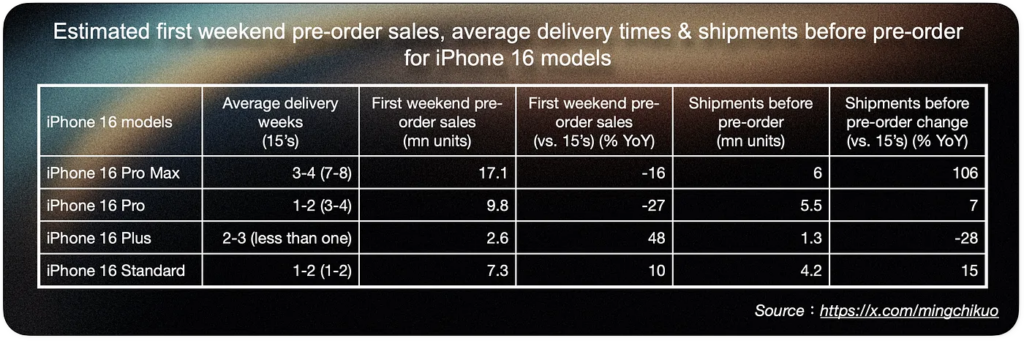

Analyst and Apple truth serum maker, Ming-Chi Kuo, has some shocking news for the Apple faithful, the iPhone 16 series saw an estimated 37 million units sold in its first weekend of pre-orders, a 12.7% YoY decline compared to the iPhone 15 series. According to Kuo, this is probably due to the lower-than-expected demand for the iPhone 16 Pro models. Kuo bases his analysis on what he learns from the supply chain and it seems like weaker demand is hurting sales.

As for why this is happening, Kuo believes it is the delayed availability of Apple Intelligence but he acknowledges competitive pressure from the Chinese market is impacting overall demand for the iPhone. And there’s a lot of talk about China on these pages, today. The strength of the Chinese display industry seems to be a reflection of its growing strength in smartphones, too.

It seems Kuo’s take here has rattled the financial markets as Apple’s shares have seen a drop, mostly because Wall Street was looking for some good news on iPhone 16 sales and it’s now fretting over what this might mean as we enter the peak holiday shopping seasons.

Tim Long, an analyst at Barclays with a similar following on all things Apple, has apparently said that it’s to “time to jump ship,” according to one news report. He is looking at the Chinese market pre-orders, and the delays of Apple Intelligence in China to 2025, and not feeling it. It’s about my pay grade to think or care about stock prices, but it looks like that’s all that really matters when it comes to Apple and that the company may have lost the thread when it comes to making cool stuff.