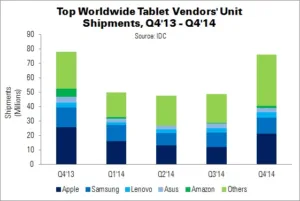

Q4’14 saw tablet shipments fall for the first time since the market became mainstream in 2010, says IDC. Overall shipments of tablets and hybrids reached 76.1 million units, a 3.2% YoY decline. However, full-year shipments were up 4.4%, to 229.6 million.

Senior research analyst Jitesh Ubrani noted that “The tablet market is still very top heavy…it relies mostly on Apple and Samsung to carry the market forward each year”. It is a dangerous place for the market to be, as Apple’s iPad sales were down in 2014, despite an expansion in the range and a lower $250 entry price point. Samsung, also, struggled as it competed against low-cost vendors, “quickly proving that mid- to high-priced Android tablets simply aren’t cut out for today’s tablet market”.

Apple is still to be challenged at the top, with its 21.4 million shipments representing 28.1% of the market in Q4. Samsung held on to second place (11 million units), with Lenovo (4.8%), Asus (4%) and Amazon (2.3%) rounding out the top five. Lenovo was the only vendor to grow YoY, maintaining a tight hold on the APAC market.

Diving deeper, Apple has so far failed to maintain iPad momentum, despite the new Mini and Air offerings – these devices only offer small upgrades compared to previous versions. iPads are also being cannibalised at the bottom by iPhones and at the top by Macs.

Samsung achieved its 40 million unit shipment goal (1.1% growth). The Tab 4 series was well-received. IDC believes that the announcement of a focus on mid-high end tablets will help the bottom line, although is likely to negatively affect market share.

Lenovo has an ‘ideal’ portfolio. The company focuses on most screen sizes in both Android and Windows, so can capture users as they move towards large screen sizes and productivity. The Anypen technology (Lenovo Dominates Showstoppers), while still niche, is likely to become a key feature of the 2015 line.

Asus’ T100, although launched in late 2013, was still a top performer in 2014, although met stiff competition. Meanwhile, Amazon recorded the steepest annual volume fall of the top vendors. Despite new products released in September, end-of-year sales were down almost 70% YoY.

Despite the apparently-slowing tablet market, IDC is adamant that there will be a rise in 2015. Windows 10, innovations such as gesture control and a general shift towards larger models and productivity-focused solutions will help the market to maintain its growth.

| Top Five Tablet Vendors’ Shipments, Market Share and Growth, Q4’14 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | 2014 Units | 2013 Units | 2014 Market Share (%) | 2013 Market Share (%) | YoY Change (%) |

| Apple | 63.4 | 74.3 | 27.6 | 33.8 | -14.6 |

| Samsung | 40.2 | 39.7 | 17.5 | 18.1 | 1.1 |

| Asus | 11.5 | 12.2 | 5 | 5.6 | -5.5 |

| Lenovo | 11.2 | 7.8 | 4.9 | 3.5 | 43.5 |

| Amazon | 3.3 | 9.8 | 1.4 | 4.4 | -66.4 |

| Others | 100 | 76.1 | 43.6 | 34.6 | 31.4 |

| Total | 229.6 | 219.9 | 100 | 100 | 4.4 |

| Source: IDC | |||||

| Top Five Tablet Vendors’ Shipments, Market Share and Growth, Q4’14 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | 2014 Units | 2013 Units | 2014 Market Share (%) | 2013 Market Share (%) | YoY Change (%) |

| Apple | 63.4 | 74.3 | 27.6 | 33.8 | -14.6 |

| Samsung | 40.2 | 39.7 | 17.5 | 18.1 | 1.1 |

| Asus | 11.5 | 12.2 | 5 | 5.6 | -5.5 |

| Lenovo | 11.2 | 7.8 | 4.9 | 3.5 | 43.5 |

| Amazon | 3.3 | 9.8 | 1.4 | 4.4 | -66.4 |

| Others | 100 | 76.1 | 43.6 | 34.6 | 31.4 |

| Total | 229.6 | 219.9 | 100 | 100 | 4.4 |

| Source: IDC | |||||