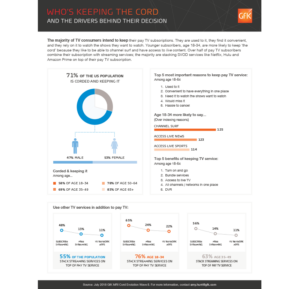

While cord cutting and shaving may be challenges for pay TV providers, the vast majority of US consumers still say they are not ready to give up on these sources of entertainment. New research from GfK MRI shows that 71% of all US consumers say they have cable, satellite or telco TV service and have no plans to drop it. This includes 58% of the crucial 18-to-34 age group, as well as 69% of people ages 35 to 49 and 80% of those 50 and over.

Reliability and comfort are top reasons that these viewers cite for sticking with their cords. Among adults ages 18 to 64, the number-one reason for keeping pay TV is simply being “used to it”, followed by “convenient to have everything in one place” and “I need it to watch the shows I want to watch”. Young adults (ages 18 to 34), however, are more likely to cite channel-surfing and access to live content as reasons why they are sticking with their cords.

Large numbers of pay TV subscribers are adding to their cord services rather than replacing them. 55% of pay TV loyalists are “stacking” other services – such as subscription streaming video – on top of cable or satellite access. Among 18-to-34 loyalists, the proportion of “stackers” rises to 76%. Although roughly three-quarters of consumers are still “loyal to the cord,” MRI has seen a 6% decline in this group since 2015, from 77% of all US adults to 71% now. And among those 18-to-34, this metric has fallen 9%, from 67% to 58%, in the same timeframe.

MRI’s research als o shows that 52% of these pay TV loyalists in the 50+ age group have never streamed and only access TV through traditional pay TV services. MRI’s Amy Hunt remarked:

o shows that 52% of these pay TV loyalists in the 50+ age group have never streamed and only access TV through traditional pay TV services. MRI’s Amy Hunt remarked:

“The fact is that pay TV services still account for most of the TV watching that happens in the US. Many of their subscribers simply cannot imagine a new way of doing things. But as younger generations more comfortable with streaming technologies set up households, cable and satellite companies need to find ways to remain attractive and relevant”.

Analyst Comment

Additionally, new consumer research from Leichtman Research Group finds that 69% of all US households have an SVoD service from Netflix, Amazon Prime and/or Hulu, up from 52% in 2015. Among those that have an SVoD service, 63% have more than one of these services, up from 38% in 2015. Overall, 43% of US households now have more than one SVoD service, an increase from 20% in 2015. Other related findings include:

- 30% of adults stream an SVoD service daily, compared to 29% in 2017 and 16% in 2015.

- 52% of ages 18-34 stream an SVoD service daily, compared to 31% of ages 35-54 and 11% of ages 55+.

- 28% with Netflix agree that their subscription is shared with others outside their household, compared to 22% with Hulu and 10% with Amazon Prime.

- 53% of TV households get both a pay TV service and an SVoD service, 25% only get a pay TV service, 16% only get an SVoD service and 6% get neither pay TV nor SVoD.

- 46% of adults watch video on non-TV devices (including home computers, mobile phones, iPads, tablets and eReaders) daily, up from 41% in 2016 and 27% in 2013.