I’ve just got back from my first day at the SID Display Week, and I spent it at the Business Conference, run this year by Display Supply Chain Consultants, a new market research firm that is focusing on OLEDs and there was lots of news and opinion about the future of OLED which is now assured – for some years, at least! The mood at the event was much more upbeat than last year’s event.

OLED has been a “promising technology” for many years – but has finally broken through to become a major category, in smartphones and tablets, and the main display technology for the next few years in those applications. The success of OLED will be limited by the industry’s ability to supply, rather than the demand for products as Chinese smartphone makers try to match the success of Samsung’s Galaxy S8 phones, which use flexible OLEDs, and the expected success of Apple’s switch to OLED for some of its next generation of iPhones.

In TV, OLED remains a niche category, but an important part of the premium end of the market.

One of the speakers at the Business Conference was Yasuo Nakane of Mizhuo Securities who covered a topic I wrote about a few weeks ago. (Why LCDs are Not Just Big Chips)

In the article, () I talked about how the LCD business had not developed in the same way as the semiconductor business. I talked about the fact that the LCD makers suffer because of the high share of the cost that is taken by material costs. As David Barnes memorably said at a previous SID Business Conference, if you look at the margin structure of LCD makers, they really look like material resellers that have very expensive shops (the fabs that they use to make LCDs). That is to say that too much of the cost of an LCD is material cost. That makes it hard to get the full benefit of scale.

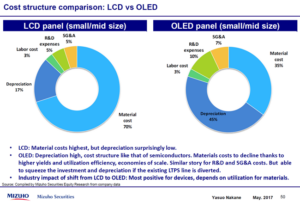

Nakane-san showed the following chart (one of 130 powerpoint slides!) in his talk.

In the early days of LCD, the depreciation cost of building an LCD fab was a big part of the cost of an LCD, but as time has gone on, the share has dropped to around 17% for small/medium panels, according to Nakane-san. However, if you look at the chart for OLED panels, you can see that the cost of depreciation is as much as 45% of the cost of a panel. That means that the technology is much more profitable if the scale can be increased as the fixed cost of the fab can be spread across more finished panels. In turn, that means that a company that has higher scale can get a significant advantage over makers with lower volume.

OLED also shows higher R&D expenses and, again, the proportion of R&D is likely to go down with higher volume.

That means that the OLED business may be more profitable in the longer term than LCD for those that can get a leading position with high yields at high volumes. At the moment, the very clear leader in small OLEDs is Samsung, which dominates more than 90% of the market for small/medium displays. The company is likely to keep that position for several years, although it is likely to be joined first by LG Display and, later, companies in China.

Samsung was widely acknowledged at the event to have several years’ advantage over the others in technology and that may persist, especially if the company can develop smartphones and other consumer devices that really exploit the flexible features of OLED, already exploited in the Samsung phones to a limited extent, but seen at the conference as a key factor going forward.

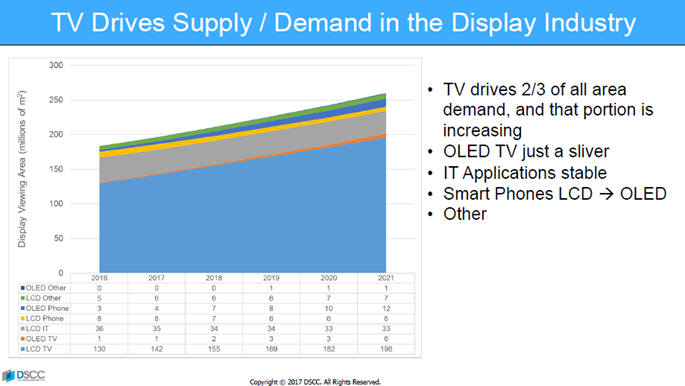

I have attended every SID Business Conference and I don’t remember an event that had less news or hype about LCD. It wasn’t helped by a ‘no show’ by Samsung, which had been due to talk about its use of Quantum Dots in LCD TVs, but, for the moment, the LCD industry, which has dominated the display industry for twenty years is now yielding to a new period where its hegemony is challenged. One of the key challenges for LCD that was discussed at the event was the move to G10.5 fabs in China. This needs a lot more people to buy big (65″ to 75″) TVs (which means that they have to be a lot cheaper, according to Stephen Baker of NPD) and also needs more photolithography equipment. The only company able to make the equipment needed for these fabs is Nikon, and it can only make limited numbers. That may limit the switch to bigger fabs. DSCC’s Bob O’Brien showed this chart of panel area sales by application and it shows the area dominance of LCD, still, and into the future.

DSCC’s Bob O’Brien showed this chart of panel area sales by application and it shows the area dominance of LCD, still, and into the future.

Of course, LCD TV is the big category, still, on an area basis and that’s what drives much of the market. The switch to move quantum dots to the front of the LCD, revealed at last year’s Business Conference, and with future products likely to be shown in 2018, according to Jason Hartlove of Nanosys, will solve some issues for LCD in viewing angles, colour and efficiency. That will make it even more formidable in TV.

There’s no doubt that these are exciting times for display analysts!