A big stink is being made about HTC delaying the commercial release of their HTC Vive until April next year, and others are worried that Oculus has already missed the mark by delaying until 2016 altogether. It’s unbelievable how so few understand the VR market and the core metrics that make it tick.

Oculus and HTC could effectively wait a whole year, and it wouldn’t harm their bottom line or lay a dent in any content or business relationship they are working to build.

How could this be, you ask? What bit of data makes it possible for all the VR HMD makers to sit back and relax and get things right? You’ll see.

Oculus DK1When the Oculus Rift first made the scene, they overcame a major hurdle by using dirt cheap smartphone panels as the core of high field of view high resolution VR displays. The technique effectively revalued VR devices that were formerly tens of thousands of dollars to just hundreds of dollars per unit in retail value. As major as this was, it’s a smaller piece of a much bigger challenge that is going to take years to overcome.

Oculus DK1When the Oculus Rift first made the scene, they overcame a major hurdle by using dirt cheap smartphone panels as the core of high field of view high resolution VR displays. The technique effectively revalued VR devices that were formerly tens of thousands of dollars to just hundreds of dollars per unit in retail value. As major as this was, it’s a smaller piece of a much bigger challenge that is going to take years to overcome.

Oculus has been shying away from public sales commitments, though I think they are expecting big numbers given the hoopla they’ve received. HTC has been bolder in that they went on record that they expect non-smartphone revenue to account for 10% of their business next year.

I’ve seen all kinds of media study blurbs and claims about VR. Everything from millions to tens of millions of units sold within the first year; most recently a study promoting the industry valued at $70 billion by 2020. With numbers like these, no wonder people think that VR’s future is going to be determined within the next six months.

Source:LucasFilmThe good news is everyone can take their time and do things right.

Source:LucasFilmThe good news is everyone can take their time and do things right.

First, we have to rule out the sales figures for SDKs and developer kits; those Ocul-i and Valve-i mind-tricks won’t work here. Unless otherwise stipulated, figure that the first 200,000 in declared sales for all platforms are in fact SDKs sold or sent to hopeful content makers and press. In many cases, they could be purchased in multiples per location so developers have it in their hands. Whether they buy it or not, it’s a valueless part of the equation. We are only interested in actual customers that just want to enjoy VR and immersive tech and are not bound to the technology in any other way. The following numbers are based on this mindset. Source: The Simpsons, 20th Century Fox

Source: The Simpsons, 20th Century Fox

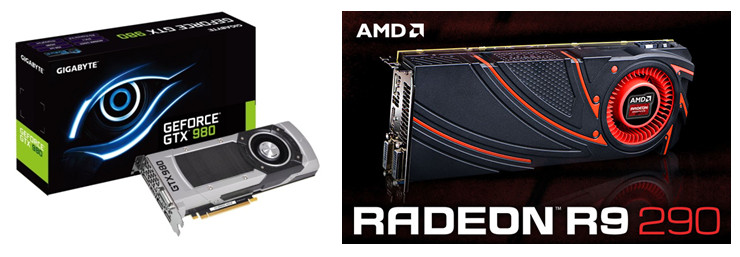

To achieve what they consider the best VR experience on their HMDs, Oculus and HTC are each recommending an AMD 290 series or Nvidia GTX970 series graphics card or better. In fact, there are already signs that the Oculus SDK will detect if your graphics card isn’t up to spec and their software won’t work for you. So everything that performs less than these GPUs is out of the VR universe – settled.

According to Jon Peddie Research, 33 to 34 million add-in boards (AIB / GPU cards) will be sold in 2015. Three to five million of these are high-end / enthusiast graphics cards. The Nvidia GTX 970 / 980 was only announced September, 2014 and AMD’s R9 290 series was announced a year earlier, though AMD’s card wasn’t framed as a required-for-VR card until 2015. For arguments sake, let’s aggressively predict that by the end of 2016, 7 million high-end GPUs are sold in 2016, and this includes the qualified GPUs sold in 2013 and 2014. Factoring in that many gamer PCs use SLI or Crossfire, I estimate there will be three million gaming PCs powerful enough to play in VR. Whether it’s SLI / Crossfire or single GPU doesn’t matter; three million PCs is the potential universe for modern VR. If an optimistic 10% of these PCs own a dedicated VR device, the industry is looking at 300,000 HMD units sold within 12 months from launch. Not 300K for Oculus and 300K for HTC and 300K for other players coming to market…300K for everyone.

