Advanced TV shipments are expected to grow by 22% Y/Y in Q4 2020, and by a comparable 22% CAGR through 2025 to 32.5 million units according the latest update to DSCC’s Quarterly Advanced TV Shipment and Forecast Report, now available to subscribers.

This report covers the worldwide premium TV market, including the most advanced TV technologies: WOLED, QD Display, QDEF, Dual Cell LCD and MiniLED with 4K and 8K resolution.

The report looks at current and future TV shipments and revenues by technology, region, brand, resolution and size, and forecasts the growth of all these technologies. Last week we covered the most recent historical results and this week we will cover our updated forecast.

In this report we define an “Advanced TV” (capitalized) as any TV with an advanced display technology feature, including all OLED TVs, 8K LCD TVs and all LCD TVs with quantum dot technology. The forecast in the report allows analysis by feature for Advanced LCD TVs, including:

- QDEF TV: TV using a Quantum Dot Enhancement Film; these TVs are sold as “QLED” by Samsung, TCL, and others.

- MiniLED: LCD TVs with a MiniLED backlight, as sold by TCL starting in 2019. Note that we expect that all MiniLED TVs will also have QDEF, but not all QDEF will have MiniLED.

- Dual Cell: LCD TVs employing dual-cell technology, as introduced by Hisense in 2019. Note that we expect that all Dual Cell TVs will also have QDEF, but not all QDEF will be Dual Cell.

- LCD Others: this category includes LCD TVs with 8K resolution, that do not fall in any other category.

- QD Display: Samsung’s term for its Quantum Dot OLED (QD OLED) technology, but our forecast also uses this term for potential successor technologies, such as QNED and EL-QD. The QD Display category excludes QDEF TVs.

- MicroLED: we expect that Samsung will introduce direct-view MicroLED TVs starting in 2021 at sizes from 88”-110”, marketed as TVs for wealthy consumers. Our report excludes larger MicroLED products such as the 146” and 292” “The Wall” products sold by Samsung, as these are primarily business displays.

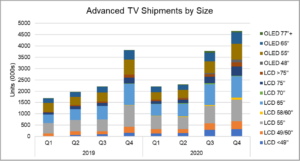

Following a massive 71% Y/Y increase in Q3 2020, Advanced TV shipments in Q4 2020 are expected to increase by a more modest 22% Y/Y to 4.7 million units, as shown in the first chart here. We expect that the screen size distribution of the first nine months of the year will continue in Q4, with big Y/Y gains at the smallest and largest sizes. Advanced LCD TVs smaller than 49” will see a 97% Y/Y increase while in 48” OLED will increase from 0 in 2019 to 112k units in Q4 2020. Overall, TVs smaller than 55” will increase from 11% of Advanced TVs in Q4 2019 to 17% in Q4 2020.

We expect that OLED TV growth will outpace Advanced LCD TV growth in Q4, increasing 26% Y/Y to 1.4 million units, while Advanced LCD TV increases 20% Y/Y to 3.3 million. OLED TV share will edge up from 29% of all Advanced TV to 30%.

Advanced TV Shipments by Size and Display Technology, Q1 2018 to Q4 2020

With lower prices and a smaller product mix, we expect that Advanced TV revenues will decline by 4% Y/Y as the average price of an Advanced TV is expected to decline from $1424 in Q4 2019 to $1154 in Q4 2020. For the full year 2020, we expect revenues to decrease by 3% to $15.7 billion. From a revenue perspective, OLED TVs have fared better than Advanced LCD TVs, with revenues growing by 10% Y/Y to $6.0 billion and the OLED TV revenue share of Advanced TV increasing from 35% in Q4 2019 to 40% in Q4 2020.

