One of the “transformational technologies” at CES 2018 (sometimes called the darling of the industry du jour) was VR / AR technology. Both technologies came to CES complete with a conference track, a dedicated AR / VR Marketplace in the coveted LVCC South Hall and its own separate exhibitor category appearing on the CES downloadable smart phone app. We will start our coverage with a brief review of the some AR / VR market numbers presented by the CES sponsors, CTA plus more complete details from a recently published IDC market study (Nov 2017) to help us baseline the industry as we start the new year. Then follow up with some highlights from the AR / VR conference track at CES.

CTA Consumer Study Top Line

A recent VR – AR study done by Harris Interactive for Accenture was released during CES 2018 that we here at Meko covered recently in an article by Dr. Norbert Hildebrand (CES Market Forecasts and AR/VR Survey). The upshot of the report: Consumers are interested in virtual and augmented reality, depending on the use, as their research shows “…consumers are more interested in practical, daily-life applications and less in using VR or AR headsets to play games,” according to the CTA.

2018 forecast for VR $1.2B in revenue, with growth at 18% in the space on sales of 4.9M units, source, Consumer Technology Assoc. research

They also reported one more data series on consumer interest levels for VR / AR virtual or augmented reality applications:

They also reported one more data series on consumer interest levels for VR / AR virtual or augmented reality applications:

- 67% — Learning more about a place they are visiting

- 67% — Want to learn new skills or techniques

- 61% — To visualize how clothes might fit

- 58% — To view 3D manuals

- 54% — Want to shop for household items and furniture

- 47% — To play games

Consumers also appear to be attracted to wearable solutions. The majority (55%) of consumers said they would like to replace their smartphone with a wearable solution that has all smartphone functions via voice, augmented reality and hologram interfaces, (just don’t make it look too nerdy.)

The group surveyed a lot of people – 21K consumers from 19 different countries with online research.

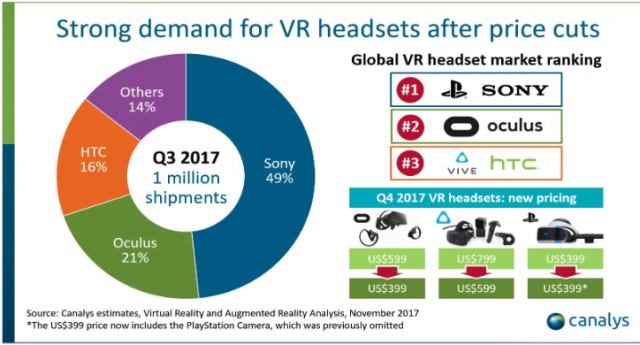

In Nov. 2017 Canalys said VR headset shipments quarterly total exceeded 1M units for the first time in Q3 2017. This came with help from Sony, that took the top unit ship spot with just under a half-million units (490K PlayStation PS VR) sets in Q3-17 alone. Oculus Rift numbers hit 210K with HTC Vive at 160K VR units. These three companies collectively make up 86% of the total market in Q3 2017. Sales growth came after significant price drops in all three leading technologies, indicating strong price elasticity in VR game headsets.

The IDC 2018 benchmark forecast Nov 2017 was published in a November 2017 report called the IDC Worldwide Semiannual Augmented and Virtual Reality Spending Guide with five year forecast numbers that look at the 2017 through 2021 period.

IDC forecasts combined worldwide revenue spend for AR VR in 2018 will hit $17.8 billion up from $9.1 billion, or 95% over 2017 spend. Thestudy from the market research company reckons to see this continued growth rate through the entire forecast period through 2021 with a compound annual growth rate of 98.8%.

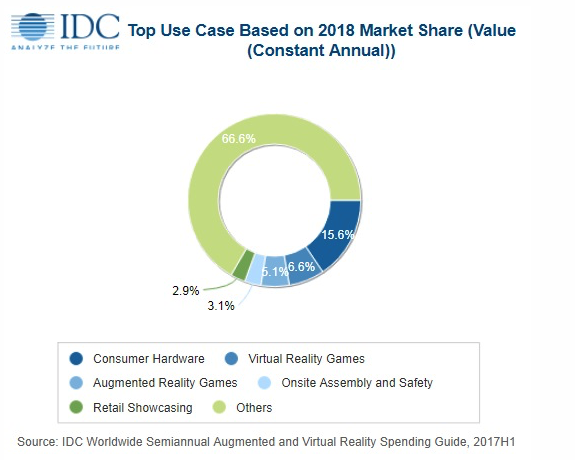

IDC VP, Tom Mainelli, expects a shift is coming from VR gaming and B2C sales that could continue to dominate up to the next 18 months, but B2B investment, and easily to justify ROI in the space will push the lion’s share of the market, going past the consumer sector in the mid-term according to the group.

