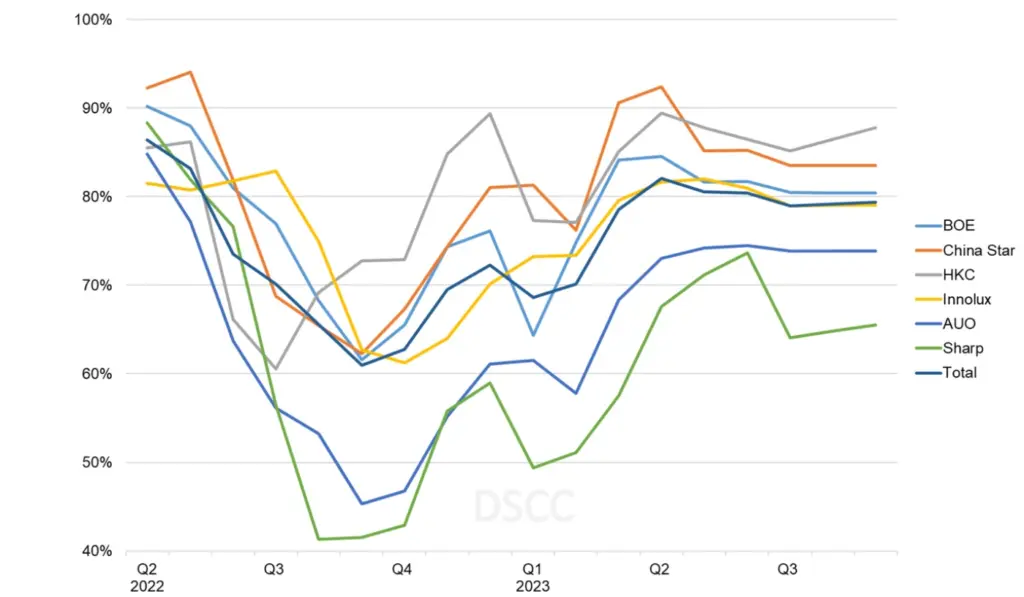

Display fab utilization has taken a nice turn in Q2’23, picking up momentum after the increase that began in Q1’23, as reported by DSCC. The display supply chain’s inventory has trimmed down to reasonable levels, and a wave of restocking is stirring up heightened demand. However, there’s a twist – the dramatic increase in LCD makers’ utilization in Q2’23 might exceed demand, potentially putting a damper on the panel price rally.

Q1’23 saw total TFT input rising by 2% Q/Q, although it was still down by a staggering 22% Y/Y, clocking in at 69.0M square meters. The ongoing Q2’23 is set to witness a 14% Q/Q surge, but a 4% Y/Y dip, totaling 78.9M square meters. The rollercoaster ride continues in Q3’23, where TFT input is predicted to be flat Q/Q at 78.6M square meters, yet boasting a remarkable Y/Y increase of 20%.

After experiencing its lowest point since the 2008-2009 financial crisis at 65% in Q3’22, utilization rates embarked on a steady climb, reaching 70% in Q1’23. DSCC forecasts suggest utilization will skyrocket to 79% in Q2’23, before slightly descending to 78% in Q3’23. Taiwan and China have emerged as the frontrunners in this utilization recovery race.

The LCD fabs’ downturn emerged from a combination of plummeting LCD panel prices and mounting inventory. As the first half of 2023 unfolds, all display technology and applications have shown signs of rejuvenation. Nevertheless, the industry’s capacity continues to overshadow display demand, and the fervent push for higher utilization might tip the supply/demand balance, causing an oversupply as we approach the second half of the year.