International Data Corporation (IDC) is excited to announce the launch of its newest Tracker ®research program focusing on the emerging Augmented Reality (AR) and Virtual Reality (VR) headset market. The first data published by the Worldwide Quarterly Augmented and Virtual Reality Headset Tracker focuses on OEM market sizing in the third quarter of 2016 (3Q16) and covers a wide range of products, technologies, form factors, and geographies. The historical data was accompanied by a five-year forecast that offers fresh insight into some of the leading trends in this new and evolving market.

“IDC’s Tracker research programs have long proven to be the industry standard for market sizing and forecasting,” said Ryan Reith, program vice president with IDC’s Worldwide Quarterly Mobile Device Trackers. “It is with great pleasure that we are now able to publish a robust database covering the AR and VR headset markets. The teams have been working on AR and VR technologies for over two years, so being able to finally bring the results to our clients is truly gratifying.”

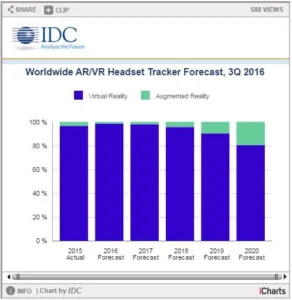

Worldwide AR and VR headset shipments are expected to see a compound annual growth rate (CAGR) of 108.3% over 2015-2020 forecast period, reaching 76.0 million units by 2020. The more affordable VR devices will continue to lead the market in terms of volume. However, IDC expects AR headsets to pick up momentum over the forecast as more affordable technologies and more OEMs enter the market. IDC is currently tracking three categories of headsets: Screenless viewers, such as Samsung’s Gear VR; tethered head-mounted displays (HMDs), such as the HTC Vive; and standalone HMDs, such as Microsoft’s HoloLens.

“2016 has been a defining year for AR as millions of consumers were introduced to Pokemon Go and, on the commercial side, developers and businesses finally got their hands on coveted headsets like Microsoft’s HoloLens,” said Jitesh Ubrani senior research analyst for IDC Mobile Device Trackers. “AR may just be on track to create a shift in computing significant enough to rival the smartphone. However, the technology is still in its infancy and has a long runway ahead before reaching mass adoption.”

“Augmented reality represents the larger long-term opportunity, but for the near term virtual reality will capture the lion’s share of shipments and media attention,” said Tom Mainelli, program vice president, Devices & AR/VR. “This year we saw major VR product launches from key players such as Oculus, HTC, Sony, Samsung, and Google. In the next 12 months, we’ll see a growing number of hardware vendors enter the space with products that cover the gamut from simple screenless viewers to tethered HMDs to standalone HMDs. The AR/VR headset market promises to be an exciting space to watch.”

|

Worldwide AR/VR Headset Shipments, 2016 and 2020 (shipments in millions) |

|||

|

Product Type |

2016 Shipments |

2020 Shipments |

5 Year CAGR |

|

VR Headsets |

10.1 |

61.0 |

100.7% |

|

AR Headsets |

0.1 |

15.0 |

196.4% |

|

Total |

10.3 |

76.0 |

108.3% |

|

Source: IDC Worldwide Quarterly Augmented and Virtual Reality Headset Tracker, December 15, 2016 |

|||

Table Notes:

- The table represents shipments of Augmented Reality and Virtual Reality headsets only. Any additional software, services, or compute devices (e.g. PC, game console, smartphone, etc.) are excluded.

- Shipments of simplistic headsets that do not have any technology built in are excluded. Examples of such headsets include Google Cardboard and other Cardboard-like devices.

- IDC defines Screenless viewers as headsets that lack a display and instead rely on the display of a smartphone. As mentioned above, this would exclude Cardboard, and Cardboard-like devices.

- IDC defines Tethered HMDs as products that rely on another compute device to be fully functional. These headsets may be tethered via a wired or wireless connection. Examples include HTC Vive, Oculus Rift, Garmin Varia Vision.

- IDC defines Standalone HMDs as products that are fully functional without the need to be connected to another compute device. Examples include Microsoft’s HoloLens and Epson Moverio.