Huawei overtook Samsung to take the leading position in the Russian smartphone market in the second half of 2019, as consumers flocked to purchase the Chinese telecommunications firm’s affordable handsets.

Huawei overtook Samsung to take the leading position in the Russian smartphone market in the second half of 2019, as consumers flocked to purchase the Chinese telecommunications firm’s affordable handsets.

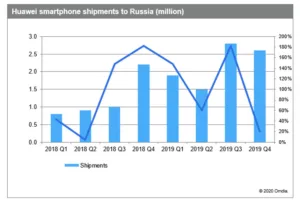

During the second half of 2019, Huawei shipped 5.4 million smartphones to Russia, a dramatic 145 percent increase from 2.2 million in the second half of 2018, according to the new Omdia report, Smartphone Market Report – Russia – H1 2019.

Huawei’s share totaled 31.7 percent in the third quarter and 29.3 percent in the fourth quarter, allowing the company to overtake market leader Samsung by 3.2 and 4.2 percentage points in the third and fourth quarters respectively.

For the entire second half, Huawei shipped 600,000 more units than its rival Samsung.

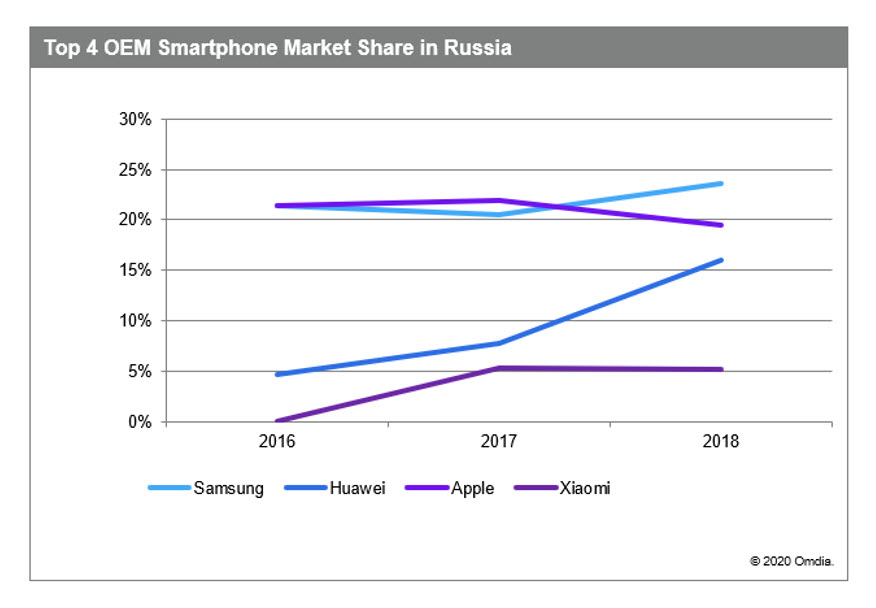

“Before 2017, the dominant smartphone brands in the Russian market were Samsung and Apple,” said Anna Ahrens, senior analyst, smartphone and mobile, for Omdia. “Huawei entered the Russian market in 2015, marking the company’s first overseas foray. During the past two years, Huawei has dramatically increased its market share in the country, overtaking Apple in the fourth quarter 2018 and surpassing Samsung in the second half of 2019.”

Honor brand spurs Huawei’s success

Most of Huawei’s shipments in the price-sensitive Russian market are lower-priced devices in the Honor series. The Honor 7, Honor 8 and Huawei Y series made up more than half of the company’s shipments in Russia in 2019. Huawei’s latest flagship models, the P and Mate series, were responsible for less than 10 percent of company shipments.

The price positioning for Huawei and its sub-brand Honor is in line with the development of the Russian market, promotional activity and Huawei’s strong brand recognition contributed to the company’s success in Russia in 2019.

No Google, no problem for Russian consumers

Following the U.S. ban on Huawei, Google suspended transactions with the company, meaning that Huawei lost access to Google apps and services in new phones.

However, users of affordable phones in Russia seem less concerned about the unavailability of Google services in the future if they can still access them with their current devices. This is a key difference compared to markets with higher shipments of Huawei flagship phones, like Western Europe. Another unique feature of the Russian smartphone market is the wide adoption of the domestic mobile applications. Those specific aspects of the Russian smartphone market helped propel Huawei’s sales and allowed the brand’s image to recover after the sales drop in the second quarter of 2019, right after the U.S. ban announcement.

Russia smartphone market grows by double digits in 2019

For the entire year of 2019, 34 million smartphones were shipped to Russia, an increase of 12 percent year-over-year. A stable economy, the ongoing replacement of feature phones and the increased variety of affordable phones in the market fueled the growth. The major OEMs benefitted from these favorable market conditions.

For the whole year of 2019, Samsung retained its market leadership position for a second year in a row, with a 27.8 percent share of shipments in 2019, up from 23.6 percent in 2018. The company shipped 9.5 million smartphones, its best-ever result in the Russian market.

Huawei closely followed Samsung with a 26 percent market share, up from 18 percent in 2018. Apple remained number three, although its market share declined for a second year in a row, from 21.9 percent in 2017, to 19.5 percent in 2018 and 13.4 percent in 2019. Apple’s premium pricing strategy does not correspond with the latest Russian market developments, and the brand is losing volume to OEMs that have a broad mid-range lineup, like Samsung or Huawei.

Xiaomi was ranked fourth, with 4.1 million units shipped, coming very close to Apple’s shipment volume of 4.6 million units. The company’s market share increased from 4.3 percent in the fourth quarter of 2018 to 12 percent in the fourth quarter of 2019.

With growing sales from Huawei and Xiaomi, the combined share of Chinese brands in Russia grew to 48.8 percent in 2019, compared to 40 percent in 2018.

After the worldwide spread of the coronavirus, Omdia reduced its forecast for Russia for 2020 to 29.8 million units, down from 33.1 million units. Year-over-year, the market is now set to decline 12.6 percent in 2020 and is expected to start recovering in 2021.