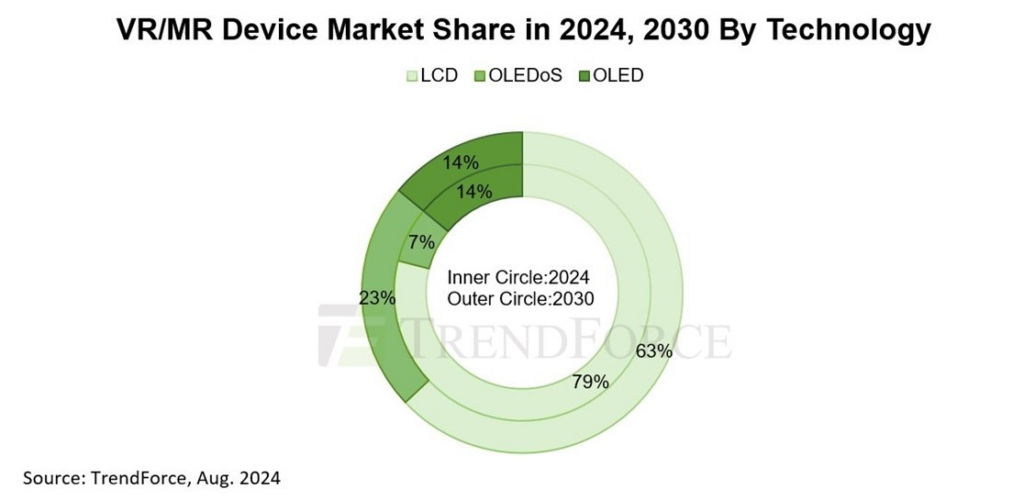

TrendForce’s latest report says shipments of near-eye displays are going to grow annually over the coming years as inventories are cleared with OLEDoS technology expected to dominate the high-end VR/MR market, increasing market share to 23% by 2030. LCD technology will continue to hold the majority share of 63% as a result of the mainstream near-eye display market.

TrendForce classifies VR/MR devices as near-eye displays designed for an immersive experience through a single display, whereas AR devices emphasize transparency and the blending of virtual and real-world applications. The company seems to have a bullish stand on the Apple Vision Pro anticipating that it will further expand VR/MR applications, despite current challenges like high pricing and limited service content. That’s why in its analysis the VR/MR device shipments are expected to reach 37.3 million units by 2030, with a compound annual growth rate (CAGR) of 23% from 2023 to 2030.

The collaboration between Sony and Apple on the Apple Vision Pro is defined as establishing OLEDoS as the leader in the high-end VR/MR market. Chinese manufacturers, such as SeeYa and BOE, are investing in OLEDoS technology, which is expected to reduce costs and improve CMOS yield rates, increasing OLEDoS’s market share from 7% in 2024 to 23% by 2030.

LCD technology remains dominant due to its cost-effectiveness, leading with its use by Meta. However, as demand for higher resolution and image quality grows, LCD products, currently at 1,200 PPI, are expected to feel the competitive pressure. TrendForce estimates a 5.6% decrease in LCD near-eye display shipments in 2024 compared to 2023, totaling 6.8 million units.

OLED technology’s market share in the VR/MR market is expected to remain between 13% and 15% from 2024 to 2030. OLED faces challenges such as the screen door effect and lower competitiveness compared to OLEDoS in the high-end market and LCD in terms of cost-effectiveness. The reliance on specific manufacturers limits OLED’s long-term penetration rate in the VR/MR market.