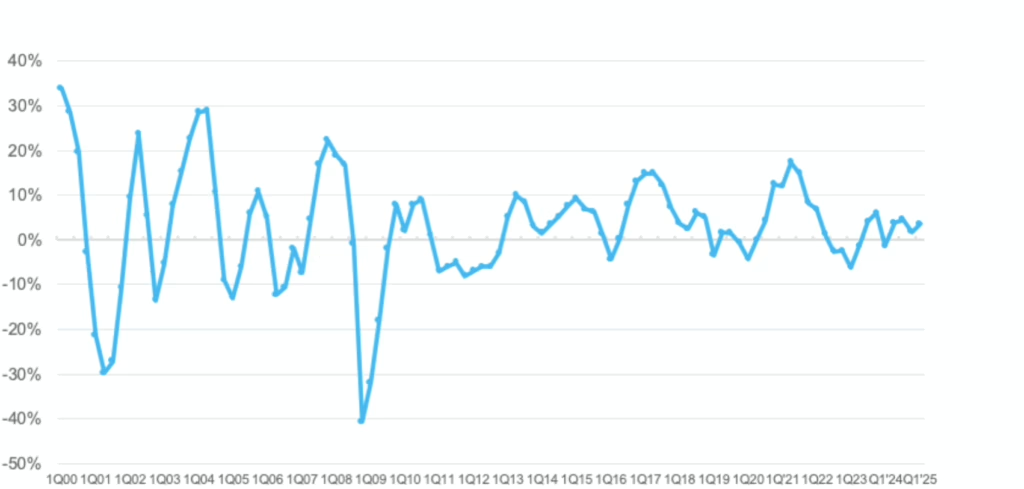

Twenty years ago, I was invited to a famous movie producer’s home in Big Horn, Palm Desert, California. The home had a circular design, was 40,000 sq. ft. and sat on a hilltop with a 360° view, where every room had glass folding doors that opened onto a swimming pool that encircled the house like a medieval moat. But what impressed me were the 20+ 40″ plasma TVs that had a combined list price of over $360K. Now, an 85″ TCL MiniLED LCD can be had for $1,500, which puts the 25-year CAGR at -15%, without applying inflation. In 2020, the cost/m² was $46,000; now it is $860. This incredible achievement is the single most significant measurement of the display industry’s contribution to the growth and success of the consumer electronics industry. With DisplayWeek now over, it’s time to take a status look, with the help of Ross Young’s landmark display industry presentation at the Business Conference.

The Crystal Cycle is over, and the display industry based on area that we knew no longer exists. Growth has been diminished, LCD capacity is already excessive, and the technology sources are split with a third possibility on the horizon.

Displays Have Become a Two-Horse Race

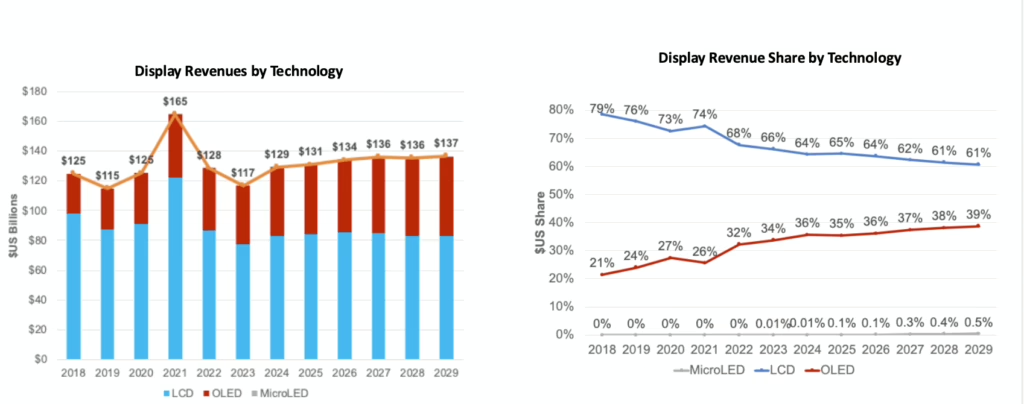

In 2024, LCD had a 64% share of display revenue with a dominant position in TVs, monitors, notebooks and automotive displays. OLED had a 36% share of revenue due to a >50% share of smartphones and a growing position in tablets and notebooks. Typically, LCDs have higher share in the low-cost panels, while OLEDs target the high-end, except in TVs where MiniLEDs are outperforming OLED TV.

