I was recently able to attend an online webinar organised by Sigmaintell, a market research company in China and SID China. There were two sessions, one on large area displays and one on mobile displays and semiconductors. I was able to join the one on small displays and it was a useful summary of ‘where we’re at’.

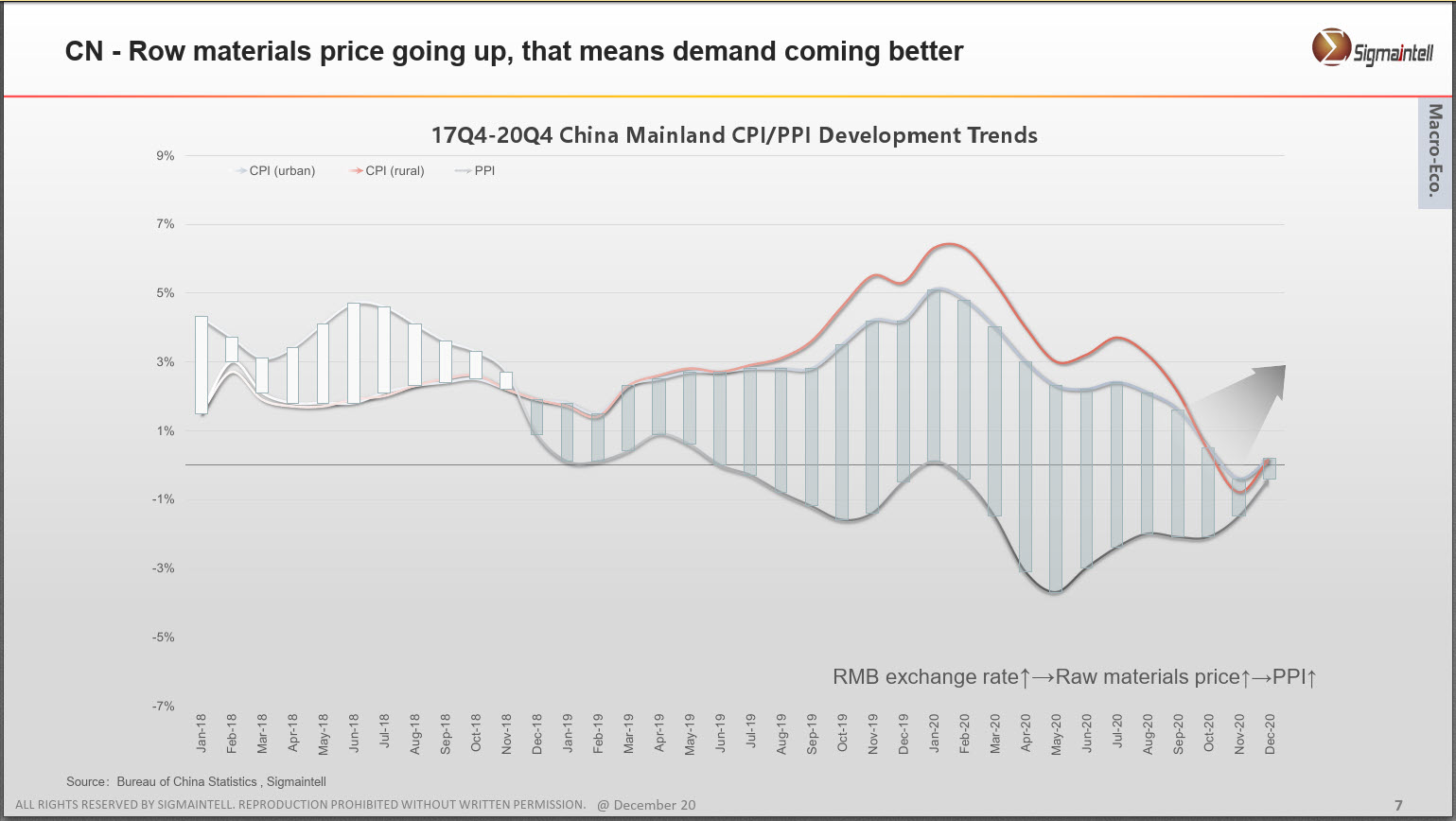

Chan went through the general macroeconomic developments and showed an interesting chart of the trend in raw material prices that showed a change in the direction of declining prices since 2018 to a rising trend in recent months. Economies are doing better than was feared partly because governments have pumped in $7 trillion to their economies in stimulus packages.

