Consumers are becoming accustomed to AR technology on their smartphones through apps such as Snapchat and Pokémon Go, yet AR headsets such as Google Glass and Microsoft HoloLens remain a niche product, with sales barely into the hundreds of thousands of units. Strategy Analytics’ latest reports on AR examine the factors which will drive growth and consumer uptake in the AR headset market. Report author David MacQueen said:

“2013 and the launch of Google Glass really kickstarted the dedicated AR device market. Although the device was not a commercial success, the potential of AR became clear and the hype around it saw Google, Apple, Microsoft and other major players make serious investments in the AR field. Five years on, and much of that technology has found its way into smartphones, while dedicated AR headsets have remained a niche product.

The major factor holding back the market for dedicated AR devices today is simply the cost of the hardware. In a typical enterprise deployment, this is not a major issue, as the hardware itself is a relatively small part of the cost. The consumer market is much more price-sensitive and this is amply demonstrated by the relative success of the low-cost $200 Lenovo slot-in Mirage AR headset, which drove the market to new heights in 2017.

Despite the product instantly becoming the top-selling AR headset of all time, it only moved the needle slightly, increasing total shipments from the tens of thousands of units to the hundreds of thousands”.

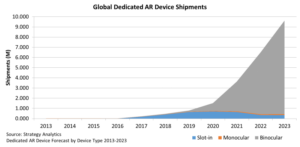

The report found that slot-in AR devices account for the majority of shipments and users today, but binocular AR units (such as HoloLens) will become increasingly important as the market evolves toward devices which offer higher-quality experiences. Strategy Analytics expects total shipments to reach just under 10 million units globally by 2023, but with further growth projected beyond that as ASPs continue to decline to more consumer-friendly levels.

Executive VP David Kerr added:

“AR is suited to

a wide variety of use cases and could conceivably be used to augment almost any category of application or service. As well as adding richness to existing services, it also opens up possibilities for entirely new apps and services. So, despite a slow start, the potential upside is huge. But for the market to grow significantly, it is the consumer market (rather than enterprise) which must drive volumes.

Key consumer use cases, including gaming, marketing and search, require a device capable of delivering rich 3D graphics. The successful devices in the consumer market should be lower cost than — yet similar in functionality to — current cutting-edge technology. To drive the price down to a consumer-friendly price point for an AR device with a stereoscopic 3D view, it is likely that some of the functionality (and therefore, component cost) will be shifted to a smartphone. Strategy Analytics believes that smartphone OEMs are the most likely contenders to succeed in the longer term”.