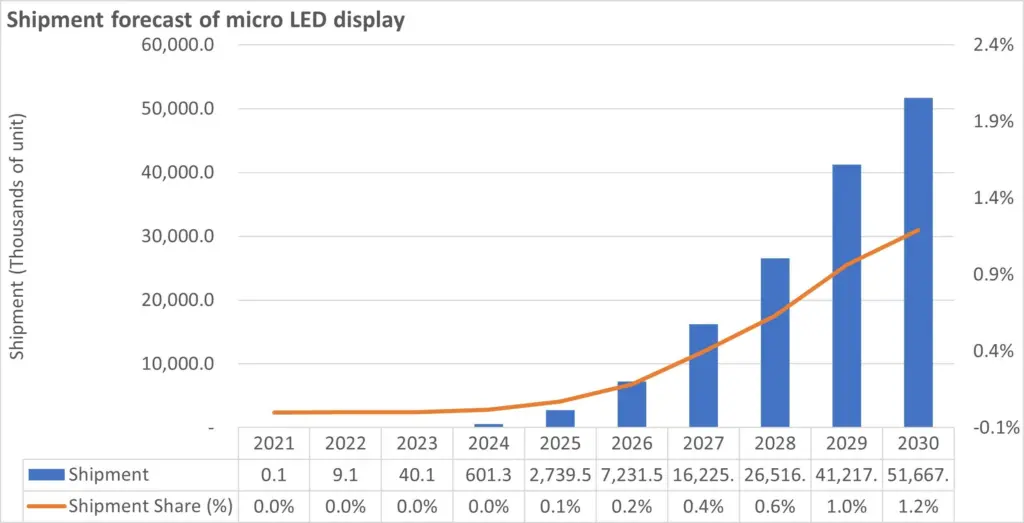

Omdia anticipates growth in the shipments of MicroLED displays, projecting figures to reach 51.7 million units by the end of the decade. Notwithstanding this increase, the share of MicroLED in the global display market is expected to constitute only about 1.2% by 2030.

The research suggests that the substantial growth in the MicroLED display market is anticipated to commence around 2025, aligning with the rising demand for small-sized display devices. These devices, such as extended reality (XR) systems and smartwatches, are predominantly used outdoors. MicroLED display offers superior performance for brightness and contrast from self-emission, typically much higher than organic light-emitting diode (OLED) displays. By 2030, it’s expected that the MicroLED display share to account for 53.5% of XR devices and 41.6% for smartwatches.

Recently we have seen a surge in display manufacturers unveiling MicroLED prototypes, vying to replace LCD and OLED displays. However, Omdia’s study underscores that as of 2023, only a handful of firms have ventured into mass-producing MicroLED displays for consumer devices, indicating potential challenges hindering large-scale production.

Samsung unveiled an 89-inch 4.5k MicroLED TV in July 2023, priced approximately at $100,000 — a stark contrast from its 98-inch 8k Neo QLED TV priced at $39,000. The challenge of MicroLEDs remains the challenge of managing the likelihood of defects with existing techniques, Samsung’s 89-inch 4.5k MicroLED TV comprises more than 33 million MicroLED chips on the glass substrate, and until mass transfer technology matures, manufacturing such large-sized MicroLED displays would necessitate assembling from multiple smaller-sized modules.