One session at the IHS Wearables – Flex conference during Display Week focused on healthcare as a driver in the wearables market, particularly as it affects the display industry. IHS Principle Analyst Shane Walker said “Health is a key driver in the wearables market and wearables will be a key driver in displays.”

The session on health care revealed what IHS calls the “Connected Patient” as the force to drive the adoption of wearables, with key factors for wearables in health care including determining how many connection points the device enables, whether or not it integrates well, or is disruptive, and the estimated impact it will have on people’s lives. Remarkably, IHS forecasts that by 2040 these varied technologies will come together to facilitate the connectivity of nearly 7 billion people to their health information.

Walker said this will drive new wearable device adoption, as currently, only 4% of the total sample from recent IHS research use a smartphone as their sole monitoring device.

Walker reported that worldwide:

Walker reported that worldwide:

- Healthcare spending $8.1trillion(10.2% of GDP) Healthcare spending per capita $1,096, UnitedStates=$9,752,India=$68.3

- Health spending as share of GDP declines slightly through 2020, mostly due to the US. Western EU flat with increases seen in many emerging markets (Brazil, Mexico, India).

- 50% of adults are managing a chronic condition (2.4 billion adults)

- 25% of those adults are managing two or more diseases (600 million adults)

- 25% aged 65 + are managing five or more diseases

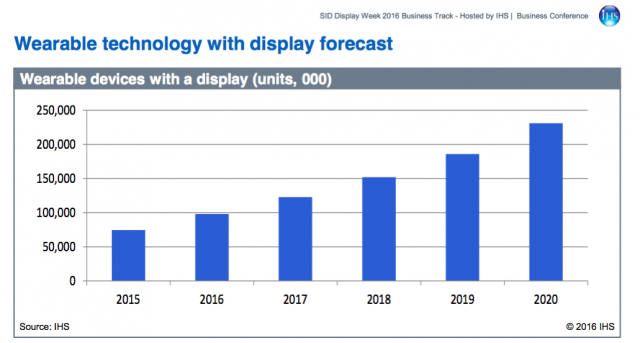

All this contributes significantly to the potential market for wearable devices with displays. In 2016, that number is forecast by IHS to be just under 100M devices and the group reckons it will more than double that number by the end of the decade (see chart.)

Already, patients are using technology for tracking. In an IHS health care user survey, the group reported on health status and device usage of their surveyed population with findings that show:

- Beyond traditional smartphone apps, users also use weight scales, activity monitors, smartwatches, blood pressure monitors, and pedometers.

- 2.3 devices per respondent that use a device to monitor their health.

- All respondents in the 18-24 age group use one or more devices to monitor their health.

- Of the respondents using a blood pressure monitor, 49% are over the age of 55 and 60% are over 45 years. Amongst these users there is a high prevalence of diabetes and hypertension.

In the opening session IHS showed that it’s the potential for health care that’s driving wearable device sales, even if consumers don’t want to use them. Cost savings for the industry translates into reduced premiums and even cash incentives to strap on that device, and ‘get stepping’. This is evidenced in the survey findings where nearly one in five (19% of respondents) reported participating in reward programs intended to incentivize improvements in health monitoring (including saving money on high deductible co-pays health plans.)

About that same number (20%) report participating in an employers’ rewards program to incentivize health improvement through monitoring. Interestingly, just 15% of respondents are using wearable technology, indicating a potential upside from device upgrades. IHS said “It is likely that the majority of these 15% have received an activity monitor, which aided in device uptake and awareness.” Overall, 14% stated their employer has provided them with wearable technology. But the elephant in the room continues to be privacy when discussing mandated or incentivised health tracking. 61% of IHS respondents reported concerns about wearing devices capable of capturing audio and video when others may not be aware.

It’s becoming clear that wearable devices and health care are getting ‘joined at the hip’, as providers (and insurers) continue to search for ways to improve health and reduce costs. Trends are looking to support this, but, again, privacy is rearing it’s head, and like all “personal” technology that is sending data into the cloud, security and trust will become major factors on the path to adoption. – Steve Sechrist