These factors will be important for set makers who will be under pressure from possibly weaker than planned for demand combined with supply side price rises. Smartphone set makers in China are up 30% to 40% compared to this quarter in 2020 and overall this year will see more production than last, although there is likely to be only small growth in the second half of the year.

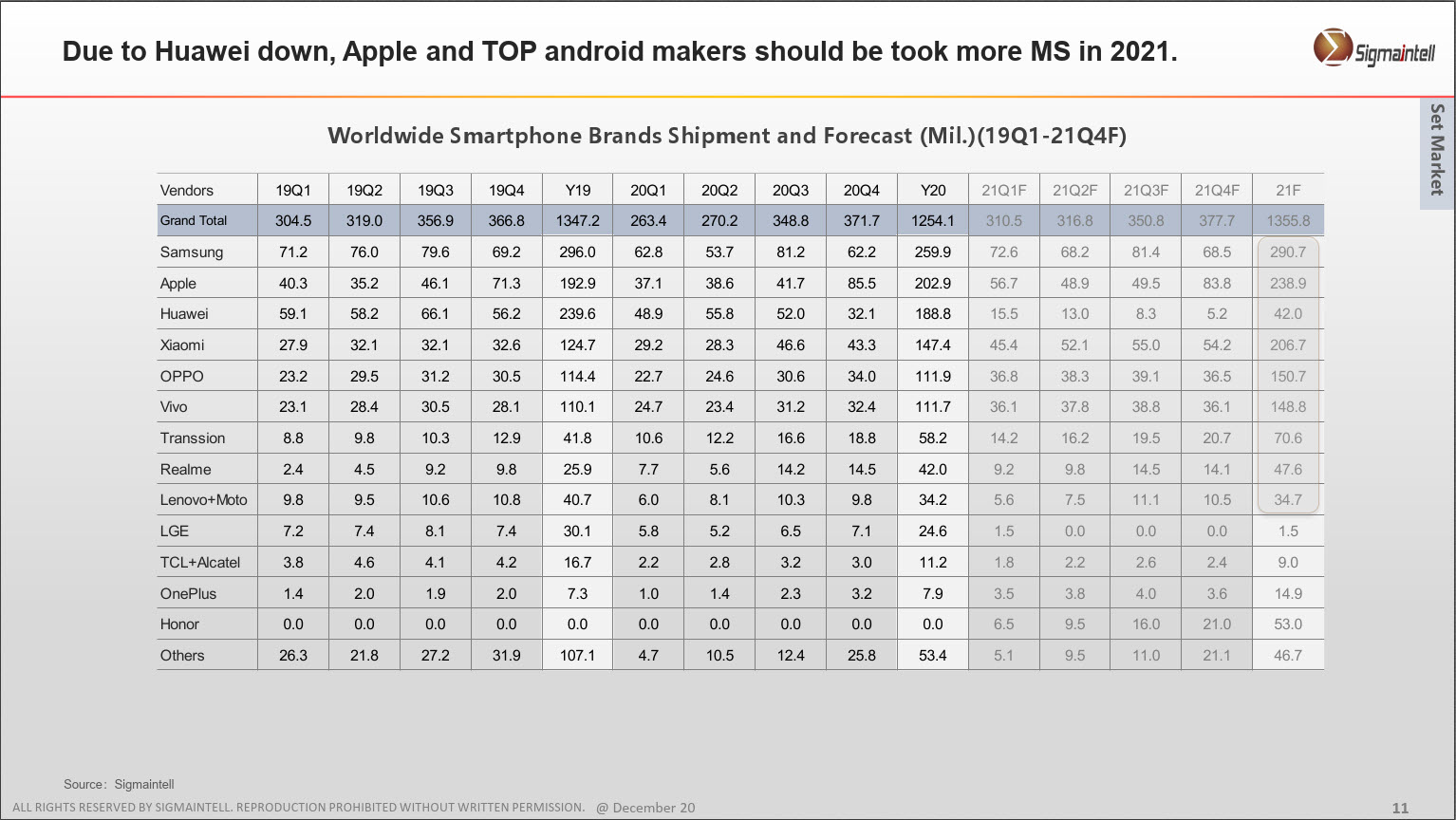

Samsung will profit from Huawei’s challenges, as will other set makers. However, their ability to make the most of Huawei’s problems will be limited by supply side factors, such as the problems in Samsung’s chip-making fab in Texas. Apple will also grow in China and elsewhere and Sigmaintell is forecasting nearly 240 million sets for the brand in 2021. Xiaomi has done very well and both Oppo and Vivo will exploit the small retailer channel in China who can’t get the Huawei sets they would like to.

Other brands are thriving as Huawei struggles

Other brands are thriving as Huawei struggles

Looking at the LCD/OLED competition, Chan expects LCD to increase in share this year because of cost pressures, but expects OLED to get a boost later in the year. Xiaomi and Oppo will buy more OLEDs this year, with the former buying ‘many more’. She went through the panel buying plans of the major brands by size, by resolution and by panel type – with a detailed slide for each!

Hot Topics

Chan then turned to ‘Hot Topics’ in the market.