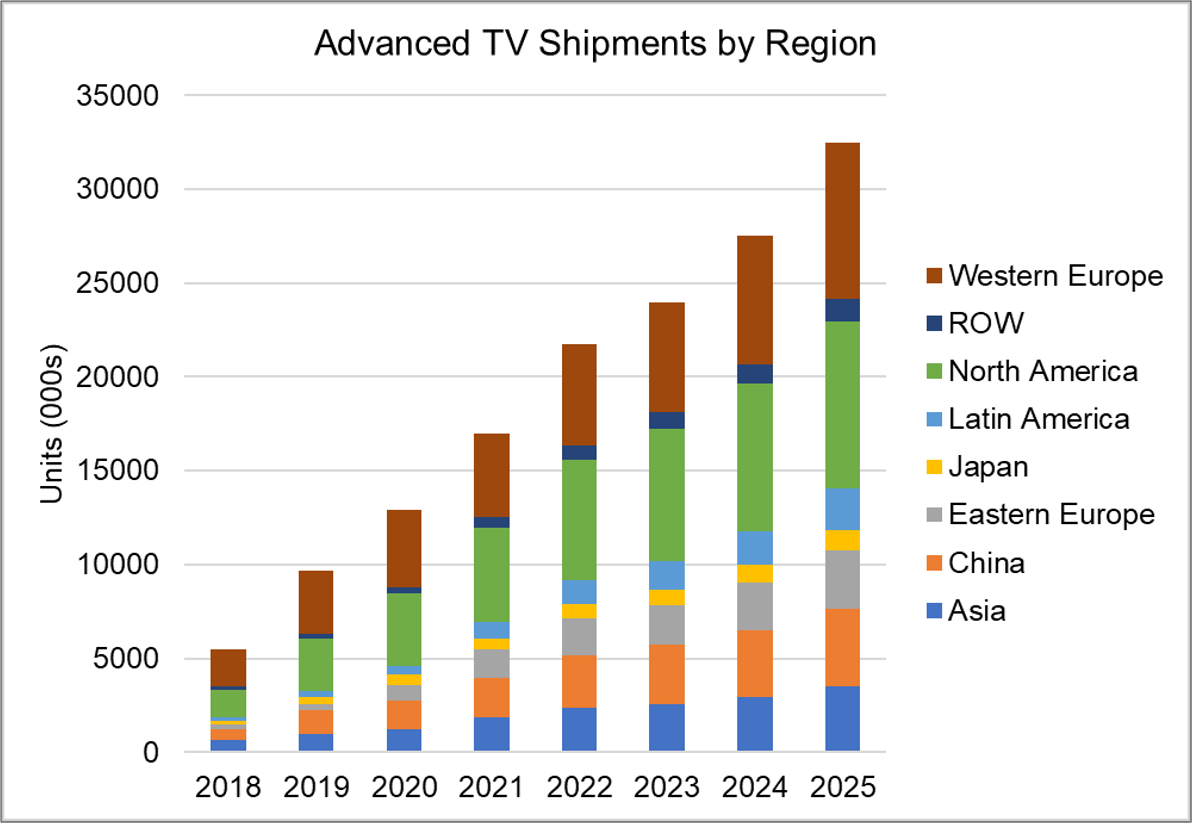

The report divides worldwide shipments into eight geographic regions, and we expect that Western Europe and North America will continue to be the largest regions for Advanced TV, but their share of worldwide shipments and revenue will decline as other regions grow faster. These two regions represent a combined 62% of Advanced TV in both units and revenue in 2020, and we expect the combined share to decrease to 53% by 2025.

