Following the session and panel discussion with five speakers moderated by Jack Kent of IHS titled What are Wearables for Anyway, the Display Week 2015 Market Focus Conference – Wearables-Flexible proceeded to an overview of the market for flexible and wearable displays delivered by Paul Gray of IHS. Gray’s first graphic (below) neatly summed up my observation from both the SID 2015 exhibit floor but also from the several recent introductions of products containing flexible displays. My observation is, “flexible displays are available in the market and offer compelling design differentiation”.

Source: IHS

Source: IHS

This jumping off point for Gray’s presentation led to his first observation that “Mobility is the new frontier”. He noted that CES 2015 demonstrated that mobility, particularly the automotive and wearables markets are the main growth areas for the flexible display segment. He identified the market drivers for this trend as the need to provide designers with the means to address product “diversity and fashion” and to address the “basic consumer need for personalization”. In the automotive market, Gray notes that “Increasing intelligence and connectivity in vehicles demands better displays”. He also described the display as a critical differentiator (and a) key consumer touch point”.

Gray pointed out that flexible displays have particular value in the automotive environment both in dealing with dashboard reflections and in dashboard design (see photos below). He noted that: “Curved screens reduce reflections, a huge problem for auto makers; Screen becoming part of the dashboard design, not a grudging adjunct”; and finally “Screen performance critical to consumer value (perception)”.

Source: Ford

Source: Ford

Source: Audi

Source: Audi

Gray foresees a variety of display technologies being applicable to the automotive and wearable display markets. He sees passive matrix OLED (PMOLED) making a comeback while AMOLEDs are being considered where heavy display interactivity is demanded. He also sees LCDs with fixed curvature being used increasingly and electronic paper (electrophoretic) displays utilized in power-critical applications.

Gray’s proposed roadmap for flexible display technology evolution (see below) defining four generations of flexible display technology was most interesting to me.

Source: IHSWe are well along the developmental roadmap shown with product introductions of curved and bendable displays for mobile devices, including Samsung’s “Edge” branded AMOLED mobile display products, as well as LG’s range of curved display smartphones. With substantial market drivers for flexible displays in the mobile, wearable and automotive market segments, the motivation to further develop flexible displays with added capabilities is clear. Gray referred to these market drivers in his forecast of flexible display growth (illustration below).

Source: IHSWe are well along the developmental roadmap shown with product introductions of curved and bendable displays for mobile devices, including Samsung’s “Edge” branded AMOLED mobile display products, as well as LG’s range of curved display smartphones. With substantial market drivers for flexible displays in the mobile, wearable and automotive market segments, the motivation to further develop flexible displays with added capabilities is clear. Gray referred to these market drivers in his forecast of flexible display growth (illustration below).

Source: IHS

Source: IHS

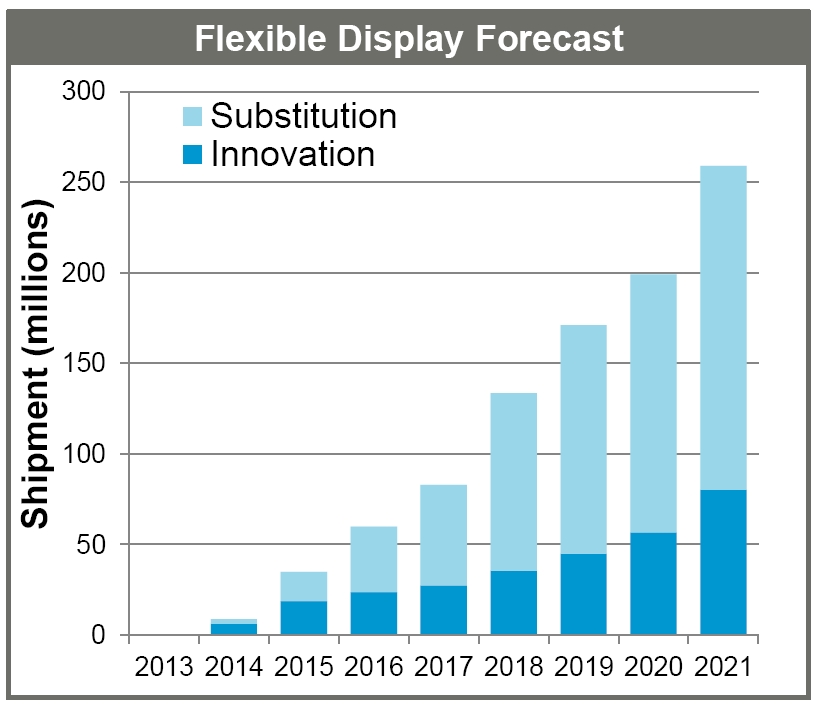

In his forecast, which showed essentially no volume flexible display shipments in 2013, Gray forecasts that shipments will grow to more than 250 million units by 2021. This rapid growth and the likely premium price afforded to displays with flexibility and other key performance attributes together bode well for a vibrant and valuable flexible display market.

Gray finds that for flexible displays, “most growth will be into existing applications”. He finds that these applications include smartphones, smart watches, and automotive dashboards, although he makes clear “new categories (are) likely to emerge”. In other application market segments he foresees clothing and medical markets being drivers for flexible display growth. Finally, Gray notes that, “Process development will be critical to create new markets. Slower introduction of new generations will inhibit growth. (and finally) Novel solutions (will be) required!” Since flexible displays themselves enable some pretty novel features, I for one am not surprised that novel solutions will be required and be forthcoming. – Phil Wright