It takes anywhere from three to five years for today’s top grade graphics chips to be affordably mass marketable, and ten years for them to be inexpensive enough to work in a smartphone. This means that year over year, the VR market potential will have sequential growth, but it’s going to take time. I’d estimate that a potential market size would be about 20 million gaming PCs give or take within the next five years or so if the GPU flexibility is there.

www.ita3d.comTo make this work, the industry – possibly through The Immersive Technology Alliance (http://www.ita3D.com) -The industry will likely have to come up with a recommended resolution limit on VR display hardware. Unless this happens, the GPU and display markets will never meet up at a mass market scale. The only way around this is if the GPU makers can arbitrarily surpass Moore’s Law (that circuitry doubles on a processor every two years), and that’s unlikely because Moore’s Law is struggling to keep pace as it is. This means that there is little to no room for major bumps in resolution from the HMD makers; too many pixels, and they are trapped in that 300K universe all over again.

www.ita3d.comTo make this work, the industry – possibly through The Immersive Technology Alliance (http://www.ita3D.com) -The industry will likely have to come up with a recommended resolution limit on VR display hardware. Unless this happens, the GPU and display markets will never meet up at a mass market scale. The only way around this is if the GPU makers can arbitrarily surpass Moore’s Law (that circuitry doubles on a processor every two years), and that’s unlikely because Moore’s Law is struggling to keep pace as it is. This means that there is little to no room for major bumps in resolution from the HMD makers; too many pixels, and they are trapped in that 300K universe all over again.

There are cheats that can help. Combined with eye tracking, foveated rendering makes it possible for the GPU to only render the pixels you physically see, but this won’t be enough to turn the tide. It will also be tempting for content makers to use horrible 2D+Depth techniques instead of true stereoscopic 3D rendering to compensate for missing horsepower. 2D+Depth killed stereoscopic 3D gaming in the past, so the market should run for the hills if this makes an appearance.

We also have to consider that DirectX and OpenGL get overhauled every two to three years with new features. Future content makers will have to support legacy APIs or they are going to quickly alienate the mass market consumers by limiting themselves to the latest generation graphics options.

Console and mobile which are practically available now face different metrics and realities entirely.

Samsung GearVREstimate that with nearly 22% of the market share, Samsung sells 300 million units a year. 20% of these are high-end, so that means Samsung’s Gear VR has a potential reach of 60 million phones. If they can achieve an aggressive 5% early adoption rate within 12 months of Gear VR launch, that brings it to about three million units sold. I think that’s very aggressive, but it’s not crazy.

Samsung GearVREstimate that with nearly 22% of the market share, Samsung sells 300 million units a year. 20% of these are high-end, so that means Samsung’s Gear VR has a potential reach of 60 million phones. If they can achieve an aggressive 5% early adoption rate within 12 months of Gear VR launch, that brings it to about three million units sold. I think that’s very aggressive, but it’s not crazy.

It’s actually more and I know the numbers won’t match up, but let’s calculate that there are around one billion Android phones sold each year. Estimate that 20% of these are mid to high-end phones that are VR qualified. If Google takes their Cardboard platform seriously, designs their own chips as pseudo-publicized a few weeks ago, and effectively flips the VR switch in all their compliant phones, they have a potential reach of 200 million Android phones each year including Samsung’s. Combined with their dirt cheap cardboard option and more premium clam-shell VR vendors like ImmersiON-VRelia, they could achieve a 10% adoption. So that brings their take to about 20 million Android phones within a twelve month period. When I say adoption, I mean people using the stuff and not just getting it in the mail or attached to their newspaper.

The challenge with mobile is that even though they have the sheer numbers potential, it’s not the same quality level of virtual reality as that of PC or console. So the VR industry is going to be a constant battle between the marketing forces, the artistic forces, and the limited forces of available processing power.

