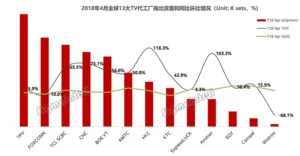

In April 2018, the world’s 13 largest TV OEM factories shipped 7.2 million units, an increase of 30.6% over the same period in 2017 and a decrease of 3% over March 2018, according to a new report from Sigmaintell Research. In a month which is usually quiet for the industry, the sector was driven by shipments from overseas markets this year.

In particular, an increase in shipments to North America and Europe largely contributed to the abnormal growth of the OEM market in April.

Analysts indicate that the growth seen in April was partly due to the promotion of OEM factories, rather than actual demand. They are predicted to drop back in May after four consecutive months of year-on-year growth in the first four months of the year.

TPV shipped 1.25 million units, ranking first, an increase of 5.9% over the same period in 2017 and a decrease of 5.3% from March 2018. Its Philips brand is still the main force behind its shipments. It mainly exports to Europe, which analysts say has been ordering extra stock in time for the World Cup.

Foxconn shipments reached 990,000 units, ranking second, a decline of 10% from the same period last year and 5.3% from the previous month. The company’s shipments have fallen year-on-year for two consecutive months. This year, its Sharp brand’s shipments have been sluggish thanks to the promotion of various other brands.

TCL SCBC shipped 910,000 units, ranking third, a growth of 65.5% over the same period in 2017 and an increase of 1.1% from the previous month. In April, Xiaomi accounted for 27% of total TCL shipments in the domestic market. Its shipments have increased substantially in overseas markets, such as Southeast Asia and Latin America.

CNC shipments reached 830,000 units, ranking fourth, an increase of 75.1% over the same period last year and a decrease of 3.5% from March 2018.

BOE VT shipped 780,000 units, ranking fifth, a growth of 56% over the same period and a decline of 4.9% from the previous month. This year, with profit as the main objective, the company maintained steady growth in terms of volume. In overseas markets, its main source of growth in April was the Middle East, Africa and North America.

As for other TV OEM factories, Sigmaintell’s research shows that AMTC shipped 600,000 units in April, driven by growth in Eastern Europe and Latin America, an increase of 50% over the previous year. HKC maintained 500,000 units shipped in April, a growth of 118.3% over April 2017. KTC shipped 430,000 units in April, an increase of 42.9% over the same period last year.

Express Luck shipped 310,000 units, an increase of 3.3% over the same period last year. Amtran maintained steady growth in April and shipped 310,000, a growth of 103.3% over April 2017. SQY shipped 170,000 in April, which represented an increase of 10.4% over the previous year.