We’ve been tracking GPU and before that graphics controller shipments for decades, and we think we have a sense of their trends and seasonal behavior. Most recently, our Market Watch report for Q3 2020 reveals unusual buying patterns for graphics boards and we naturally wondered, what’s up?

We’ve been tracking GPU and before that graphics controller shipments for decades, and we think we have a sense of their trends and seasonal behavior. Most recently, our Market Watch report for Q3 2020 reveals unusual buying patterns for graphics boards and we naturally wondered, what’s up?

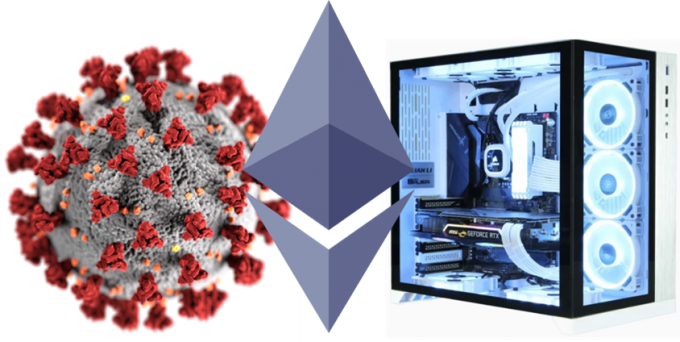

Look at the following chart that shows shipments for the past 15 years.

Discrete and integrated GPU shipments over 10 years

Discrete and integrated GPU shipments over 10 years

What we observe from this is that there is a certain seasonality to shipments, which has been distorted from time to time by factors such as recessions and crypto-mining. If we look at the past 6 months we see a dramatic rise in the sales of notebooks and the re-establishment of seasonality in desktops. Both phenomena could be attributed to COVID and working at home. But, if we segment the view to just discrete GPUs we get a different perspective.

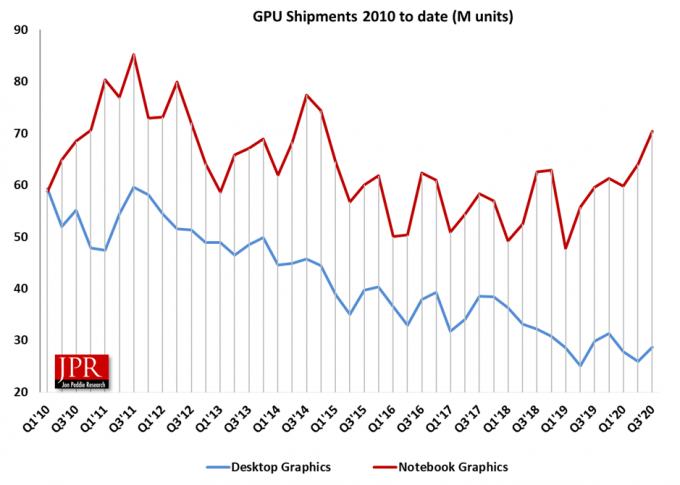

Discrete GPU shipments over 15 years

Discrete GPU shipments over 15 years

This chart indicates growth in desktop dGPUs for Q2 and Q3 2020, and that is not normal seasonality. The notebook increase in shipments can be attributed to Covid. The desktop can be attributed to Covid, and/or gaming, and/or Crypto-mining. Looking back, you can see the Crypto surge in desktop dGPUs in 2017 and 2018 and the following crash pretty clearly. The question is, are we headed into another coin-rush now?

One element fueling suspicion is the immediate buy-up of the new AIBs when AMD and Nvidia announced new GPUs in Q3 and Q4 of 2020. Automated buying bots grabbed all the AIBs that were available at various on-line retailers. The suspicion is that the AIBs were being hoarded and sold on the secondary markets at an inflated price. What’s more, the people who were buying them at those higher prices were miners. Miners have been willing to spend the extra money on their equipment when the value of coins rises. In 2020, the dollar equivalent value of coins has jumped in the past four months.

Bye bye new normal

As part of our ongoing research on the PC graphics market, we recently released our Market Watch report for the third quarter of 2020. Before 2020, the PC market was showing signs of improvement and settling into a new normal. The pandemic has distorted all models and predictions. Our Market Watch report confirms that trend for the third quarter of 2020, but with mixed results for this very unusual year.

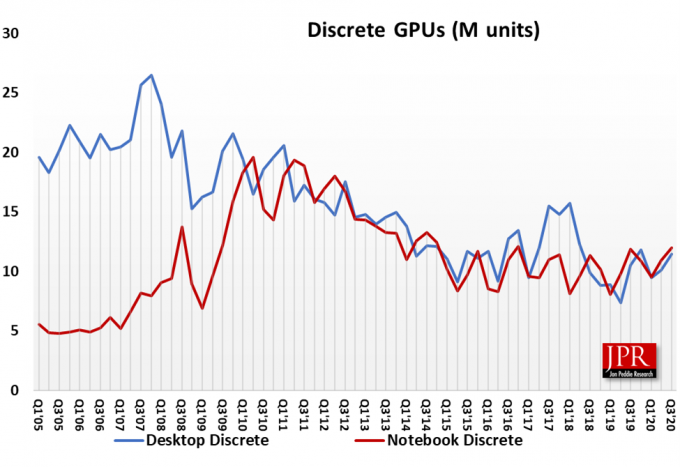

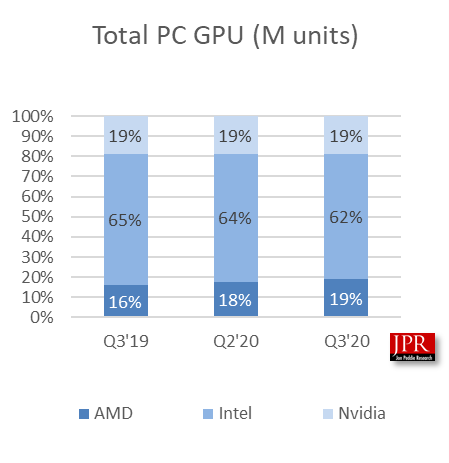

AMD’s market share from last quarter increased by 1.3%, Intel’s decreased by -1.4%, and Nvidia’s market share increased by 0.09%, as indicated in the following chart.

