The global foundry market experienced remarkable growth in 2022, reaching a record high and benefiting from various factors such as long-term agreements, higher prices, process advancements, and expanded production facilities. According to IDC, the market size of the foundry industry expanded by 27.9% last year, with all top 10 vendors reporting double-digit revenue growth.

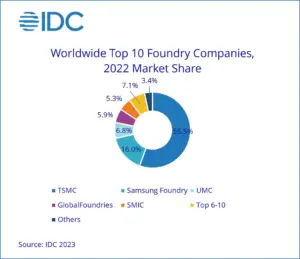

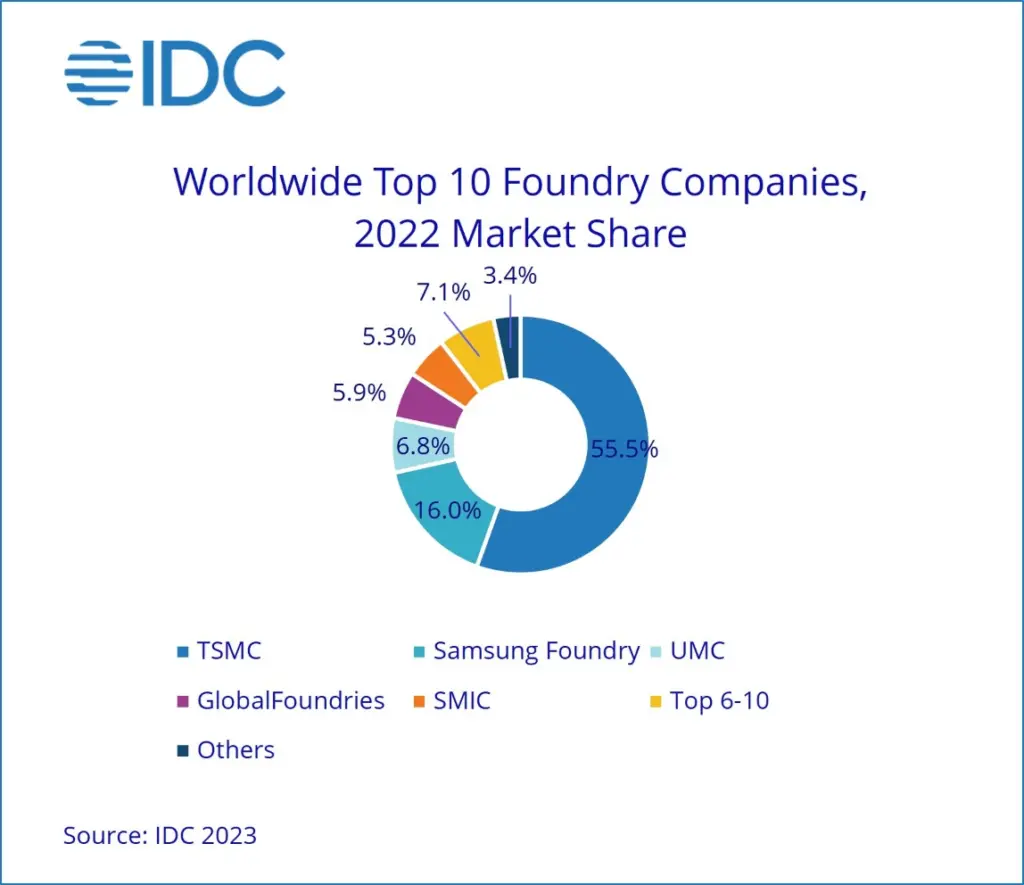

Among the top 10 semiconductor foundry vendors – TSMC, Samsung Foundry, UMC, GlobalFoundries, SMIC, HHGrace, PSMC, VIS, Tower, Nexchi – TSMC continued to strengthen its position with advanced processes, increasing its market share from 53.1% in 2021 to 55.5% in 2022. The company is expected to further solidify its market share in 2023 due to an increase in orders for 3/4/5nm wafers. Chinese foundry vendors also made notable progress, developing mature processes and capturing a combined market share of 8.2% in 2022, up from 7.4% in the previous year, accompanied by over 30% revenue growth.

However, despite the positive growth, changes in market conditions caused a significant decline in the capacity utilization of foundries during the last three quarters of 2022. Order revisions, cautious supply chain operations, and reduced orders from IC designers, particularly for consumer ICs, contributed to top-heavy operations throughout the year.

Looking ahead to 2023, a slight drop of 6.5% in the worldwide foundry market size is projected. In the first half of the year, low purchase intentions for consumer electronics and an ongoing inventory adjustment for endpoint products dampened market demand. While orders for AI and high-performance computing-related wafers remain strong, some IC designers are expected to de-stock and replenish inventory in the second half of the year. The decline in long-term agreements and fading price increases further contribute to a less optimistic demand for inventory.

Considering the high baseline set in the previous year, the foundry segment is expected to experience a slight decline compared to the overall semiconductor supply chain. However, the industry as a whole is anticipated to regain momentum and get back on track in 2024, according to IDC’s analysis.