The global smartphone market recovery will be impacted in 2020 as uncertainties around COVID-19 increased over the last month. According to the latest forecast from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, the worldwide smartphone market is expected to decline 2.3% in 2020 with shipment volume just over 1.3 billion. The COVID-19 outbreak is expected to stress the short-term scenario with shipments declining 10.6% year over year in the first half of 2020.

Global smartphone shipments are expected to return to growth in 2021 driven by accelerated 5G efforts.

IDC has considered optimistic, probable, and pessimistic forecast scenarios driven by the uncertainties around COVID-19. Our current forecasts are aligned with the probable scenario, which ascribes a multi-quarter recovery for manufacturing and logistics given a more gradual return of Chinese workers to factories amidst persisting transportation challenges. China’s demand shock extends several quarters but is mitigated by the end of the year with the aid of government-backed stimuli and subsidies. Demand in surrounding regions will also be briefly suppressed. Global smartphone shipments show a more U-shaped recovery from the second half of the year. However, actual phone shipments could show a different overall shape given the seasonal nature of shipments.

“COVID-19 became yet another reason to extend the current trend of smartphone market contraction, dampening growth in the first half of the year. While China, the largest smartphone market, will take the biggest hit, other major geographies will feel the hit from supply chain disruptions. Component shortages, factory shutdowns, quarantine mandates, logistics, and travel restrictions will create hindrances for smartphone vendors to produce handsets and roll out new devices. The overall scenario is expected to stabilize from the third quarter of the year as the COVID-19 situation hopefully improves and 5G plans pick up the pace globally,” said Sangeetika Srivastava, senior research analyst with IDC’s Worldwide Mobile Device Trackers.

With February and March as the time when manufacturers unveil key flagship products and conduct final pre-production tests and debug their products slated to be unveiled in the first half of the year, changes made to product plans for the first half of the year will likely lead to adjustment of product plans for the medium term and even the long term.

“For the epicenter, China, we forecast the domestic market to drop by nearly 40% year over year for first quarter and even with a potential March recovery it will still be difficult to reach last year’s levels,” said Will Wong, research manager with IDC’s Asia/Pacific Client Devices Group. “Buyers will purchase from online channels, which will account for a significantly increased share of phones sold in the first half of 2020 and may represent a permanent shift in buying behaviors.”

The epidemic outbreak will undermine the Chinese economy as a whole and the many SMEs will likely bear the brunt, leading to tightened wallets of consumers. At the same time, the SMEs in the phone industry, especially retail channel partners, will see the biggest effect and phone vendors that can effectively help their retail channel and other partners recover and reconsolidate after the end of the epidemic will secure more opportunities in the long term.

|

Worldwide Topline Smartphone Forecast Changes, Year-Over-Year Growth %, 2020-2021 (Annual) |

||||

|

Forecast Version |

2020 Shipments (M) |

2020 Year-Over-Year Growth |

2021 Shipments (M) |

2021 Year-Over-Year Growth |

|

4Q19 – Feb. 2020 |

1,339.8 |

-2.3% |

1,424.2 |

6.3% |

|

3Q19 – Nov. 2019 |

1,403.6 |

1.5% |

1,437.0 |

2.4% |

|

Source: IDC Worldwide Quarterly Mobile Phone Tracker, February 27, 2020 |

||||

|

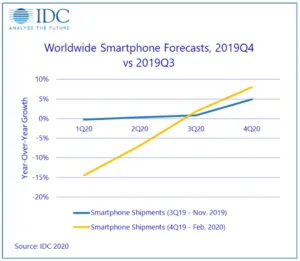

Worldwide Topline Smartphone Forecast Changes, Year-Over-Year Growth %, 2020 (Quarterly) |

||||

|

Forecast Version |

1Q20 |

2Q20 |

3Q20 |

4Q20 |

|

4Q19 – Feb. 2020 |

-14.5% |

-6.9% |

1.8% |

8.0% |

|

3Q19 – Nov. 2019 |

-0.3% |

0.3% |

0.8% |

4.9% |

|

Source: IDC Worldwide Quarterly Mobile Phone Tracker, February 27, 2020 |

||||

Note: Figures are not exact due to rounding.