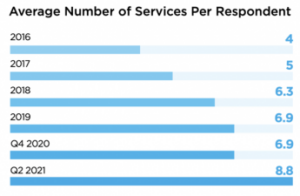

TiVo’s latest Video Trends Report was just released, covering the second quarter of 2021, and it’s full of interesting data about how, when, and where we in North America watch video content.

A little over a decade ago, the video streaming business didn’t exist. YouTube got off the ground in February of 2005 and a year later was sold to Google for $1.65 billion. Netflix began streaming video content a year later and soon became the #1 streaming platform worldwide, outstripping cable giants like Comcast and AT&T in total subscribers.

Concurrently, we saw increases in broadband speeds through those same cable networks that enabled more and more customers to drop conventional cable TV packages and subscribe to Netflix, Amazon Prime, Hulu, and other streaming-video-on-demand (SVOD) channels. Today, every major Hollywood studio except Sony Pictures operates a subscription SVOD channel, many in partnership with jointly-held TV networks: Disney+. Hulu+. Peacock. Paramount+. HBO Max.

And plenty of alternatives to costly cable TV bundles have sprung up, like Sling TV, Vimeo, Pluto TV, and Tubo. The latest trend is advertiser-supported-video-on-demand (AVOD), and the king of the hill of AVOD is YouTube. Amazon Prime members can watch first-run shows on selected channels with limited commercials. Hulu offers a cheaper, ad-supported (no skipping) package and a more expensive one without ads. TiVo, who invented the DVR over two decades ago, has its own ad-supported free TV channel.

To the casual observer, the streaming TV business seems extremely fractured and disorganized. Currently, the top players in this market are Netflix, Amazon Prime, Hulu, and YouTube. These channels account for the majority of SVOD subscriptions, although Disney+ is knocking at the door with over 200 million worldwide subs.

TiVo itself has been sold a couple of times. Once part of Rovi (the company that was once known as TV Guide), TiVo is now owned by Xperi. And in addition to its DVR products (I use a TiVo Bolt for over-the-air TV reception and recording), the company sells advertising on its boxes and also conducts extensive market research on TV viewing habits.

Watch the Money

Their latest report, covering the 2nd quarter of 2021, is full of insights. TiVo found that the average consumer spends $142.20 per month on broadband and video services, which isn’t a whole lot different than a conventional “double play” cable/internet bundle would cost. Fifty-five percent of the 4500 survey respondents are already at their spending limit and 30% don’t have room in their budget for any additional streaming services, while 25% said they can only pay less than $10 per month for additional streaming services (25%).

It has been noted more than once that adding on multiple SVOD subscriptions can quickly get you back to what a traditional pay TV channel bundle cost, and subscribers are finding that out the hard way. Perhaps not surprisingly, the TiVo survey revealed that SVOD subscriber churn is twice that of conventional cable TV. From the report: “Around 11 percent of respondents said they canceled pay-TV service within the last six months. Of those, 73 percent cited price as a factor in their decision. Still, nearly 70 percent admitted they’re not sure if they’re actually saving money on entertainment.”

We do like watching TV, though. Over 60% of pay TV subscribers reported watching about 4 hours of TV per day, and the majority of those are channel surfers. Even so; about a third of viewers who subscribe to SVOD services also like to surf through streaming program options. As far as local content (news, weather, etc) goes, 86% of pay-TV subscribers replied that they consider viewing local content important, while 65% of broadband-only customers consider viewing local content important.

It Ain’t Chicken Feed!

In my household, we decided to slash our monthly cable/broadband bill by dropping all cable TV packages, then adding back HBO Max, subscribing to a Sling TV “blue” package (essentially low-tier cable channels like TNT, MSNBC, CNBC, The Weather Channel, USA, etc.) and using my outdoor antenna system to grab the free channels out of the Philadelphia and Allentown/Bethlehem/Easton markets. That’s a total of 12 major channels and over 65 minor channels of programming, all received and recorded through the Bolt. (We already had Netflix and Prime and kept those). Cost savings after all promotional offers ran out? About $75 per month, or $900 annually…which ain’t chicken feed!

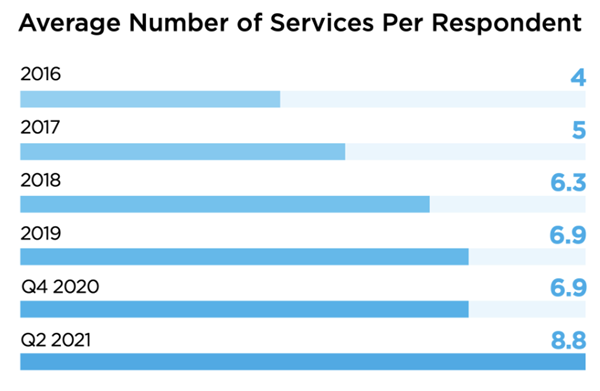

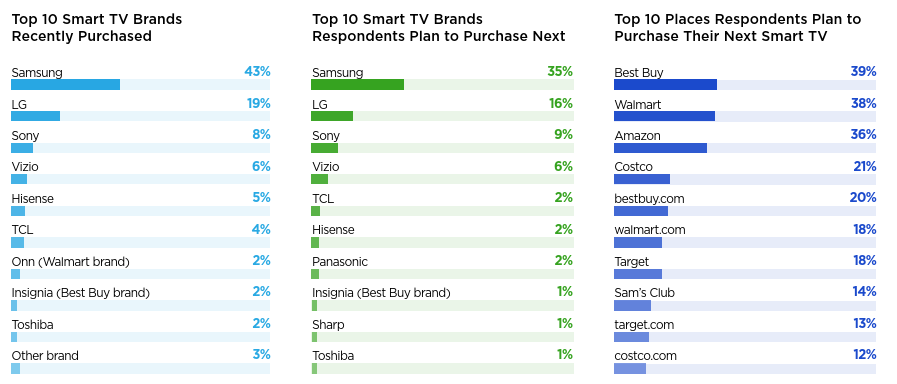

In the hardware department, 71% of respondents to the TiVo survey own a smartTV, which is an 11% increase over Q4 2020. And 29% of responses revealed smart TV purchases in the past six months. Not surprisingly, Samsung led the field with 43% of recent smart TV purchases, followed by LG (19%), Sony (8%), Vizio (6%), Hisense (5%), and TCL (4%). That order was essentially the same when survey participants were asked which brand of smartTV they’d be most likely to purchase next.

As far as retailers go, Best Buy topped the list of the most likely place to buy that next smartTV, edging out Walmart 39% to 38%. Amazon was #3 at 36%, followed by Costco (21%), Best Buy’s Internet store (20%), Walmart’s Internet store (18%), Target (18%), and Sam’s Club (14%). (I assume the survey offered multiple, ranked choices). And televisions remain the most popular platform for watching television: 77% of respondents watch conventional pay channels on TVs, while 61% of SVOD subscribers do. Smartphones were the second most-popular choice for viewing, with tablets coming in a distant 3rd across all viewing categories.

There’s lots more to the report and you can download it here. (PP)