LCDs Reach Minimum Cost – The LCD TV is so inexpensive to produce that some retailers are giving them away when a streaming service is ordered. A recent report, produced before Vizio was sold, showed the company broke even on sales of TVs, as the profits came from the Vizio streaming service.

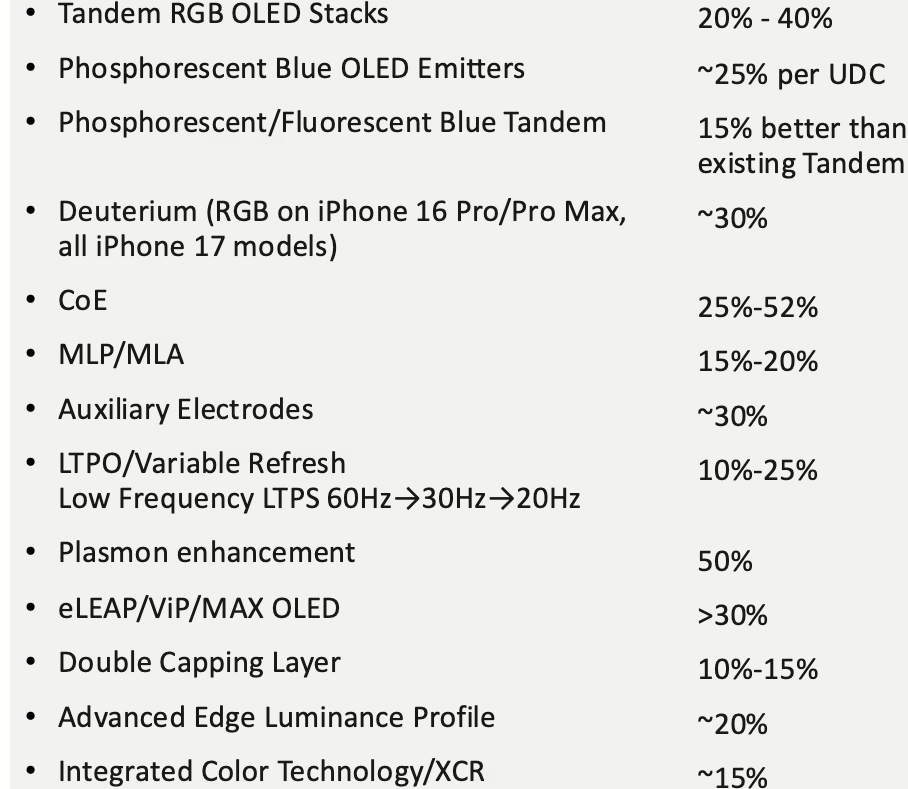

OLEDs Getting More Efficient and Less Expensive – The smartphone market is getting to be similar to TVs, where carriers subsidize the complete cost of the phone when cellular service is contracted. But OLEDs are relatively new compared to LCDs and continue to innovate to make the panels higher performing and also less expensive, as shown in the next figure.

As a theoretical exercise, applying the accumulated power reduction for these improvements would reduce power consumption on an OLED display down to 1.5% to 3.6% of its present value.

Power consumption for an iPhone 16 Pro Max, which has a 6.9-inch OLED display with ProMotion (adaptive refresh rate up to 120Hz) and peak brightness capabilities of 1,000 nits typical and up to 2,000 nits for HDR content, is 200-800mW depending on brightness level and content. If all the improvements were executed, the power consumption would drop to 1.2mW – 3.3mW.

