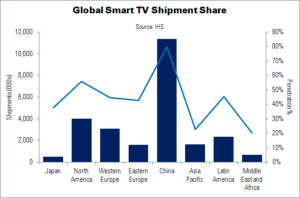

Early 2016 marked a turning point in the TV industry: more than half of all sets shipped in Q1 were smart TVs. IHS says that the acceleration in adoption was led by China, where 80% of sets featured smart functionality. This figure, despite a seasonally slow quarter, was 56% in North America.

Principal analyst Paul Gray called it a “remarkable result,” noting that the feature “is now established in entry-level products.”

Despite the strong showing in the above markets, shipments have stagnated in Japan and Europe. Only 38% of sets shipped in Japan were smart in Q1: the lowest level since 2011. European shipments have remained steady, at 40-45%, for the past two years. Gray blamed content:

“[W]here the local offering is relatively weak, consumers are reluctant to pay extra for built-in internet TV services. Good streaming content in local languages remains the key to value in smart TV.”

Almost half of all smart TVs shipped in Q1 used Android TV. Tizen, however, is performing well, with a 43% share outside of China. “Android in various forms has been wholeheartedly adopted by Chinese brands,” said Gray. “The first quarter of this year was exceptional, with seasonally strong sales in China, but weak sales elsewhere, and it is clear the Android-based solutions have a global lead.”

An additional smart TV platform is common in North Ameria: Roku. Adding this to TVs is a significant value booster for Chinese brands. Chinese brands typically ship 10-20% of their sets with Roku TV in Europe, but more than 90% in North America.