Advanced TV Shipments by Region, 2018 to 2025

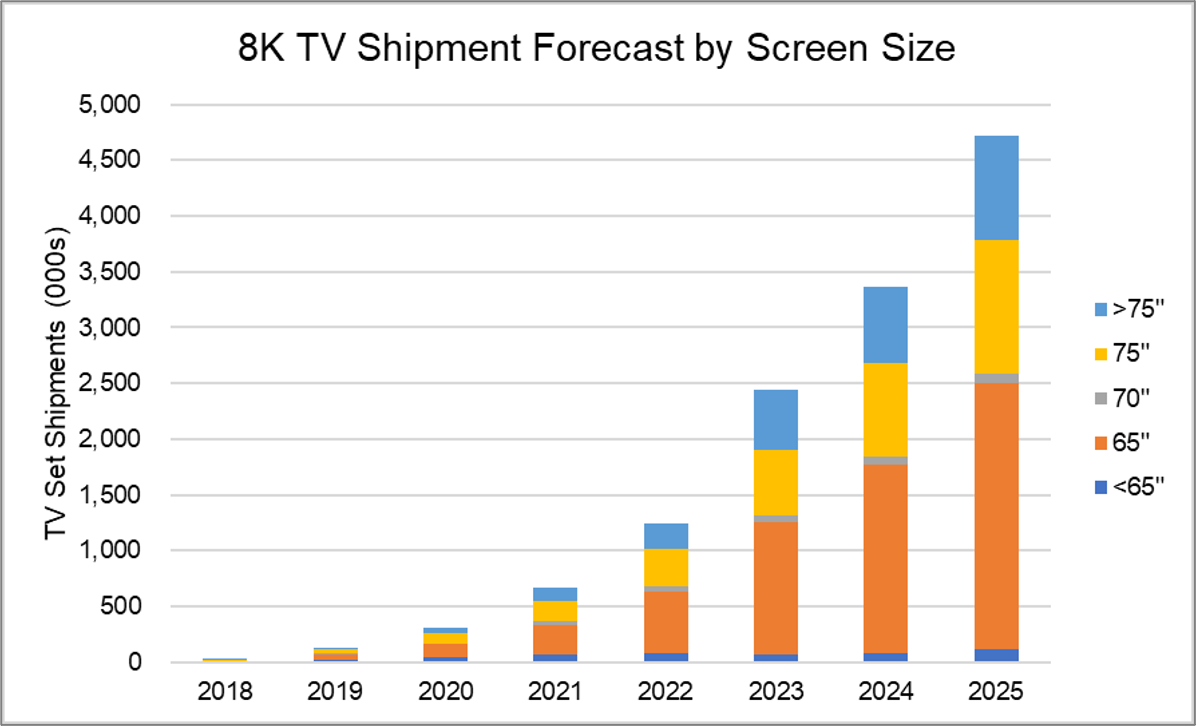

The Advanced TV landscape in the coming years will include dramatic growth in 8K TV sets. 8K TV will be led primarily by LCD technology, since the cost and performance disadvantages in LCD are relatively modest, but will also include some WOLED and QD Displays. Unlike the flat panel technologies, we do not expect 8K to be introduced for MicroLED TV during this forecast time frame, as the cost penalty for 4x higher resolution in MicroLED technology would be prohibitive.

Our forecast for 8K TV by screen size is shown in the next chart here. While we have seen 8K TV offered for 55” TVs, including Samsung aggressively pricing its 55” 8K QLED TVs for Black Friday at $1999, we expect that 55” and other sizes <65” will be only a small portion of the overall 8K market. Because of the huge volumes in 65” supplied by Gen 10.5 fabs, we expect that 65” will be the largest volume for 8K, but that 75” and >75” will represent bigger growth and revenue opportunities as the 8K market increases.