“The consumer sector will remain the single largest source of spending for AR/VR products and services with worldwide spending in 2018 expected to reach $6 billion. Nearly three quarters of this total will be for VR hardware and software while AR spending will be dominated by software purchases. Gaming will be the dominant AR/VR use case for consumers throughout the forecast period. The five-year CAGR for consumer AR/VR spending will be 45.2% with total spending exceeding $20 billion in 2021,”

according to Mainelli at IDC.

But AR VR will see a shift to commercial sectors dominating with more than 60% of the spending that will boom to 85% by the end of 2021 according to the group. In 2018, you should look to Retail distribution to dominate the channels to market with a forecast of $4 billion spending (includes distribution in retail, transportation and professional services-see charts). For top applications, IDC says think, both in-store and online retail showcasing that alone should hit just under $1 billion in AR VR spending this year, and a forecast five year CAGR of 225% (wow.)

Process manufacturing in including construction is forecast at $3.2 billion in AR VR sending this year according to the group, “…with balanced spending across the process manufacturing, construction, and discrete manufacturing industries,” Mainelli said. Here the top applications for AR and VR will include onsite assembly and safety, process manufacturing training, and industrial maintenance, all areas with trackable ROI through increased productivity and increased safety. The technology can also document that correct maintenance procedures are followed, using head mounted recording / viewing systems. Finally, the public sector with also see healthy growth over the entire forecast period with a CAGR of 157% from 2017 – 2021.

Process manufacturing in including construction is forecast at $3.2 billion in AR VR sending this year according to the group, “…with balanced spending across the process manufacturing, construction, and discrete manufacturing industries,” Mainelli said. Here the top applications for AR and VR will include onsite assembly and safety, process manufacturing training, and industrial maintenance, all areas with trackable ROI through increased productivity and increased safety. The technology can also document that correct maintenance procedures are followed, using head mounted recording / viewing systems. Finally, the public sector with also see healthy growth over the entire forecast period with a CAGR of 157% from 2017 – 2021.

On the breakdown between VR and AR, IDC said look to VR to drive spending in the near term (the next 12-18 months) “…as both consumer and commercial use cases gain traction,” Mainelli said. The AR side “…will deliver more modest levels of spending near term with mobile AR on smartphones and tablets likely to get the most attention from consumers, (think Apple ARKit, and Google ARCore) while head-mounted displays will primarily sell into commercial use cases, …we should start to see developers beginning to grasp the potential of AR,” Mainelli concluded.

Digi-Capital Blog mobile AR VR

We found one more point of interest in benchmarking the space for 2018 and CES. Venture capital in the combined space is hot but with investor cash on the line – the category is incredibly focused. Case in point, a Digi-Capital research blog in December 2017 takes the AR VR categories a step further extending the space into computer vision and machine learning ( CV / ML ). That combined investment number topped out at $2.5 billion in 2017, $1 billion of which took place in the last quarter of the year according to their research.

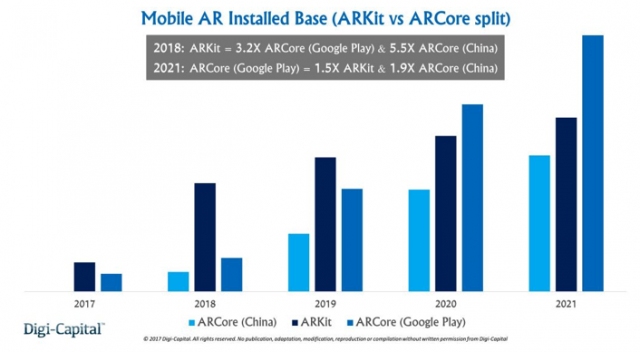

Digi-Capital sees the mobile AR development kits from the big three, Apple (ARKit), Google (ARCore) and Facebook (Camera Effects) leading to a 900 million installed base in the space. The number includes an impressive 600 million Apple ARKit enabled devices that the market research firm believes will dominate in the short-term. This is a powerful position for Apple, particularly since it is based on the historically high iOS software update adoption rate of Apple users. This gives a homogeneous platform for developers to target and a distinct advantage to Apple in the short-term in AR based application adoption over Samsung / Google based systems.