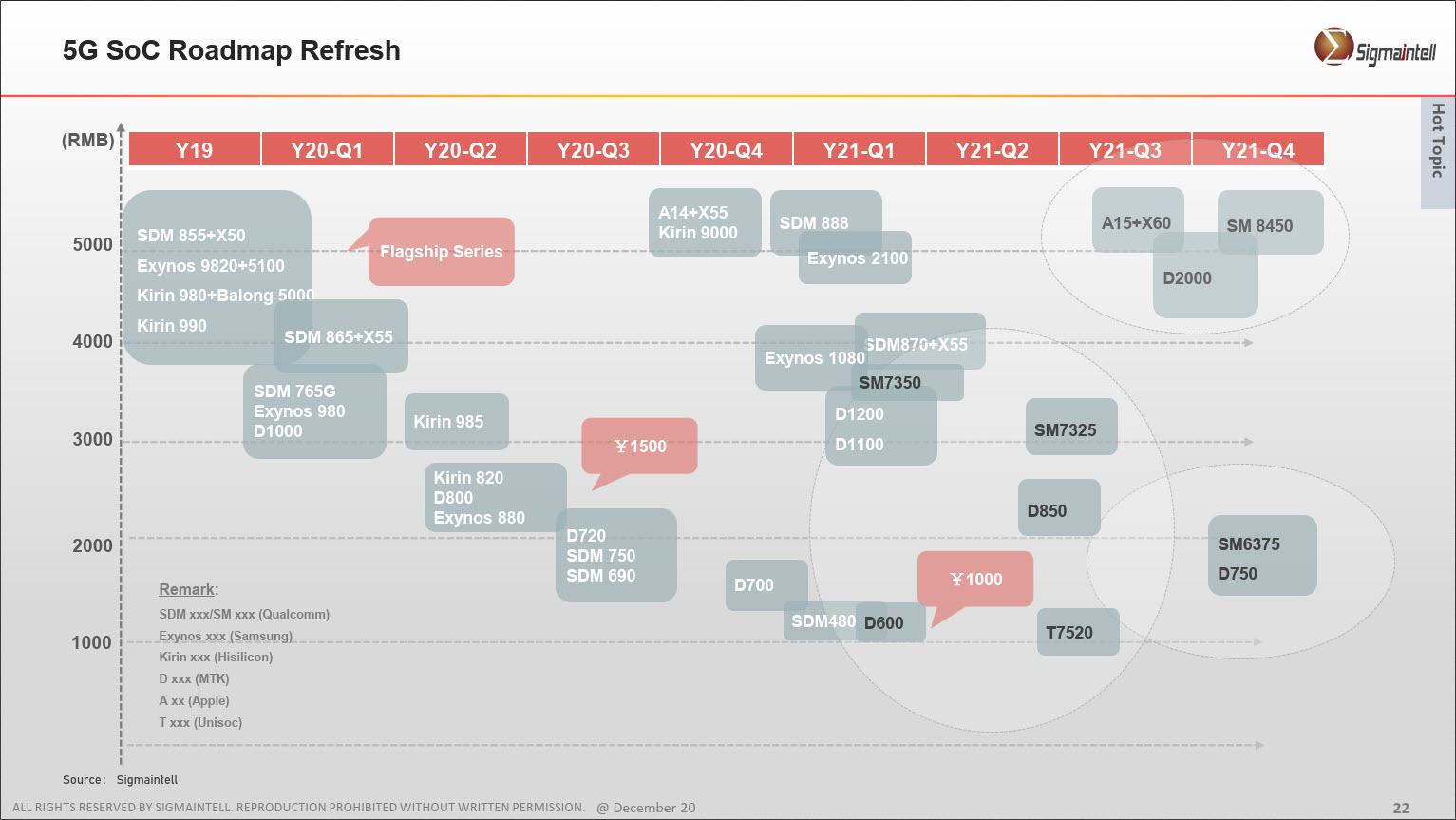

5G is the big topic and there was faster growth in 5G sets than 5G users in the second half of 2020. She presented this interesting roadmap of 5G SoCs. There are currently appearing more low end 5G chips, but in the second half this will switch back to mainly higher end chips. This year will see the share of the market that goes to 5G will rise from 20% to 40% in 2022. It will be even more in China.

Cheaper 5G Phones are enabled by lower cost SoCs

Cheaper 5G Phones are enabled by lower cost SoCs

Part 2: Panel Supply in Smartphones

In the second part of the session, Fiona Wu looked at the panel supply aspects of the industry.