8K TV Shipments by Screen Size, 2018 to 2025

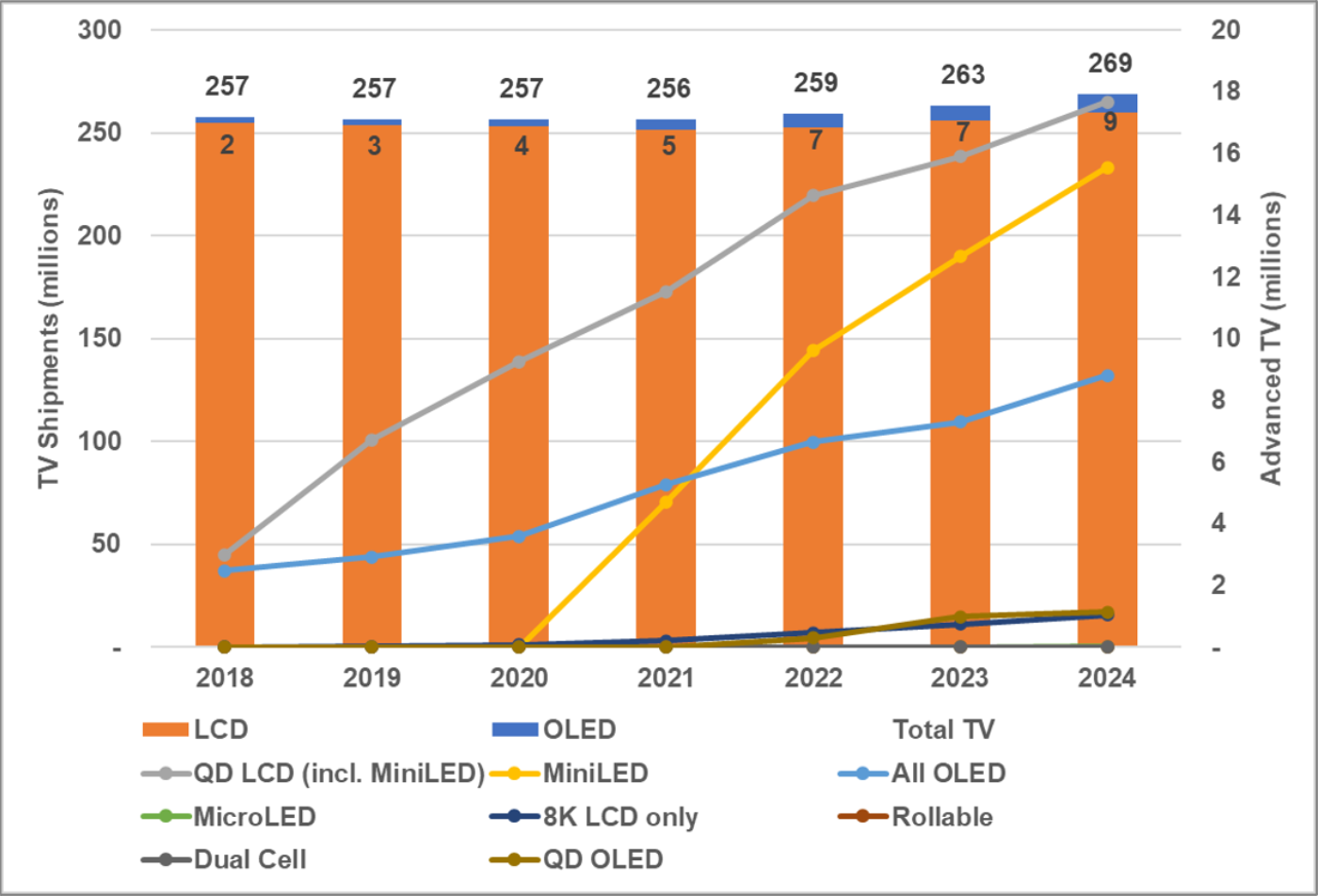

The category of Advanced TVs represents only a small fraction of the total TV market in unit terms, but it represents where all “the action” is in the technology battle. The last chart here shows DSCC’s forecast for various Advanced TV technologies in the context of DSCC’s total TV market forecast. Note that as described above some of these categories are not exclusive: MiniLED TVs are included within the QDEF total, for example.

Advanced TV Shipments by Display Technology, 2018 to 2024

We expect that OLED TV, including both White-OLED and QD OLED, will increase to 8.8 million units by 2024, growing to 3.3% of the overall TV market by that year. QDEF TVs have outnumbered OLED, and we expect that pattern will continue as QLED grows to 17.7 million by 2024. MiniLED TV was introduced by TCL in 2019 but sold only in very small volumes, but as described in DSCC’s new MiniLED Backlight Technology, Cost and Shipment Report, we expect that Samsung and other brands will aggressively introduce TVs with this technology starting in 2021, and that MiniLED will grow rapidly to take a majority of QLED TV offerings. We expect that Dual Cell LCD TV and Rollable OLED TV will continue to remain niche products with small volumes. For MicroLED, while we also expect volumes to be small, the very high prices of these TVs will generate substantial revenues, growing to $3.6 billion in 2025.

DSCC’s Quarterly Advanced TV Shipment and Forecast Report includes technical descriptions of all major Advanced TV display technologies, plus quarterly shipment results from Q1 2018 through Q3 2020 preliminary results, sortable by technology, region, brand, resolution and size, and includes pivot tables for analysis of units, revenues, ASPs, and other metrics. The report includes DSCC’s quarterly forecast for 2020 plus an annual forecast for five years across technology, region, resolution and size.