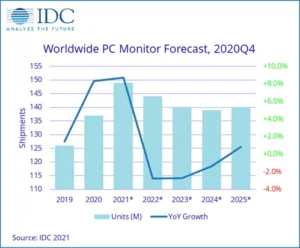

Persistent demand led the global PC monitor market to impressive heights during the fourth quarter of 2020 (4Q20). The market grew 16.9% year over year with shipments surpassing 39.2 million units, a number last exceeded during the fourth quarter of 2011. For the full year 2020, shipments grew 8.3% compared to 2019, according to the International Data Corporation (IDC) Worldwide Quarterly PC Monitor Tracker.

This was the strongest full year growth since IDC began tracking the monitor market in 2008.

The high volume in 4Q20 was fueled by a combination of strong demand due to working and learning from home requirements and display panel component shortages that further expanded shipments. Although some geographies have seen life move closer to pre-pandemic levels, ongoing restrictions of varying degrees continued to help funnel consumer budgets to furnish their homes for work or entertainment, even as low office occupancy inhibited commercial monitor spending. At the same time, a shortage of components like display driver integrated circuits (ICs) and rising shipping costs also contributed to shipment growth as some manufacturers opted to amass stock ahead of component price hikes that could last through the middle of 2021.

Company Highlights

The top 5 companies commanded a smaller share of the overall market in the fourth quarter compared to a year ago as IT budgets continued to prioritize other initiatives and office occupancy remained low. Notably, commercially focused Dell and HP Inc. experienced slight contractions for the full year 2020 while vendors with more focus on consumers and less dependent on mature markets collectively increased their market share compared to a year ago.

|

Top Companies, Worldwide PC Monitor Shipments, Market Share, and Year-Over-Year Growth, Q4 2020 (shipments are in thousands of units) |

|||||

|

Company |

4Q20 Shipments |

4Q20 Market Share |

4Q19 Shipments |

4Q19 Market Share |

4Q20/4Q19 Growth |

|

1. Dell Technologies |

7,686 |

19.6% |

7,237 |

21.6% |

6.2% |

|

2. HP Inc. |

4,980 |

12.7% |

5,010 |

14.9% |

-0.6% |

|

3. TPV |

4,613 |

11.8% |

4,293 |

12.8% |

7.5% |

|

4. Lenovo |

4,547 |

11.6% |

3,926 |

11.7% |

15.8% |

|

5. Samsung |

3,839 |

9.8% |

2,578 |

7.7% |

48.9% |

|

Others |

13,571 |

34.6% |

10,534 |

31.4% |

28.8% |

|

Total |

39,236 |

100.0% |

33,578 |

100.0% |

16.9% |

|

Source: IDC Quarterly PC Monitor Tracker, March 2021 |

|||||

|

Top Companies, Worldwide PC Monitor Shipments, Market Share, and Year-Over-Year Growth, Calendar Year 2020 (shipments are in thousands of units) |

|||||

|

Company |

2020 Shipments |

2020 Market Share |

2019 Shipments |

2019 Market Share |

2020/2019 Growth |

|

1. Dell Technologies |

26,434 |

19.3% |

26,461 |

21.0% |

-0.1% |

|

2. TPV |

19,248 |

14.1% |

17,605 |

14.0% |

9.3% |

|

3. HP Inc. |

18,500 |

13.5% |

18,626 |

14.8% |

-0.7% |

|

4. Lenovo |

14,361 |

10.5% |

13,503 |

10.7% |

6.4% |

|

5. Samsung |

11,754 |

8.6% |

9,001 |

7.1% |

30.6% |

|

Others |

46,317 |

33.9% |

40,902 |

32.4% |

13.2% |

|

Total |

136,615 |

100.0% |

126,099 |

100.0% |

8.3% |

|

Source: IDC Quarterly PC Monitor Tracker, March 2021 |

|||||

Notes: Data for all companies are reported for calendar periods.

“Many of the same trends from earlier in the year continued in the holiday quarter,” said Jay Chou, research manager for IDC’s Quarterly PC Monitor Tracker. “Amidst the surging demand, production has had issues so some markets remain short of stock and we can expect more fulfillments for back orders through much of this year. Beyond 2021, we believe the market will settle into a faster replacement cycle that is based on a higher attach rate to notebooks and a more active usage model inside the home.”

Looking ahead, IDC expects component shortages to last at least through the first half of 2021. Changes in work style will also lead to shifts in the market’s customer mix and geographic focus. IDC expects both hybrid work and the popularity of gaming to drive continued strength in the consumer market that will complement a recovery in commercial spending as office occupancy improves. On a geographic basis, the U.S. overtook China as the biggest market in 2020 and will likely remain the largest market going forward. IDC expects North America and Europe will help drive the global market to grow 8.7% in 2021, then cool by 2022 as the monitor market finishes the 2020-2025 forecast with a compound annual growth rate (CAGR) of 0.4%.