Close to press time, we were writing up a story, widely reported by many web blogs that ran, as below:

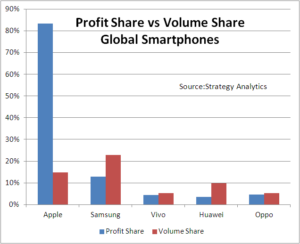

“Strategy Analytics pointed out in a report that Apple took 83.4% of the profits of the smartphone industry in Q1 2017, although it has only 14.9% of the share of the volume of the market. Samsung was the second strongest, taking 12.9%, although its share of the market was higher at 22.8% in unit terms. Oppo, Huawei and Vivo took 4.7%, 3.5% and 4.5%, respectively”

Now, call us crazy, but we didn’t like the look of the numbers. Adding the numbers up suggests that the total profit was 109%.

Separately, the company forecast that smartphone sales would grow by 7% in 2017, up from 2% in 2016, thanks to improved economic situations in selected regions / countries, as well as expected hardware innovations which would trigger strong replacement sales.

Worldwide smartphone volumes will steadily expand by +36% from 2016 to 2022. Asia Pacific remains as the biggest region, followed by North America. Africa Middle East will maintain the highest growth rate through 2021. The three largest smartphone countries by far in the next five years will be China, India and the USA, due to their massive populations.

The world’s top 20 countries will account for 79% of worldwide smartphone sales in 2017, up from 73% in 2007 – and since 2017 it will stabilize at 79%

Analyst Comment

Our analysis is that the numbers probably take into account losses by other companies. In other words, the percentages quoted represent the percentage of the net profit, after taking into account the losses by other companies. In other words, if we assume that these five are the only ones making profit, it would suggest that they made 109% of the net profit, while other companies’ losses added up to -9%. I was mainly surprised that others that picked up the report didn’t highlight the apparent contradiction. We contacted the firm to double check, but hadn’t heard back at press time.

Going back to the main story, this chart must really frustrate the management of Samsung and Huawei, although it also shows that Vivo and Oppo apparently have their business models pretty well sorted. (BR)