The cable companies and networks in the US have been facing a change in their business models over the last few years. As we have reported before, cable subscriptions are declining, while the use of on demand or over the top (OTT) providers is increasing.

As Fierce Cable reports, The Diffusion Group (TDG) released a report on the shifts in the US home entertainment market and came to a surprising conclusion. It seems that cable cutters are not the ones subscribing to Netflix and the like. This seems odd at first glance, as many analysts have suggested a connection between Netflix users and the ones leaving the pay TV service.

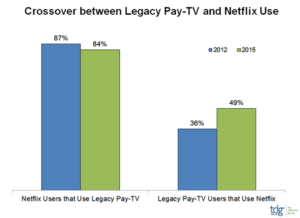

TDG surveyed 3,428 consumers this year and found that the number of Netflix users that use legacy pay-TV services has shrunk only very little in the last three years. In 2012, the same survey (2,001 consumers) showed that 87% of Netflix users were still subscribing to pay TV. This number is now slightly lower at 84% in 2015.

Source: FierceCable

At the same time, the number of cable subscribers that are using Netflix as well has increased from 36% in 2012 to 49% in 2015. It appears that half of the cable subscribers are now also using Netflix as a source for their entertainment (Note: a Netflix subscription costs $8 per month, while a cable subscription may vary anywhere between $35 and over $100, depending on the number of premium channels).

Of course, there are also other SVOD (subscription video on demand) providers in the US, but Netflix is certainly one of the largest. According to their own numbers, they had 27.1 million subscribers at the and of 2012 and roughly 40 million subscribers at the end of 2014. This equates to about 47% increase of subscribers compared to a 36% increase in cable subscribers using Netflix.

The report is for sale at TDG.

Analyst Comment:

As it seems, Netflix has a large attraction as a home entertainment content source, however it seems not to be a large motivator for cable subscribers to cut out cable all together. If this is indeed the case, it would suggest that Netflix is a growing entertainment content source for non-cable subscribers. This also means that there must be a larger group of those that have never been cable users that sign up for Netflix, without signing up for cable pay TV.

Following this thought, it seems that the shifts in video content consumption are more driven by generational differences, than by changes in consumer behavior. There is one thing to be said about generational shifts; they are very very hard to reverse. As a consequence, changes in the network’s business models must be coming soon to deal with this growing trend.

If we assume that the non-cable users (cutters and “nevers” combined) have their strongest foothold in the current twenty something generation, cable companies will have to address retirement homes as their main customers in the next three to four decades. By then the current business models will have collapsed anyway. – NH