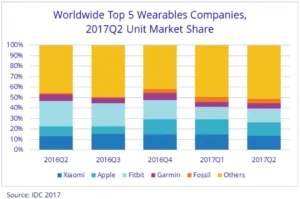

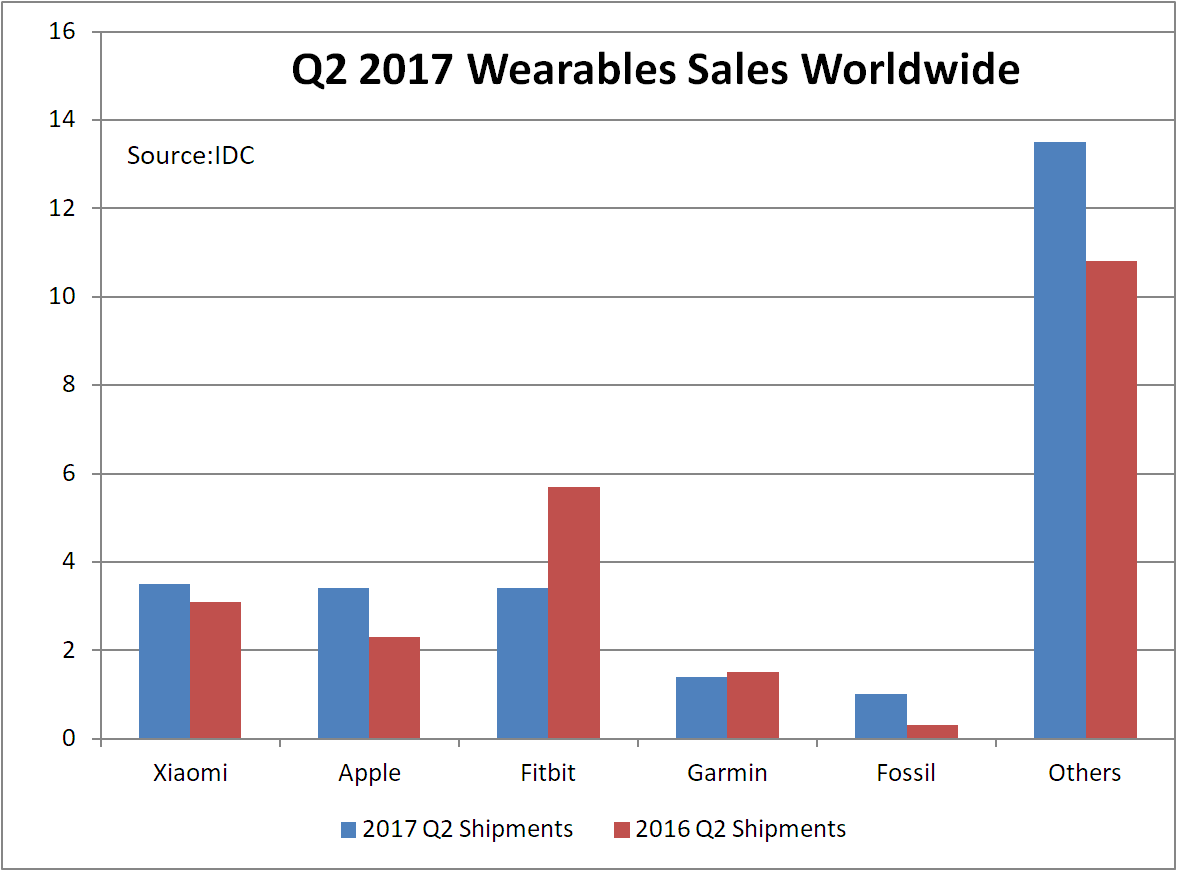

According to the IDC Wearables Tracker, the worldwide wearables market again has shown positive growth as shipments grew 10.3% in the second quarter of 2017 compared to the same quarter in 2016. Shipments reached 26.3 million units during the quarter compared to 23.8 million in the same quarter of 2016.

During the quarter, basic wearables (those that do not run third party apps) declined for the first time, dropping 0.9%. However, smartwatches like the Apple Watch and Android Wear, grew 60.9% in the quarter mainly due to fitness and fashion enthusiasts.

According to Jitesh Ubrani, senior research analyst, the transition towards more intelligent and feature-filled wearables is in full swing and previous niche features such as GPS and additional health tracking capabilities, are becoming staples of the modern smartwatch. A year ago only 24.5% of all wearables had embedded GPS while today that number has reached almost 41.7%.

Ubrani also pointed out that there is growing interest from the medical industry in adopting wearables and consumer expectations are also on the rise. Companies like Apple and Fitibit have the potential to maintain their lead as their investments in the tracking and perhaps diagnosing of diseases will be a clear differentiator from low-cost rivals.

Ramon Llamas, research manage, pointed out that the growth in the market was mainly due to new and emerging products in the quarter with smartwatches recording double-digit yearly growth, compared to the same quarter in 2016, as smartwatch are slowly becoming a more suitable mass market product. He also pointed out that much of the increase can be attributed to a growing number of models aimed at specific market segments, like the fashion-conscious and outdoor enthusiasts.

According to Llamas, there was triple-digit growth from clothing and earwear. Although these products are still in their initial stages, the growth was due to targeting specific market niches, such as performance tracking clothing for professional athletes, and language translation for earworn devices.

Xiaomi maintained its lead in the quarter with low-cost devices such as the Mi Band range, which was the most popular. Xiaomi also tackles the growing market of children’s’ devices, and recently shipped its first pair of smart shoes under the Mijia brand.

Apple continued its growth and outpaced the market as the Series 1 and Series 2 smartwatches are now mature products which are slowly gaining ground with health insurance providers. The release of the latest Watch OS later this year is expected to bring features like Siri to the wrist.

Early leaks and the recent official announcement of the Fitbit Ionic will help the company keep its place in the growing smartwatch market. However, short-term growth remains challenged as the product portfolio is vast and undifferentiated.

Garmin suffered a decline of 6.6% from last year, although the company did grow revenue. Transitioning existing users from basic fitness trackers to more advanced smartwatches like the Fenix range has worked well for the company. Recent developer outreach has also allowed Garmin’s ConnectIQ platform to branch outside health and fitness.

Fossil came into the top five for the first time mainly due to its acquisition of Misfit in late 2015. With a large distribution network of fashion stores and multiple brands Fossil managed to attract a previously unaware audience to the wearables market. Smartwatches from Michael Kors and Fossil did very well, as did the company’s hybrid watch range.

![]() Worldwide Wearables Market Sees 10.3% in Second Quarter of 2017

Worldwide Wearables Market Sees 10.3% in Second Quarter of 2017

Analyst Comment

We have recently seen a new category in wearables – earware – which is to say headphones with ‘intelligence’. At IFA, Sony showed headphones that track motion to change their operation and Samsung has earpieces that include an MP3 player and memory so that they can be used offline. (BR)