of most vendor line-ups now, which lends well to work and learn-from-home demand. Even as laptop demand stays hot, Windows Detachables from Microsoft, Lenovo, HP, and Dell are showing growth once again. And, as we all seek ways of unwinding at home, tablets provide flexibility in being able to enjoy videos, games, and communication.”

Most Major Tablet Vendors Showed Strong Growth as Market Grew 44%1

|

Global Tablet Shipments by Vendor |

||||

|

Vendor |

Q1 ’21 |

Q1 ’20 |

Quarterly Growth Y/Y |

|

|

Apple |

16.8 |

9.6 |

75% |

|

|

Samsung |

8.3 |

4.7 |

76% |

|

|

Amazon |

3.8 |

2.8 |

37% |

|

|

Lenovo |

3.8 |

1.6 |

138% |

|

|

Huawei |

2.0 |

3.0 |

-33% |

|

|

Others |

11.1 |

10.2 |

9% |

|

|

Totals |

45.8 |

31.9 |

44% |

|

|

Global Tablet Market Share by Vendor |

||||

|

Vendor |

Q1 ’21 |

Q1 ’20 |

||

|

Apple |

36.7% |

30.1% |

||

|

Samsung |

18.1% |

14.7% |

||

|

Amazon |

8.3% |

8.7% |

||

|

Lenovo |

8.2% |

4.9% |

||

|

Huawei |

4.4% |

9.5% |

||

|

Others |

24.3% |

32.1% |

||

|

Totals |

100.0% |

100.0% |

||

|

Source: Strategy Analytics’ Connected Computing Devices service |

||||

Windows Showing Quiet Resurgence as Vendors Refreshed Detachable Line-ups1

|

Global Tablet Shipments by Operating System |

||||

|

Operating System |

Q1 ’21 |

Q1 ’20 |

Quarterly Growth Y/Y |

|

|

Android |

23.8 |

18.1 |

32% |

|

|

iOS/iPadOS |

16.8 |

9.6 |

75% |

|

|

Windows |

5.0 |

4.1 |

22% |

|

|

Chrome |

0.2 |

0.2 |

45% |

|

|

Totals |

45.8 |

31.9 |

44% |

|

|

Global Tablet Market Share by Operating System |

||||

|

Operating System |

Q1 ’21 |

Q1 ’20 |

||

|

Android |

51.9% |

56.6% |

||

|

iOS/iPadOS |

36.7% |

30.1% |

||

|

Windows |

10.9% |

12.8% |

||

|

Chrome |

0.5% |

0.5% |

||

|

Totals |

100.0% |

100.0% |

||

|

Source: Strategy Analytics’ Connected Computing Devices service |

||||

1 All figures are rounded

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need.