In case you missed it, Apple’s non-growth in the Smartwatch market has hit a new high (errr, low?) with a whopping -72% market growth (year over year) according to data from IDC last week. That topped (a very specific wearable) category non-growth of -52% with predictions of market growth for Apple not getting any better anytime soon.

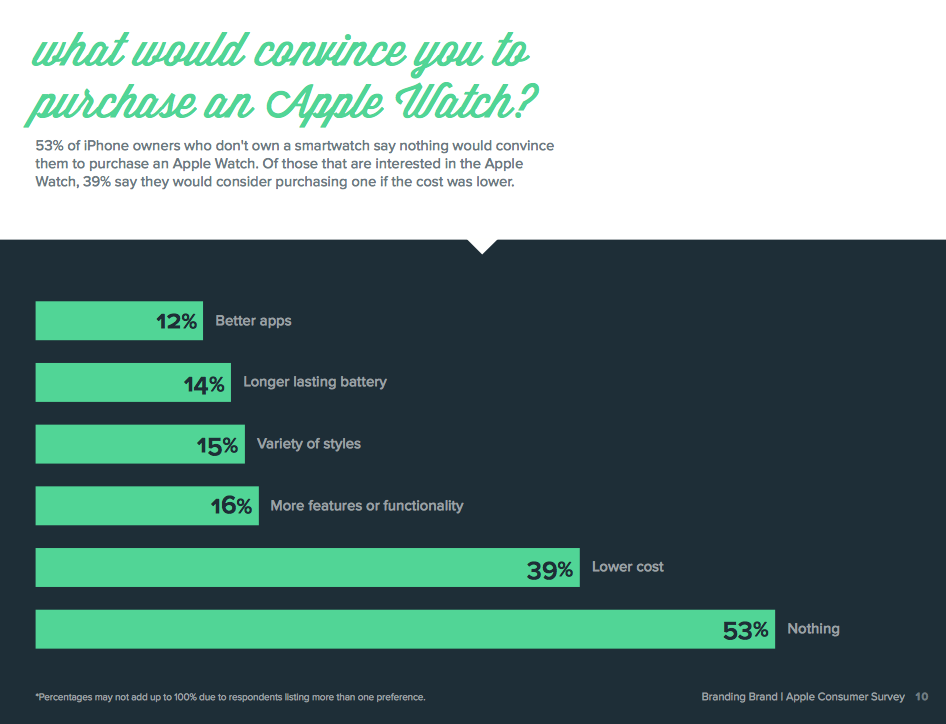

For example, a February 2016 Brandingbrand.com survey of more than 1000 Apple iPhone owners revealed that 53% stated “nothing’ would convince them to purchase an Apple Watch. It’s not as though there isn’t a market for Apple, as only 8% of these iPhone owners own a smartwatch (with half of these non-Apple brand), according to the survey. Remarkably, close to half (46%) of this group “always owned an iPhone,” so a good many of the respondents are resolute Apple fans.

OK, for the record, there is a circumstantial reason for the dramatic market growth drop. The quarter last year included inflated numbers for the 2015 Apple Watch (pent up demand) and poor launch timing on Apple’s part with only two-weeks of sales availability for the Apple Watch2 in Q3 this year.It’s “next year” again, and still cool product designs in smartwatches using flexible displays are missing from the market While this may be part of the explanation for the huge decline in year over year market growth, with penetration among the Apple faithful so low, we still “smell something rotten in the state of Denmark”.

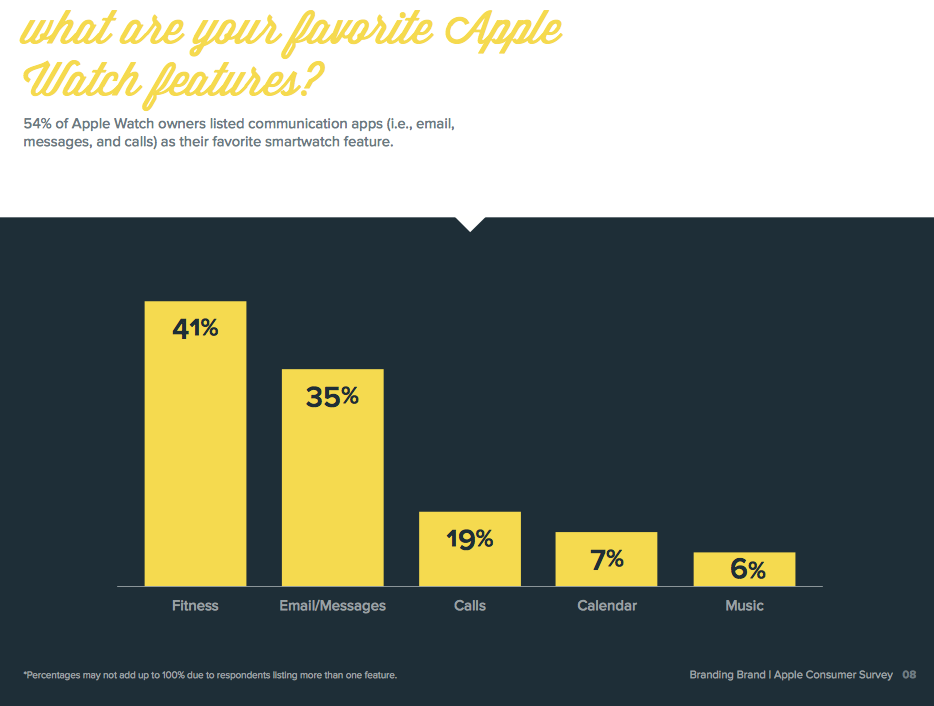

IDC pins the dearth in smartwatch sales on a lack of a clear purpose for having a smart watch. Senior research analyst for IDC Mobile Device Trackers, Jitesh Ubrani said “Having a clear purpose and use case is paramount, hence many vendors are focusing on fitness due to its simplicity,” concluding, “…smartwatches are not for everyone.” That same Brandingbrand.com survey concurs with Ubrani, it revealed the killer app, (if there is one) seems to be health monitoring with 41% of the respondents listing the top feature as “fitness” among iPhone users surveyed.

