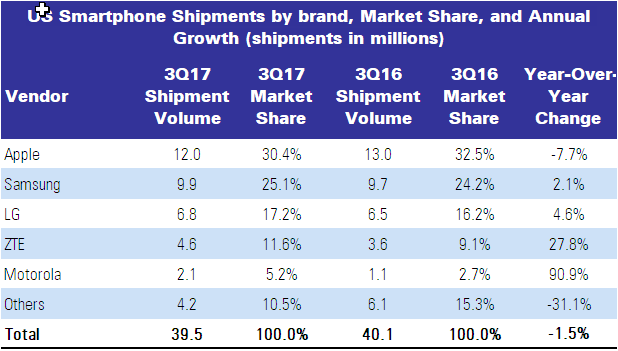

Strategy Analytics reported that US smartphone shipments were 39.5 million in Q3 2017, down 2% from 40.1 million last year, with Motorola, owned by Lenovo, growing from 1.1 million last year to 2.1 million, with its share growing from 2.7% to 5.2%.

Ken Hyers, Director at Strategy Analytics, said, “

The US smartphone market slowed down, due mostly to mixed demand for new iPhones from industry leader Apple.”

Other executives added these comments:

“Demand for the new iPhone 8 portfolio was mixed, while some Apple fans delayed purchases in anticipation of the later introduction of iPhone X. Samsung’s flagship Galaxy S8 performed relatively well in the high-tier, while its A5 model and others are popular in the mid-tier.”

“LG has expanded its retail presence at major operators this year, like Sprint and AT&T, and this is helping LG to stay one step ahead of ambitious new rivals such as ZTE.”

“ZTE is benefiting from strong demand in the prepaid segment, particularly with operator Tracfone. ZTE has been capturing large chunks of smartphone share from midrange rivals such as TCL-Alcatel and Blu. Motorola took fifth place and captured 5% smartphone market share in the US during the quarter, returning it to a top-five ranking for the first time since 2015. Motorola’s recovery has been driven by expanded distribution with all top four US carriers, selling popular new models such as Moto Z2 Play.”