In the run-up to the holiday period there were a number of news items about problems at LCD maker, Chunghwa Picture Tube (CPT), that fit my definition of ‘an inflection point’. It got me thinking (again) of the word that I learned from David Barnes, when he gave a talk at SID some years ago.

David explained that one of the features that has led the LCD industry to be the way it is is that LCD fabs are ‘fungible’. That’s the term that economists use to describe a manufacturing facility that is very flexible and can be used for many different purposes. So, a factory that was originally designed to make one kind of LCD can be modified to make another kind. This fungibility has allowed LCD makers to respond to different requirements, but has also allowed them to stay in business in different economic and industry conditions.

A classic example of this is Hannstar of Taiwan, that had one LCD fab that was designed initially to be optimised for making 19″ 5:4 monitor LCDs. When other makers built bigger and more efficient fabs that could undercut the pricing of Hannstar, the company moved to different panels and for some time the firm was the largest supplier of panels for netbooks (remember those small notebooks?). It then moved on to making panels for mobile devices and touch panels.

The effect of this flexibility is that it effectively keeps the larger panel suppliers ‘honest’. One strategy sometimes adopted by big companies (not particularly LCD makers) is to take advantage of economies of scale to drive out competition and then exploit monopolistic supply (or close to monopolistic capacity) to drive up prices and make profit. The fungibility of LCD supply make this very difficult. If big panel makers were to drive others out of a category, such as the 19″ panels mentioned above, if they push the prices up, a company such as Hannstar could see the opportunity for more profit to come back into the market, pushing pricing back down again.

The result is that it is very hard for LCD makers to make fat profits over the longer term, unlike, for example, semiconductor chip makers who can use scale to dominate a category and then exploit a high market share to boost profits. My view is that this is the reason that even LG and Samsung, when at times they had over 50% of the capacity of the industry, have struggled to make really good profits. I wrote in more detail about this issue in a Display Daily article last year (Why LCDs are Not Just Big Chips)

Anyway, in discussions, I have often said that the LCD industry won’t see real change until companies such as Hannstar can no longer survive. The company has no chance of raising enough capital to construct another new fab to compete with the latest generation, but as it’s plant costs have been amortised, as long as it could stay cash positive, covering materials and labour, the company would probably stay in business.

CPT Hits a Wall

Just before Christmas, in my ‘What Bob Saw Around the Net’ articles, I pointed to several articles from the Taiwanese press that reported on real problems for CPT, another company, like Hannstar, that was built in the main wave of Taiwanese LCD investment, but didn’t get to the scale of CMO (which became Innolux and is now part of the Foxconn grouping) or AUO, which is now developing as a supplier of specialist LCD products. Unlike Hannstar, CPT did try to boost its capacity by building a G6 fab in China in 2016 (CPT Invests in IGZO OLEDs in China). However, the ramp up of this fab was slower than hoped for (we reported last summer that output was just 4K to 5K substrates a month, against a 30K per month capacity).

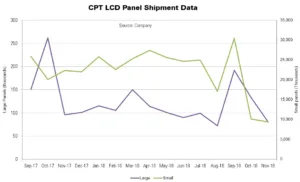

CPT’s Results show the problems it has had towards the end of the year.

Taiwanese resources reported that production had been shut down as material suppliers cut deliveries. The Taiepei Times reported that the firm had seen a net cash outflow of $264 million in the first three quarters of the year and revenues were down on last year. The company is now looking for new investment, but it’s hard to see who would want to buy the company. Over many years, it has rarely been the case that it makes sense to combine older and less efficient fabs to create new combines, when the route to survival is more likely to be to have a large new fab.

So, after many years, it looks as though we have got to the point that will see some companies drop out of the market altogether. I think it might be argued that one of the reasons is that to compete in the smartphone panel market, these days, you need not only LCD capacity, but also OLED and even flexible OLED facilities. In TV, LG Display has taken a lot of business in the premium segment and Samsung is widely reported to be looking at making Quantum Dot OLED technology. It’s not easy to change between these technologies and LCD, so the display industry may be becoming less ‘fungible’.

However, I wouldn’t bet on that improving the profitability, at least in the short to mid term! (BR)