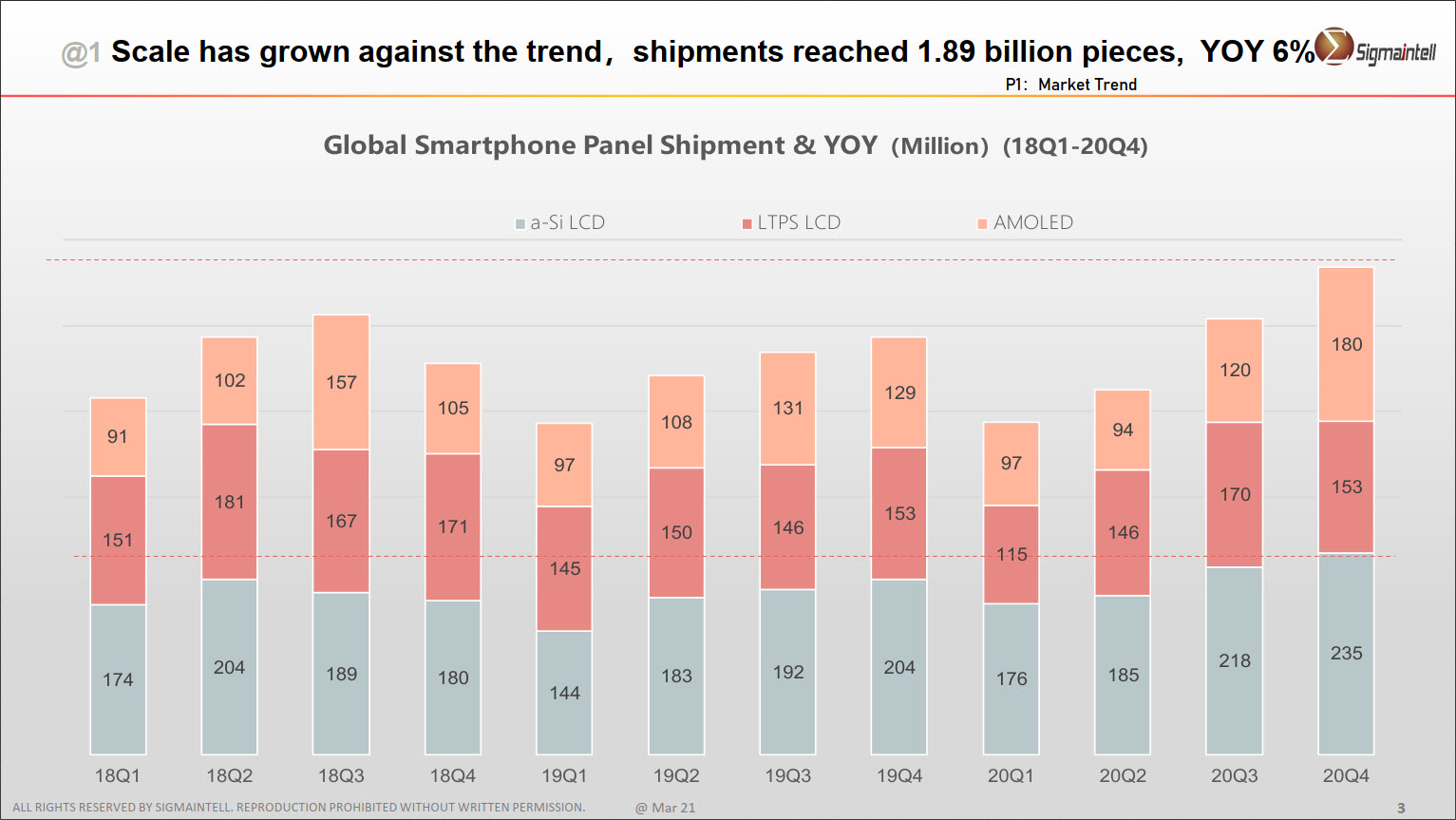

The panel supply side has been growing and there was a big quarter of 517 million units in Q3 last year, but that grew to 568 million in Q4 as brands promoted low end products and built up inventory to avoid stock shortage problems because of tight supply.

