Yole Développement was at CES and looked at developments in microLED. The show highlighted the increasing interest in LED and the firm emphasised the developments from Samsung and Lumens (Lumens Idea of MicroLED is not Really MicroLED).

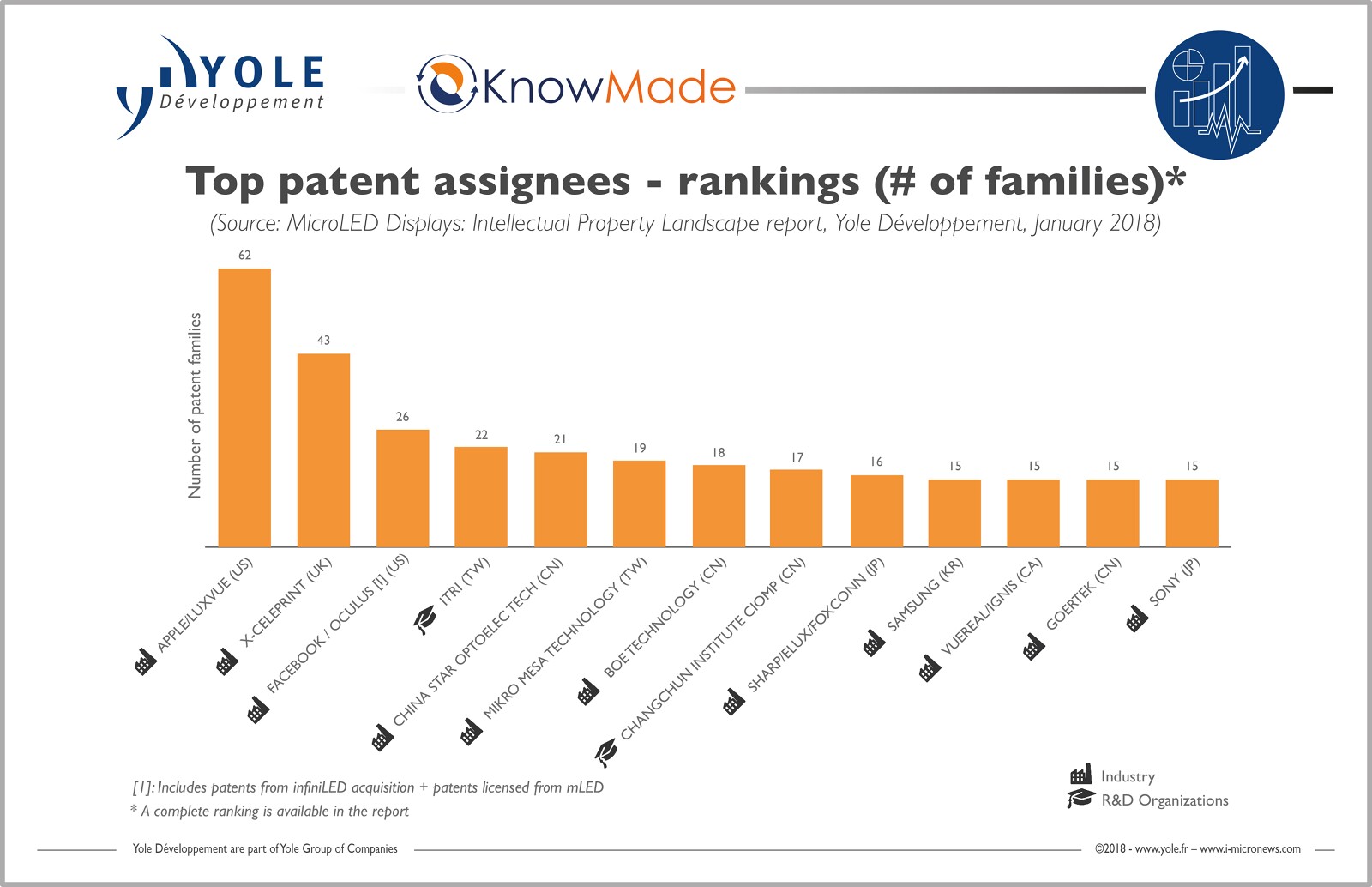

The company has also released an interesting chart that shows the patent environment for microLED that comes from a new report. The chart highlights that Apple subsidiary, Luxvue, is the top ranked and the company said that, as of today, close to 1,500 patents relevant to the microLED display field have been filed by 125 companies and organisations.

As well as the companies listed, Yole said that others such as Huawei are working in the area, but have not yet applied for patents.

Yole microLED patent assignees – click for higher resolution

Yole microLED patent assignees – click for higher resolution

Overall, the activity is still led mostly by startups (including those such as Luxvue or eLux acquired by larger organisations) and research institutions. With the exception of Sharp and Sony, display makers and LED makers are relative latecomers. Many companies started ramping up their microLED research and development activities after Apple showed faith in microLED with its acquisition of Luxvue.

According to Yole, as of December 2017, Apple appears to have the most complete IP portfolio, covering almost all key technology nodes. However, many of its patents pertain to the technological ecosystem developed around the company’s MEMS transfer technology. Other companies like Sony, with a smaller portfolio but which had a head start, might own more fundamental design patents with strong blocking power.

Dr. Eric Virey from Yole said

Dr. Eric Virey from Yole said

“The supply chain is complex and lengthy compared to typical displays. Every process is critical and it’s a challenge to effectively manage every aspect. No one company appears positioned to master and execute across a supply chain that will likely be more horizontal, compared to other established display technologies.”

