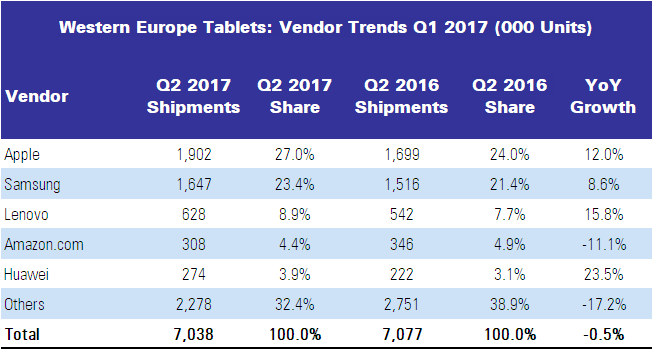

According to the latest figures published by IDC, the tablet market in Western Europe posted just a 0.5% YoY contraction in Q2. In total, 7.0 million devices were shipped in the region, which shows an almost complete recovery of the market in the region. Apple’s new tablets and the improvement of the macroeconomic situation in several countries were some of the drivers for Q2 2017 and were key to the further stabilization of the consumer segment. In general, detachables remained positive with 1.0% YoY growth and slate tablets showed resilience with a decrease of just 1.0% YoY.

Overall, the commercial segment performed positively with 2.8% YoY growth. This was mainly driven by Apple and Android-based detachables, which grew 29.3% and 34.9% YoY respectively.

“Detachables are showing particularly strong growth within the corporate business, facilitated by the introduction of more commercially oriented models. These models are geared toward operating primarily as a portable PC with the secondary benefit of a tablet, helping to compete against the growing commercial trend toward the adoption of convertibles,”

said Liam Hall, research analyst, IDC Western European Personal Computing Devices.

On the other hand, although remaining negative, the consumer segment showed better results after a couple of years of dramatic declines. This was due mainly to the release of the new iPad, which was launched with an attractive price point and pushed users to renew their devices. It led to Apple slate tablets growing 27.0% YoY and stabilized the segment, with the YoY decline at just 1.0%.

“It’s clear that Apple played the right cards this quarter and, as expected, outperformed with the release of the new iPad Pro and iPad, targeting both the consumer and commercial segments. In the short term, this may help support shipment volume as older devices might be renewed thanks to the attractive product and price on offer,” said Laura Llames, research analyst, IDC Western European Personal Computing Devices.

The back-to-school period in some countries, especially in the Nordics, bolstered the market in the public space, with growth of 37.0%. In the private sector, Android-based devices played well in both SMBs and large enterprises, with total growth of 16.2%.

Company Analysis

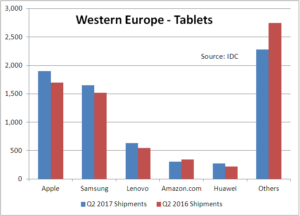

Apple ranked first with 27.0% market share and growth of 12.0% thanks to the release of the new iPad and iPad Pro. The price positioning of the new iPad encouraged users to renew devices and that, combined with the innovation of the new iPad Pro, enabled the company to grow strongly.

Samsung ranked second, recording a market share of 23.4% and growing at 8.6% YoY. This was driven by growth of the Galaxy Tab S2 and the new Galaxy Book detachable, but slate tablets made the largest contribution to volume after showing signs of recovery.

Lenovo gained 1.2% market share YoY to reach 8.9%, with solid growth of 15.8% YoY. This was driven mainly by the strong performance of the Android-based slate tablets, especially in the SMB segment.

Amazon.com was in fourth place, due to its portfolio of new slate tablets and by expanding its Alexa service to the U.K. Ahead of Prime Day, growth remained negative (-11.1% YoY) with a market share of 4.4%.

Huawei continued to grow, with market share of 3.9% and 23.5% growth YoY, enabling it to enter the 5 top thanks to its mobile broadband enabled devices.

Note: Tablets are portable, battery-powered computing devices inclusive of both slate and detachable form factors. Tablets may use LCD or OLED displays (epaper-based ereaders are not included here). Tablets are both slate and detachable keyboard form factor devices with color displays equal to or larger than 7.0in. and smaller than 16.0in.