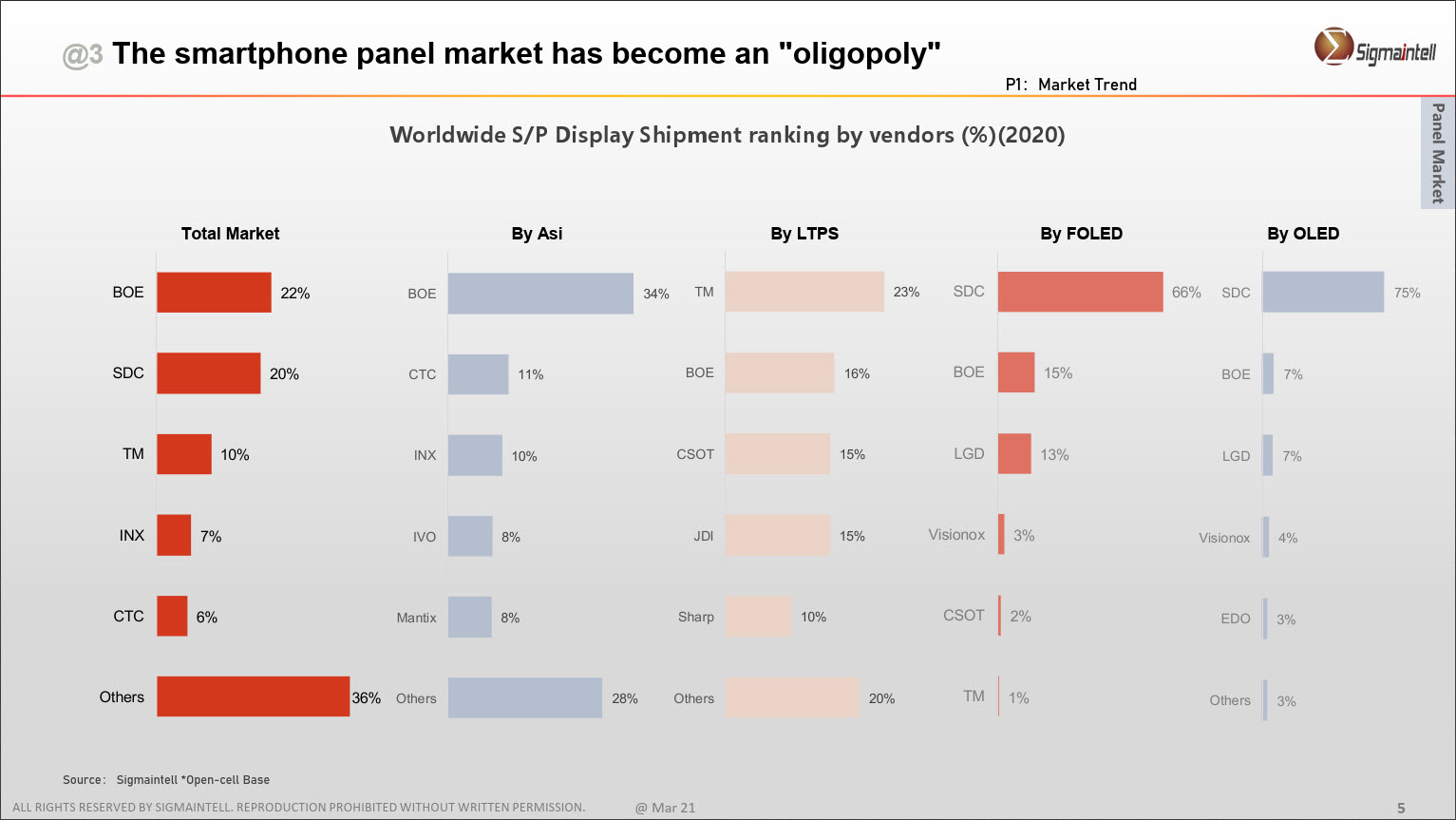

Samsung Display (SDC) was top in Q4, ahead of BOE and Tianma which was in third, down 11.7% year on year. The panel market is becoming an oligopoly now with the top three taking over 50% of the market. Over the whole year, because of its strength in LCD, BOE was top with 22% ahead of SDC at 20%.

Tianma will be hit by the drop in demand from Huawei, but is still top in LTPS with 23%. LTPS LCD declined because of Apple’s move into OLED, with only one LTPS model last year.

Different Suppliers are Strong in different technologies

Different Suppliers are Strong in different technologies

Supply/demand balance will change in each technology during this year. Low end LCD will go from tight supply at the end of 2020, with just 4% oversupply to 29% oversupply by the end of 2021. LTPS will also rise to 14% oversupply and rigid OLED will be balance. Flexible OLED will be in oversupply, but will tighten by the end of the year.

The oversupply situation may change if more capacity continues to be moved into the production of panels for IT products.