Console in every way, shape, and form has it made. I estimate that Sony PlayStation 4 will have 35 to 40 forty million units sold by the end of 2015. Thanks to their console’s fixed specification and their HMD’s committed resolution limit, it’s an easy sell. If there are 35 million PS4’s in the world, and if they could sell the PSVR HMD to 10% of them – that’s 3.5 million units sold in the first year with sequential market growth to follow. The genius of it is that PlayStation is suddenly in the display business as well as the console business. Even if they have a modest success, their hardware consistency makes for a promising future.

Console in every way, shape, and form has it made. I estimate that Sony PlayStation 4 will have 35 to 40 forty million units sold by the end of 2015. Thanks to their console’s fixed specification and their HMD’s committed resolution limit, it’s an easy sell. If there are 35 million PS4’s in the world, and if they could sell the PSVR HMD to 10% of them – that’s 3.5 million units sold in the first year with sequential market growth to follow. The genius of it is that PlayStation is suddenly in the display business as well as the console business. Even if they have a modest success, their hardware consistency makes for a promising future.

So what’s the moral of the story?

First, while we have a very exciting market to look forward to, it’s to no one’s advantage to rush products to store shelves to capture market share because…there is nothing to capture. The graphics market is not yet ready to handle the numbers of units that analysts are boasting about. The scalable technology doesn’t exist to make this happen.

At these early stages, I think it’s worthwhile for the PC hardware makers to consider selling their products for $1,000 a piece. They’ll make money on the mark-up, and the market segment that owns the required GPUs spend this kind of money anyway. This isn’t going to be a lower to mid-tier industry at the very beginning and this is the normal way of things. As the compliant GPU market grows, the display prices can drop.

Content makers are definitely going to have to get behind truly open standards and discussions because every HMD sale is important. It’s the only way their product distribution will add up in the early days. The exception to the rule is if they can somehow garner a lucrative exclusivity pre-paid sponsorship deal, but there are only so many cheques to go around.

PC products and product mind-sets need to be designed to work in universes sized at hundreds of thousands to a few million later on. The peripheral business has been doing this for years, and it’s very possible to flourish if the players have the right strategy. Content makers can succeed too provided they can thrive with a dedicated audience of a few hundred thousand people at the high end, thousands to tens of thousands at the earliest stages.

The professional, public exhibition, and academic markets will do very well. Anything that doesn’t require millions of units right away to make their business work will benefit from VR and immersive tech. I’m confident they will do even better than they were previously.

Source: picknick.blogspot.caFinally, for those concerned about when the Oculus CV1 or HTC Vive or PSVR or other promising option is released, or even developers who feel compelled to pledge their undying allegiance to a specific brand…relax. There is no meaningful advantage or disadvantage to launching first or getting tied down. The real market growth will happen further down the road – not this year or next. Just learn all you can, collaborate with industry friend and foe alike, and build.

Source: picknick.blogspot.caFinally, for those concerned about when the Oculus CV1 or HTC Vive or PSVR or other promising option is released, or even developers who feel compelled to pledge their undying allegiance to a specific brand…relax. There is no meaningful advantage or disadvantage to launching first or getting tied down. The real market growth will happen further down the road – not this year or next. Just learn all you can, collaborate with industry friend and foe alike, and build.

http://www.ita3D.com

http://www.ita3D.com

These challenges exemplify why The Immersive Technology Alliance is so important. The industry is going to have to seriously get together in a safe and open forum so the market can figure these things out together and build towards a future that works. It’s the only way.

As Executive Director of The Immersive Technology Alliance (http://www.ita3D.com), I’m very committed to helping grow this market because it’s something I’m very passionate and excited about it. This is my career, and I want to be working in this field for a very long time. Oculus got their launch on Meant to be Seen (http://www.mtbs3D.com) after all. As with any industry, the first years will be the most challenging, and we have to proactively plan for this to succeed. I’m hopeful this analysis will help put the industry in perspective and financial strategies can be designed for the long term. With some planning, I feel confident that everyone’s hopes and dreams will become a reality; not just a virtual one. Neil Schneider

Neil Schneider is best known for founding Meant to be Seen (mtbs3D.com), the first modern immersive technology gaming community and the launch point of products like The Oculus Rift, the Virtuix Omni, the open source Vireio Perception VR drivers, and more. Neil is also the founder of The Stereoscopic 3D Gaming Alliance which the Immersive Technology Alliance (http://www.ita3D.com) is born from.