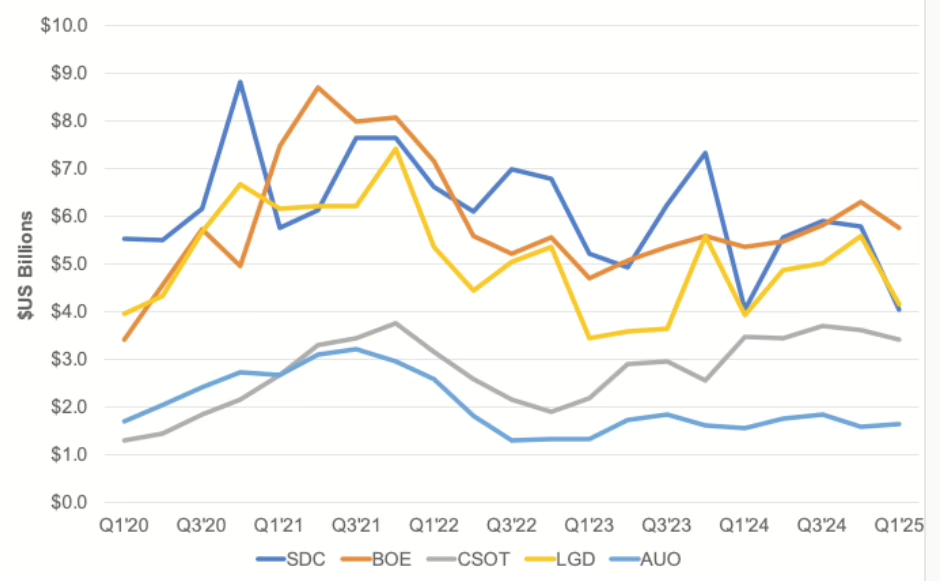

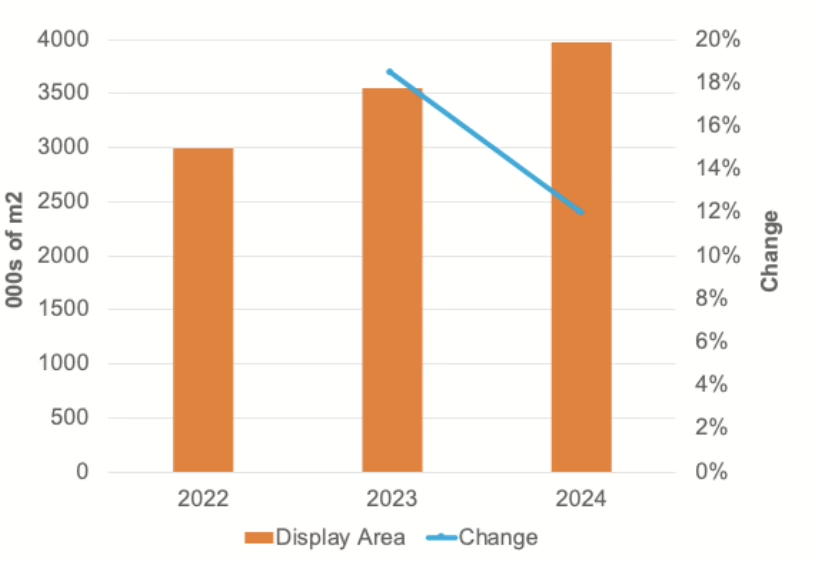

Revenue and shipment growth in the major display applications has ended. Revenue from the five major panel makers in Q1’25 is just about equal to their revenue in Q1’20.

Any growth is relegated to niche apps such as vehicle and public displays.

Smartphones, a 1.2 billion unit market that fueled the adoption of OLEDs, has run out of innovations and is now being targeted by smart glasses with AR, which, if adopted, would result in downsizing the existing display industry as two 1″ displays could eat into the demand for the 6-7″ 1.3 billion smartphone panels, the 400 million tablet and notebook panels, the 250 million 25″-32″ monitor panels, and the 32″-85″ 220 million TV panels.

AR has been a testing ground where the current high-tech leaders, be it Google, Microsoft, Apple, Meta, or Samsung, have chosen to invest billions in search of the ultimate personal solution that has yet to deliver a viable product. The most advanced concept is a pair of glasses with a high-performing micro display that is connected to the Internet, driven by AI and serving as a personal aid that replaces the smartphone, TV, PC and can be used while driving a vehicle.

