New results from the International Data Corporation (IDC) Worldwide Quarterly PC Monitor Tracker show that the global PC monitor market posted flat results in the first quarter of 2022 (1Q22), registering a 0.3% increase in shipment volume compared to the same quarter a year ago. Although the result was higher than expected, the trend still conformed to expectations of a slowing market which began in the second half of 2021.

With 36.5 million units shipped, the first quarter outpaced all 2021 quarters except 4Q21. Nearly all regions saw good commercial uptake, as well as improved product availability to fulfill markets that had been previously neglected due to product and logistical challenges. At the same time, consumer inventories have also begun to build in the face of inflationary concerns and more diversified spending.

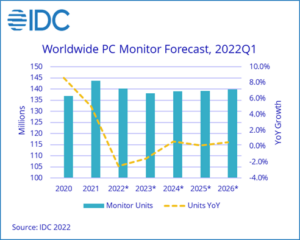

Looking ahead, IDC expects monitor shipments will decline as the market digests the tremendous volumes recorded in 2020 and 2021. The outlook for the rest of 2022 has been lowered compared to the previous forecast with global shipments expected to shrink 2.5% year over year in 2022. IDC expects 2023 shipments will decline another 1.5% year on year before stabilizing in 2024. China, the second largest market in the world, has notably lowered its forecast due to much gloomier outlook. Consumer demand has been pared back while commercial demand has been raised.

“We are seeing large portions of the consumer demand slowing amidst economic challenges and budget diversion as countries continue to re-open,” said Jay Chou, research manager for IDC’s Client Devices Tracker. “Some emerging market consumer demand will linger in the short term as vendors are now able to fulfill backlogs, while gaming and office returns will also drive demand. However, we are largely reverting to the pre-pandemic trend of a market driven largely by commercial replacements, many of which require multiple-monitor PC setups.”

Company Highlights

Amidst a tough market, Dell expanded its leadership position through its supply chain competency and commercial sales. The company took 22.4% of the market, a record for the firm since IDC began tracking monitors in 2008. Competition for others remained close and fierce with the rest of the top 5 monitor vendors each having shares of between 10.1% to 10.8%. Overall, the market was a tale of two halves – the commercial market grew over 5% while the consumer side declined 5%. Other commercial heavy firms like HP Inc. and Lenovo rounded out the top 5 and were buoyed by more office re-openings. Samsung also saw year-over-year growth, buoyed in part by its leader status in the consumer monitor space. TPV, owner of AOC and Philips, was hurt by a struggling Chinese market and events in Eastern Europe.

Top Companies, Worldwide PC Monitor Shipments, Market Share, and Year-Over-Year Growth, Q1 2022 (shipments in thousands of units) |

|||||

|

Company |

1Q22 Shipments |

1Q22 Market Share |

1Q21 Shipments |

1Q21 Market Share |

1Q22/1Q21 Growth |

|

1. Dell Technologies |

8,184 |

22.4% |

6,816 |

18.7% |

+20.1% |

|

2. TPV |

3,955 |

10.8% |

5,138 |

14.1% |

-23.0% |

|

3. Samsung |

3,888 |

10.6% |

3,765 |

10.3% |

+3.3% |

|

4. HP Inc. |

3,814 |

10.4% |

3,808 |

10.5% |

+0.2% |

|

5. Lenovo |

3,709 |

10.1% |

3,831 |

10.5% |

-3.2% |

|

Others |

12,999 |

35.6% |

13,075 |

35.9% |

-0.6% |

|

Total |

36,549 |

100.0% |

36,434 |

100.0% |

+0.3% |

|

Source: IDC Quarterly PC Monitor Tracker, June 22, 2022 |

|||||