Typically, market forecasts are based on penetration models and the latest report from Park Associates, “Virtual Reality: Disrupting the Entertainment Experience” assesses the purchasing intentions and use cases for US households in the coming years. Like all forecasts, this is highly speculative in terms of quantitative numbers but nevertheless shows a trend of increasing consumer interest in VR technology.

Park Associates estimates VR usage by application

Park Associates estimates VR usage by application

According to their results, 9% of US households are planning on buying a VR headset in the next 12 months. They see 24 million global broadband households owning a VR headset by the end of 2017, a number that will be growing to 77 million broadband households by 2021. In this time frame, the number of worldwide broadband households will be around 650 million (of 1.5 billion total households). 77 million households would equate to around 0.1%, hardly a hit in the way that the CE industry hopes. To put this number into perspective, it includes all kinds of VR viewers including the Samsung Gear VR that is by far the most bought VR headset in the US in 2016 (31%). The slow penetration is also due to a low overall familiarity of the consumers with the technology. Parks said that fewer than 13% have actually tested VR in person.

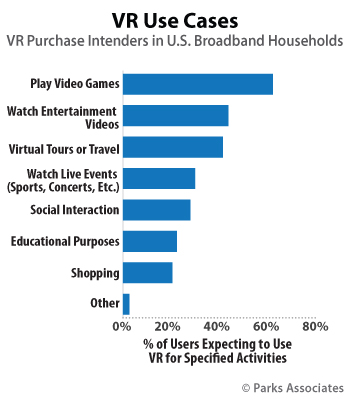

he report also looks at the use cases and concludes that gaming is the most anticipated application for VR followed by videos and virtual tours. These entertainment type applications are the most important applications with social media following on fifth place with about 30% of the potential buyers are planning to use it for that. (NH)

Analyst Comments

This is a different view of the VR landscape and the report acknowledges that the VR market is just in its infancy. The researchers also expect many changes to occur on the technical as well as content side before this technology will become an entertainment staple around the world. We can expect that the adoption in some countries will be faster than in others, depending on the regional and local conditions. The presented numbers don’t seem unrealistic high, instead showing a more moderate expected growth in coming years. (NH)