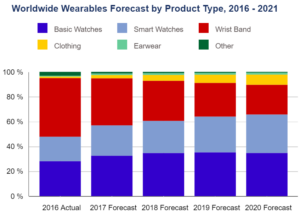

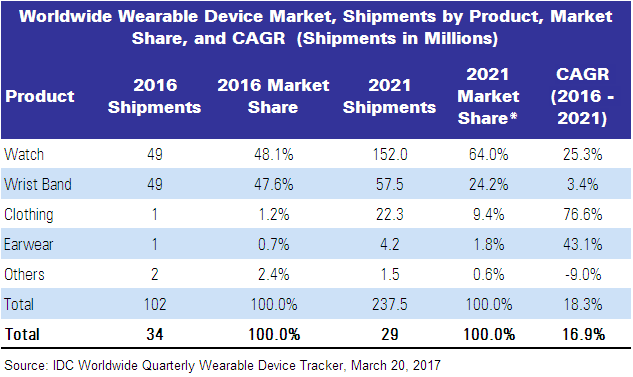

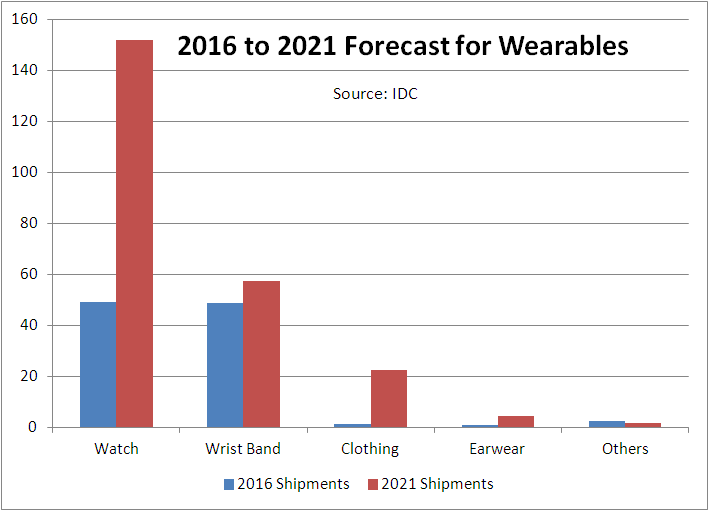

IDC has forecast that the global Wearables market will hit 125.5 million devices this year, up 20.4% from the 104.3 million units shipped in 2016. From there, the wearables market will nearly double before reaching a total of 240.1 million units shipped in 2021, resulting in a five-year CAGR of 18.2%.

“The wearables market is entering a new phase,” points out Ramon T. Llamas, research manager for IDC’s Wearables team. “Since the market’s inception, it’s been a matter of getting product out there to generate awareness and interest. Now it’s about getting the experience right – from the way the hardware looks and feels to how software collects, analyzes, and presents insightful data. What this means for users is that in the years ahead, they will be treated to second- and third-generation devices that will make the today’s devices seem quaint. Expect digital assistants, cellular connectivity, and connections to larger systems, both at home and at work. At the same time, expect to see a proliferation in the diversity of devices brought to market, and a decline in prices that will make these more affordable to a larger crowd.”

The commercial market will continue to grow and be a good opportunity for developers and channel partners.

By Product

- Watches: IDC anticipates that watches will account for the majority of all wearable devices shipped during the forecast period. However, basic watches (devices that do not run third party applications, including hybrid watches, fitness/GPS watches, and most kid watches) will continue out-shipping smart watches, as numerous traditional watch makers shift more resources to building hybrid watches, creating a greater TAM each year. Smart watches, however, will see a boost in volumes in 2019 as cellular connectivity becomes more prevalent on the market.

- Wrist Bands: Once the overall leaders of the wearables market, wristbands will see slowing growth in the years ahead. The sudden softness in the wristband market witnessed at the end of 2016 will carry into subsequent quarters and year, but the market will be propped up with low-cost devices with ‘good enough’ features for the mass market. In addition, users will transition to watches for additional utility and multi-purpose use.

- Earwear: IDC is not counting Bluetooth headsets whose only task is to bring voice calls to the user. Instead, we are counting those devices that bring additional functionality, and send information back and forth to a smartphone application. Examples include Bragi’s Dash and Samsung Gear Icon X. In most cases, the additional feature centres on collecting fitness data about the user, but can also include real-time audio filtering or language translation.

- Clothing: The smart clothing market took a strong step forward, thanks to numerous vendors in China providing shirts, belts, shoes, socks, and other connected apparel. While consumers have yet to fully embrace connected clothing, professional athletes and organisations have warmed to their usage to improve player performance. The upcoming release of Google and Levi’s Project Jacquared-enabled jacket stands to change that this year.

- Others: IDC includes lesser known products like clip-on devices, non-AR/VR eyewear, and others into this category. While the firm does not expect an immense amount of growth in this segment, it will nonetheless bear watching as numerous vendors cater to niche audiences with creative new devices and uses.

Analyst Comment

As Paul Gray of IHS Markit has said in the past, the success of wearables, including fitness trackers, is really dependent on the apps becoming part of your life habits, so that the short term fascination with steps or other data from fitness trackers becomes more than a gimmick. (BR)