Foldables

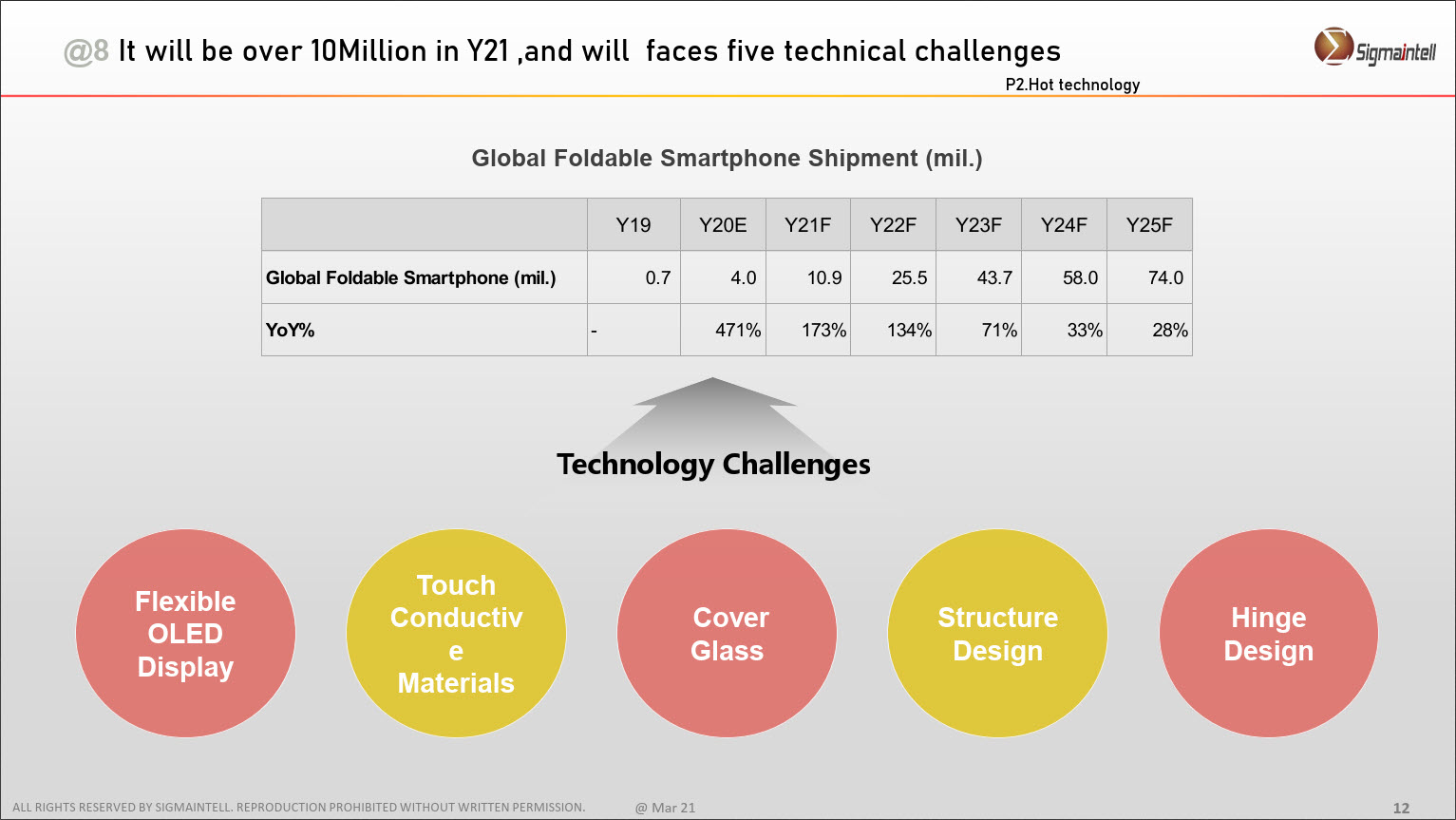

Sigmaintell is one of those analysts that thinks that the foldable phone segment may get over 10 million units this year and will jump to 25.5 million in 2022 and up to 74 million by 2025. That growth will be despite challenges in mechanical design as well as in display manufacture.

