With Apple’s star power, smartwatch markers were hoping to move the market from niche to mainstream after the first shipment of the Apple Watch in April 2015. OLED suppliers were also hoping the Apple Watch would take OLED technology adoption to the next level. Apple was not the first company to introduce a smartwatch, nor it was the first company to use OLED display technology for the product.

The market had already started a few years ago with smartwatch products from brands such as Samsung, LG, Sony, Pebble and many others. Samsung and LG used OLED displays in their smartwatches. Still, it did not receive mainstream consumers’ acceptance due to high price, a lack of fashionable design and lack of functionality.

Smart Watch, the future mass market?

The smartphone has established itself as a necessity in consumers’ everyday life, but smartwatches are still seen just as an extension of smartphone. It is a device waiting to find its place in the consumer market. Can Apple’s star power change that? Early signs have shown that Apple was somewhat able to stir consumer’s interest with fashionable design, increased apps, flexible retina display, taptics, health sensors and connectivity to its loyal customers’ iPhone.

However, after the first year, sales have been way lower than the industry’s original expectation. This is due to the high price, the lack of killer applications and the need for attachment to the smartphone. In March 2016, Apple reduced the entry-level watch price to $299, $50 lower than original price of $349, in a bid to increase sales.

OLED in Smart Watch, a path to success?

OLED in Smart Watch, a path to success?

Apple and other brands’ ability to establish the smartwatch market for mainstream customers will have major implication for the display industry. Smartwatch displays can be LCD, e-paper, or OLED technology. But recent smart watch products from Samsung, LG and now Apple are all based on OLED.

LCD has dominated the electronic display market with its mature production technology, competitive costs, lower price (the result of fierce competition) and continued improvement. It is the dominant display technology for TV, monitor, notebook, tablet and even the smartphone market.

Of course, Samsung has been successful in serving the high-end smartphone market with its OLED technology under its own brand. LG has also introduced curved smartphone with OLED technology along with Samsung. OLED TV has been introduced by LG, which excels in terms of picture quality but is facing higher cost and production challenges. It is not able to compete with LCD TV in terms of price/performance in the current market.

The smartwatch is the only consumer application market, up to now, where OLED technology has the potential to really win the battle with LCD due to thin design, slimmer form factor, flexibility, lower power consumption, better black levels and better viewing angle.

OLED Investment increasing

In 2013, Samsung introduced first OLED smartwatch with the Galaxy Gear, which had a 1.63″ display with 320 x 320 pixels with about 278 PPI. In 2014, LG Display began mass production of the world’s first circular P-OLED (Polymer OLED) panel.

In the same year LG also introduced the LG G watch R with a 1.3″ circular plastic OLED display, 320 x 320 pixels and 245 PPI. Other Android-based watches such as the Moto-360 have also adopted a circular design. Samsung introduced a circular design in its Galaxy Gear 2. Apple, however, has used a flexible retina OLED display, produced by LG Display, with a rectangular design.

The Samsung and LG brands use displays from their own affiliated companies: Samsung Display and LG Display. Both are ramping up capacity for flexible OLED for use in smartphone and smartwatches. LG Display announced major investments (KRW1.84 trillion, $1.6 billion) in OLED panel production at the end of 2015. The company is expecting to install a 9th Gen or above OLED fab along with a flexible OLED line both for large size OLED TV and flexible OLED panel for smart watch and automotive display. The first production line is scheduled to start mass production in the first half of 2018.

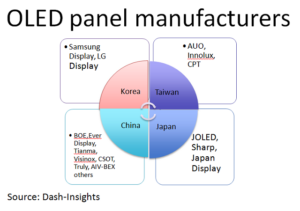

Many display companies from China have also started investing in OLED along with flexible OLED panels in the hope of capturing this next generation product market. Other display companies from Taiwan and Japan are also planning to ramp up OLED production for smart phone, tablet, wearable, TV and other applications.

OLED in the Mass-market?

Apple’s success in establishing the smartwatch was expected to open up new opportunities for many display suppliers to jumpstart their OLED production. But even after one year, the market outlook for smartwatches is still not clear. The expectation for Apple Watch sales in 2016 is not optimistic due to a lack of a killer application to drive mass consumer interest.

To date, Samsung Display and LG Display are the only two companies who have found success with OLED technology. There are many other companies who started earlier, and gave up. Many are still starting to ramp up OLED production while new entrants are coming, mostly from China.

As history has shown, success in the OLED market will not be easy or fast for most panel suppliers due to high cost and production challenges. Only a few can succeed. With the current Apple Watch outlook, they may have to wait longer for new mass-market opportunities.

– Sweta Dash

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com