Quarterly market share, and year-to-year results

Quarterly market share, and year-to-year results

Overall GPU shipments increased by 10.3% from last quarter, AMD shipments increased 18.7%, Intel’s shipments rose 7.8%, and Nvidia’s shipments increased 10.8%.

Quick Highlights

- AMD’s overall unit shipments increased by 18.7% quarter-to-quarter, Intel’s total shipments rose by 7.8% from the last quarter, and Nvidia’s increased 10.8%.

- The GPU’s overall attach rate (which includes integrated and discrete GPUs, desktop, notebook, and workstations) to PCs for the quarter was 122%, up 0.6% from last quarter.

- The overall PC market increased by 9.75% quarter-to-quarter and increased by 9.47% year-to-year.

- Desktop graphics add-in boards (AIBs that use discrete GPUs) increased by 13.44% from the last quarter.

- Q3’20 saw an increase in tablet shipments from last quarter.

The third quarter is typically the strongest compared to the previous quarter. Q3’2020 was no exception, showing healthy growth.

GPUs are traditionally a leading indicator of the market since a GPU goes into every system before the suppliers ship the PC.

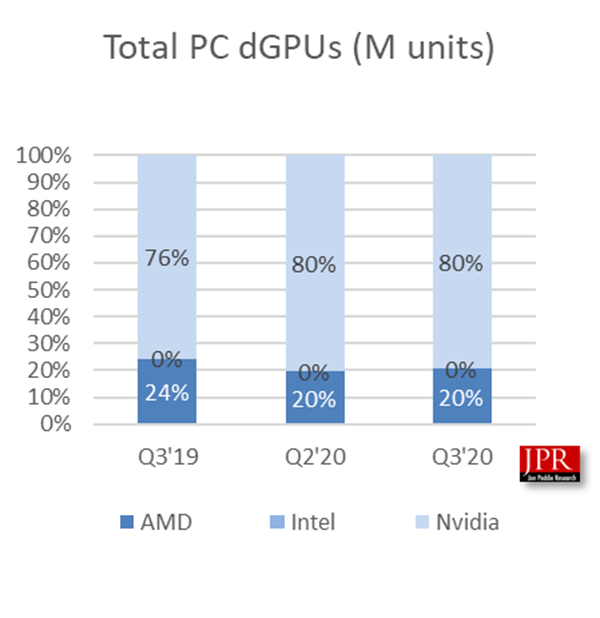

PC dGPU shipment market shares

PC dGPU shipment market shares

The third quarter behaved seasonally as it has in the past, with the quarter-to-quarter change of 10.3%, Q3’2020 outperformed the ten-year average growth for graphics shipments of 9.7%.

The quarter saw shifts in market shares from the previous quarter and year-to-year. In the third quarter, AMD and Nvidia showed outstanding results, with Intel remaining steady.

Factors influencing the robust sales of AIBs in the past two quarters have clearly been increasing growth in gaming, and the need to outfit home offices due to COVID. And now, there’s the growing realization that mining for cryptocurrency is coming into play.

Until recently we saw the power consumption of AIBs greatly diminishing the payoff for crypto-mining, but as crypto-currency prices are going up so the equation is shifting. Ethereum, the best-suited coin for GPUs, is forking into version 2.0 very soon, making GPU mining obsolete … eventually. The shift to Ethereum 2.0 is not happening right away and miners have a grace period. They may be making the most of it.

What do we think?

Most of the semiconductor vendors are guiding up for the next quarter by an average of 1.25%. That’s up, but it’s not way up. Some of that guidance is based on normal seasonality, but there is also a Coronavirus impact factor as people invest in notebooks for remote work. A vaccine may be on the way, but many remote workers have made it clear that they’d prefer a hybrid approach for the future. If there is indeed a significant interest in crypto-mining that guidance could change. (JP)

This article was originally published on Jon Peddie’s Techwatch at Jon Peddie Research and is re-published with permission.

Dr. Jon Peddie is a recognized pioneer in the graphics industry, President of Jon Peddie Research and named one of the most influential analysts in the world. He lectures at numerous conferences and universities on topics pertaining to graphics technology and the emerging trends in digital media technology. Former President of Siggraph Pioneers, he serves on advisory board of several conferences, organizations, and companies, and contributes articles to numerous publications. In 2015, he was given the Life Time Achievement award from the CAAD society Peddie has published hundreds of papers, to date; and authored and contributed to eleven books, His most recent, “Augmented Reality, where we all will live.” Jon has been elected to the ACM Distinguished Speakers program.

Well, actually Jon’s latest book is here. I have bought it, but haven’t yet read it. However, his last book was the last fiction book I read and it was a pacy topical thriller! (BR)