The final speaker of the morning session was Ron D Reich of Intel Capital where he is Managing Director of the Strategic Transactions Group. He said, after hearing Barnes’ talk, that he wondered why any VC would ever invest in the display industry! Reich’s team works on mergers and acquisition (M&A) activity for Intel Capital.

VCs are totally focused on internal rate of returns, he said. Technologists may have solutions for the pain points in the display industry and that may give opportunities for M&A activity.

Intel Capital has over $11 billion of capital invested in 1,400 companies in 57 countries over 20 years. The company is a strategic partner, but it works hard to ensure results for its VC partners. There have been 211 IPOs and 369 acquisitions from its activities. There has been a lot of investment in touch and in enabling the RealSense technology.

Why is Intel interested in displays? If you look at the BOM cost for mobile phones and tablets, much of the BOM goes to display and touch rather than CPUs, so they are very important. The second reason is that the display takes a lot of the power budget and that makes it important. If Intel saves a lot of power in its CPUs, it doesn’t help if the displays take too much power.

From an outsider’s point of view, it’s strange that displays are important and can really help to make the device appealing and attractive, but makers can’t make money.

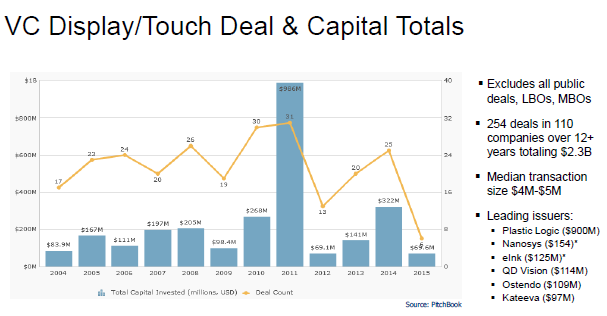

Reich looked at VC investments in display and touch which typically total somewhere around $200m per year. Plastic Logic was an exception at $900m in one year. Once you get to “nine digits of capital”, the exit value has to be very high to give VCs the return they are looking for.

Reich then showed some recent exits and showed that there had been some good returns on particular investments. There have been no “billion dollar exits”, though, and even the best exits are in the range of $200m to $500m. Cloud and software start-ups are very low cost these days because so many assets can be rented and so with billion dollar valuations, there are potentially huge returns. That doesn’t happen in displays, typically, where more investments can be much bigger.

Finally, he went through some classes of investment that are seeing activity. There is a lot of excitement about LED-based microdisplays, but there are a lot of real and serious challenges. There is work in virtual displays and projection. ITO alternatives are also interesting.