IDC pins the dearth in smartwatch sales on a lack of a clear purpose for having a smart watch. Senior research analyst for IDC Mobile Device Trackers, Jitesh Ubrani said “Having a clear purpose and use case is paramount, hence many vendors are focusing on fitness due to its simplicity,” concluding, “…smartwatches are not for everyone.” That same Brandingbrand.com survey concurs with Ubrani, it revealed the killer app, (if there is one) seems to be health monitoring with 41% of the respondents listing the top feature as “fitness” among iPhone users surveyed.

The IDC data also supports the fitness trend as evidenced by the shipments of Garmin’s devices that have a strong focus on fitness. The company’s smartwatch market share was up 324% in Q3 on 600K devices shipped according to IDC. Garmin, the once mighty GPS device company now claims a 20.5% market share in smartwatches, just behind Apple, as it looks to reinvent itself in the fitness camp, in the wake of the smartphone phenomenon that all but wiped out its consumer single purpose GPS device market.

That said, Fortune Magazine reported a Kantar Worldpanel survey published in the summer of 2016 showing a shift from fittness brands (not covered in the IDC smartwatch study) toward smartwatches. “In the three months ending July 2016, 47% of wearable sales in the U.S. occurred in the smartwatch category, versus the more basic fitness bands,” according to survey director for the company, Lauren Guenveur. The group also reported that a mere 4.7% Americans and fewer still (3.2%) in Europe’s four biggest markets currently own a smartwatch, indicating plenty of up side potential in the market.

That said, Fortune Magazine reported a Kantar Worldpanel survey published in the summer of 2016 showing a shift from fittness brands (not covered in the IDC smartwatch study) toward smartwatches. “In the three months ending July 2016, 47% of wearable sales in the U.S. occurred in the smartwatch category, versus the more basic fitness bands,” according to survey director for the company, Lauren Guenveur. The group also reported that a mere 4.7% Americans and fewer still (3.2%) in Europe’s four biggest markets currently own a smartwatch, indicating plenty of up side potential in the market.

Going beyond fitness, the Brandingbrand.com survey also shows a combined 54% look to calls and other communication including e-mail and texting on the watch as a “favorite” Apple watch feature. IDC’s Ubrani also sees it that way and he said “differentiating the experience of a smartwatch from the smartphone will be key and we’re starting to see early signs of this as cellular integration is rising and as the commercial audience begins to pilot these devices.”

Of the smartwatch category, the Kantar study concludes “…there are no signs of widespread adoption coming anytime soon.” By the numbers, the group predicts 11.3% of UK-based and 9.3% of U.S.-based non-owners they surveyed had intent to purchase a wearable (note this is a larger category than smartwatch) in the next 12 months, according to Kantar’s researcher, Lauren Guenveur.

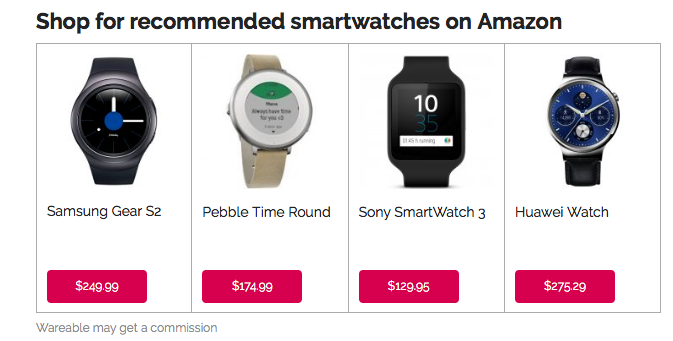

Suffice it to say that the smartwatch market is in a bit of a funk, not too unlike the MP3 player serving the music industry just before the iPod shipped. And to those who say nothing would convince them to buy a smartwatch, I say, never underestimate the power of ‘way-cool’. As a display hack, my theory is that the device coolness factor is simply not there yet, with too many look-alike devices on the market, none differentiating on style and product design in a way worthy of a wearable digital device. My prediction is that will continue until someone ships a smartwatch with a truly flexible (wrap around the wrist) display. Then stand back and, well, watch! – Steven Sechrist

Ed. Note: IDC categorizes smartwatches as those that can run third party applications. Smartwatches are part of IDC’s larger category of Smart Wearable devices, which also include smart glasses and certain wristbands. IDC expects total smart wearable volumes to reach 21.5M units shipped in 2016. The real problem in the smartwatch market, too many smartwatch look alikes with no design or display sex appeal, so “nothing” will convince users to buy…

The real problem in the smartwatch market, too many smartwatch look alikes with no design or display sex appeal, so “nothing” will convince users to buy…