But that has not stopped newcomers from entering the fray. Last week, OpenAI’s CEO Sam Altman gave his staff a preview of the devices he is developing with former Apple designer Jony Ive, as he hopes to ship 100 million AI “companions” that become a part of everyday life. Sir Jony Ive, best known for his design work on the iPhone and Mac, is joining OpenAI in a $6.5 billion deal. Microsoft-backed OpenAI is paying $5 billion in stock to acquire Ive’s hardware startup. The remaining $1.5 billion comes from a 23% stake that OpenAI acquired in the fourth quarter of 2024.

Altman noted that it would amount to a “family of devices,” and that stealth will be vital for their success to avoid rivals copying the product before it is ready. Ive and his team have been talking to vendors able to ship the device at scale. Altman said, “We’re not going to ship 100 million devices literally by late next year.” Developing a device is the only way OpenAI and other AI companies could be able to interact with consumers directly, the report noted.

Altman and Ive believe that current devices don’t support the new paradigm. While ChatGPT changed people’s expectations about the power of technology, it is still used in old ways — holding a laptop, opening a website, and typing something in and waiting. Clinging to yesterday’s ideas will be a problem. AI is quickly becoming as foundational as the multitouch display was two decades ago, and it’s ushering in a new wave of devices — centered on instant access to information and intuitive voice interaction.

What of Apple?

Apple services chief Eddy Cue acknowledged the challenge: “New technologies come about, new companies get formed, and the incumbents have a hard time with it.” It was a moment of candor. For all of Apple’s past success, it’s clearly struggling to pivot. While Ive and Altman’s first device may not immediately threaten Apple’s empire, it’s a powerful reminder: In tech, nothing is guaranteed. Whether it’s OpenAI or another insurgent, someone will eventually take a successful swing at the iPhone. Cue put it bluntly: “You have to earn it in technology every day. You may not need an iPhone 10 years from now, as crazy as that sounds. You have to earn it.”

Cue pointed to the iPod, which Apple obsoleted with the iPhone — before anyone else could. But how is Apple preparing to disrupt itself before someone else does? Even Apple’s smart glasses expected next year will be an accessory to the iPhone, not a replacement for it.

New Display Technologies: QD-EL, IJP, MicroLED

DisplayWeek is always a superb place to show new display technology, be it a startup, a product company with a new idea, or one of the majors showing state-of-the-art technology. For years, QD-EL has been proposed as a research effort, but this year, SDC claimed it had solved the key problem of blue lifetime. TCL again showed that it would soon deliver IJP OLEDs, and then again there was the ever-present MicroLEDs with their OLED replacement strategy. None of these demonstrations, even when extended 5-10 years out, offered a competing argument for replacing the incumbent technology.

QD-EL is targeting the high-end TV, with a message that it reduces the cost of a QD-OLED panel by eliminating ~$100 of OLED expense. The OLED TV market isn’t large enough to justify a major investment, and IJP doesn’t provide sufficient pixel density to go after smartphones.

IJP OLED has yet to prove it has the performance and lifetime to compete with VTE OLEDs and could face targeted competition from OLED Max.

MicroLEDs—even the purveyors have shifted to AR away from watches, TVs and smartphones, but being dependent on a product with major UI challenges is unlikely to encourage continued investment.

Moreover, the market researchers, once burned, are reluctant to forecast revenue of more than $0.5 billion through the end of the decade.

The rise of AI, merging with AR, is going to create new challenges for a display industry already plagued with too much capacity and encumbered by slow growth of its mainstream products. Altman may be parroting Trump with his outlandish projections that people want to stop looking at displays. But the display industry needs to participate in changing how we interact with displays and make it simple to use the new tools that are available to enhance the visual experience.

Barry Young has been a notable presence in the display world since 1997, when he helped grow DisplaySearch, a research firm that quickly became the go-to source for display market information. As one of the most influential analysts in the flat-panel display industry, Barry continued his impact after the NPD Group acquired DisplaySearch in 2005. He is the managing director of the OLED Association (OLED-A), an industry organization that aims to promote, market, and accelerate the development of OLED technology and products.