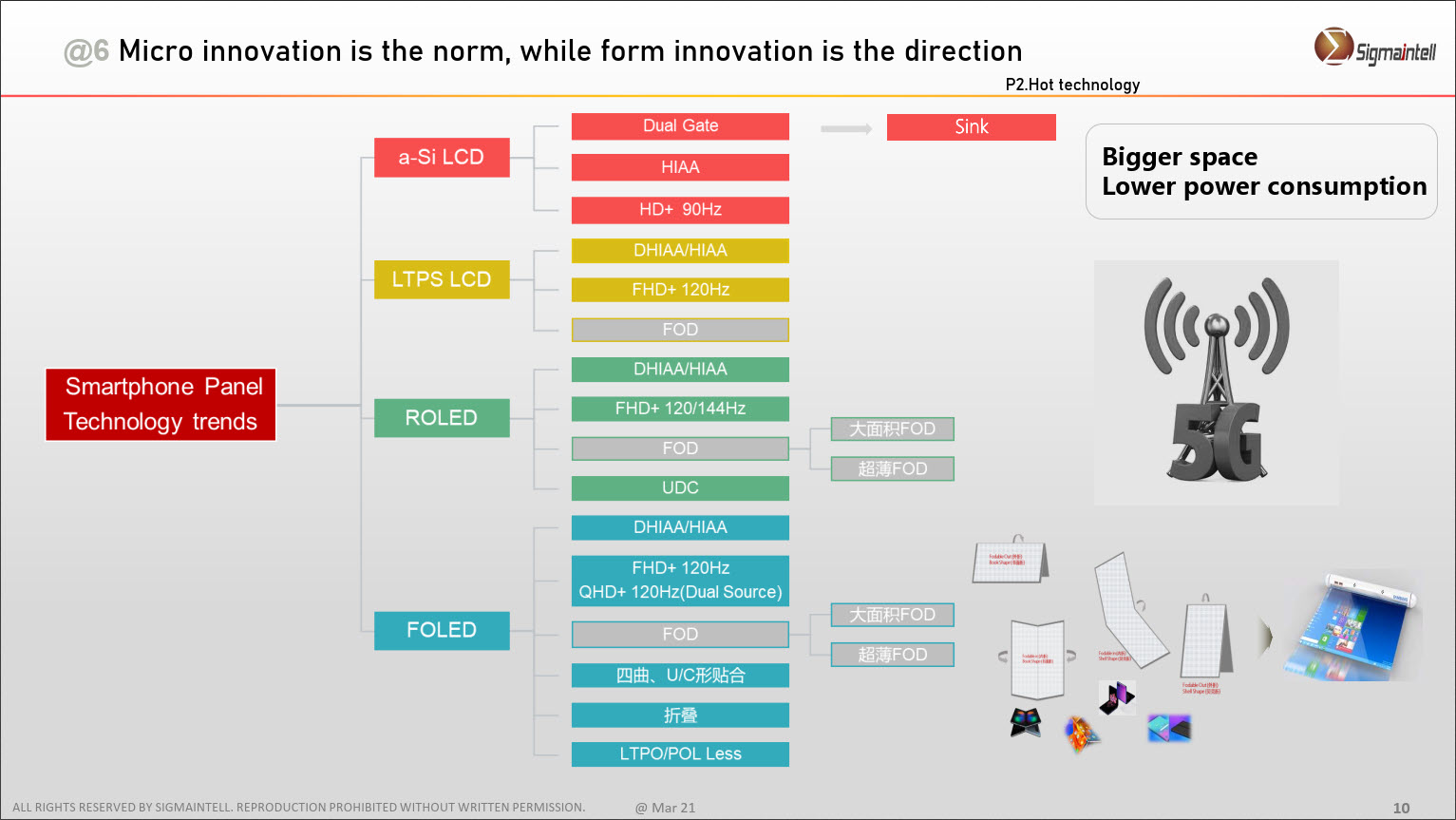

There is still plenty of work going on to improve all technologies. Wu said that colour filter on encapsulation (COE) could reduce display thickness by 20% and improve product lifetime and performance. There will be more work on and adoption of LTPO. It should be cheaper than LTPS as well as saving power.

She briefly mentioned ‘Sinking’ designs of panels which will extend the ratio of display area at the same module size. That could allow 6.7″ displays in the same form factor as 6.5″ currently takes. (I’m hoping to be able to write a follow up article on this topic – Editor)

Chart of technology developments – all technologies are still improving

Chart of technology developments – all technologies are still improving

(BR)