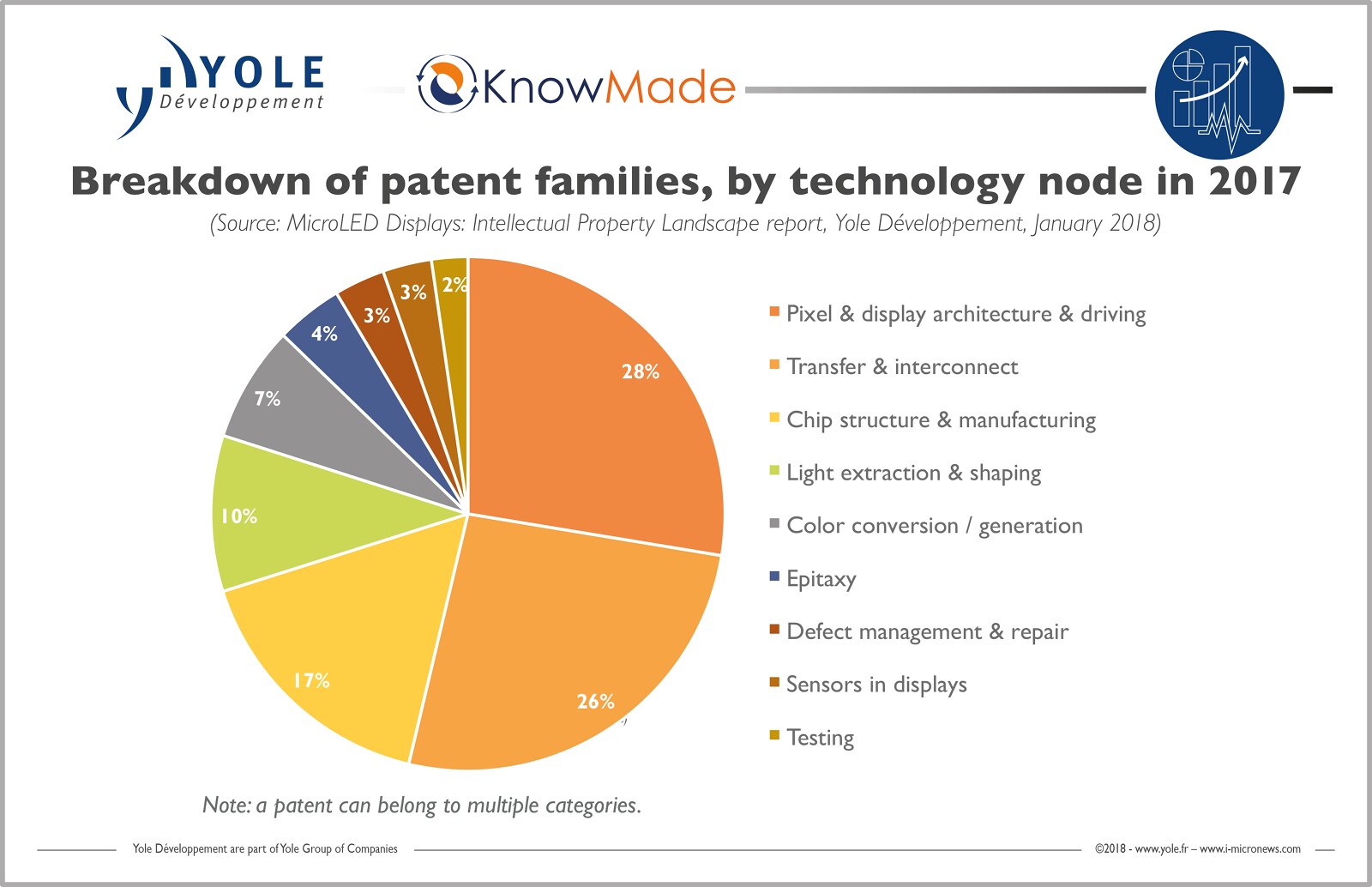

The IP landscape reflects these challenges through the variety of players involved, but requirements differ from one application to another. For low-volume, high added-value applications, like microdisplays for augmented/mixed reality for the enterprise, military, and medical markets, Virey can envision a well-funded startup with good technology efficiently managing the supply chain. However, consumer applications such as TVs and smartphones will require significant investments to unlock large scale manufacturing.

Though only a few companies have a broad IP portfolio covering all major technology nodes (transfer chip structure, display architecture, etc.), enough players have patents across many technology bricks to guarantee that complex licensing and legal battles will arise once microLED displays enter volume manufacturing and reach the market, Virey believes. Small companies with strong positions in various technology bricks will attempt to obtain licensing fees from larger players involved in manufacturing. Large corporations will try to block each other and prevent their competitors from entering the market. To prepare for such events, some latecomers appear to be filing large quantities of patents, sometimes with little substance.

Yole showed there are patents in all areas of MicroLED development. Click for higher resolution

Yole showed there are patents in all areas of MicroLED development. Click for higher resolution

Analyst Comment

I’m pleased to see that Yole shares my view that what Samsung (with ‘The Wall’) and Lumens showed at CES is not really microLED, but just very good examples of the current leading edge in conventional LED. It’s not the first time that Samsung has used its marketing money to hijack a perfectly useful technical term for its own purposes. I doubt it will be the last! – Bob Raikes