Digi-Capital sees the mobile AR development kits from the big three, Apple (ARKit), Google (ARCore) and Facebook (Camera Effects) leading to a 900 million installed base in the space. The number includes an impressive 600 million Apple ARKit enabled devices that the market research firm believes will dominate in the short-term. This is a powerful position for Apple, particularly since it is based on the historically high iOS software update adoption rate of Apple users. This gives a homogeneous platform for developers to target and a distinct advantage to Apple in the short-term in AR based application adoption over Samsung / Google based systems.

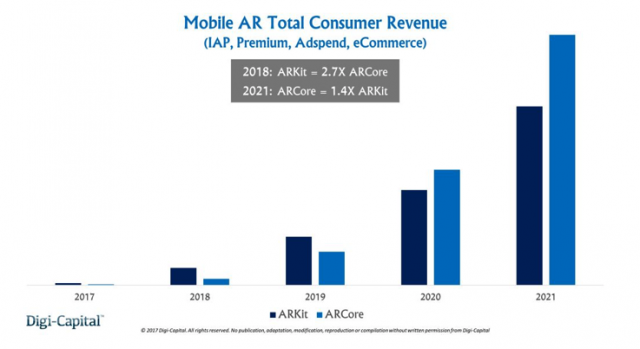

Long-term, the group expects Google and facebook systems running on the Android platform will begin to dominate as the older mobile devices are replaced by higher OS devices that support the ARCore software, see chart.

Most analysts also see the 2018 time frame as a learning period, where developers are looking to find just what works and scales up to needs of specific clients in niche vertical markets first. This is because the ROI, (return on investment) is currently driving the adoption of AR in the B2B space.

The group also make the point that for revenue return, look to mobile and ad spend as the driving forces. Think AR overlay of a McDonalds Big Mac deal on your Google maps or Waze driving app, just when your car get’s in proximity of those golden arches – and it happens just around lunch time. Pop goes the coupon on the display, complete with turn by turn guidance to the drive through window. Now that’s real progress… (If they would just serve gluten free buns…)

The group also make the point that for revenue return, look to mobile and ad spend as the driving forces. Think AR overlay of a McDonalds Big Mac deal on your Google maps or Waze driving app, just when your car get’s in proximity of those golden arches – and it happens just around lunch time. Pop goes the coupon on the display, complete with turn by turn guidance to the drive through window. Now that’s real progress… (If they would just serve gluten free buns…)

AR VR conference at CEA 2018

Game session at CES 2018 mostly talking heads, source: SechristAt the Monday AR – VR conference session at CES, the topics came under the Digital Hollywood track. Unlike SID conference events, the CES AR/VR conference was basically talking head sessions that included a group of panelists / experts and their opinions on the topic. No slides, or deliverables beyond this. The following are some highlights from the conference sessions.

In Gaming: The Killer AR/VR App proposes that both VR/AR “…have captured the gaming industry, …characterizing the technology as “…a transformative experiences,”. OK, we will go with the potential to be that way.

This session included moderator, Greg Potter, an analyst at S&P Global Market Intelligence who started off with remarks that VR gaming is still in the very early days. He sees this space taking off and moving to “10’s of millions of devices” in 2018 (global), and was quite bullish on the Sony PSVR headset with some 80M Sony game market as a total available market (TAM) and an attractive $199 price point.

Speaker, Johnny Monsarrat, CEO, Monsarrat (and pictured) said that freedom of motion (“walk around AR”) makes you happy, but the hardware is an impediment. He calls wearing headsets today a “fashion faux pas” with continued platform challenges. Presumably, this is why the B2B space (where one is paid to wear this stuff) will be more successful in the near term. He calls for more simplified platforms but recognizes the technical challenges that have resulted in the present waiting game.

Speaker, Johnny Monsarrat, CEO, Monsarrat (and pictured) said that freedom of motion (“walk around AR”) makes you happy, but the hardware is an impediment. He calls wearing headsets today a “fashion faux pas” with continued platform challenges. Presumably, this is why the B2B space (where one is paid to wear this stuff) will be more successful in the near term. He calls for more simplified platforms but recognizes the technical challenges that have resulted in the present waiting game.

Christina Lee from Google’s AR / VR content group said Google’s strategy is to incorporate the phone into other form factors. They are looking at VR (not AR) with the real world as the backdrop.

Don Daglow, CEO, 4thRing sees the small studio development approach, or what he called Indi (independent content makers), should be hardware agnostic and should be “mercenary” to go where the players are, and work to establish an emotional commitment from the gamers to keep them coming back and enhance engagement.

Everything is Transformed by VR/AR:Discuss….

In the session, Virtual Reality Transforms Media the premise of the session is that everything (TV, news, sports and music) is being “transformed by VR/AR” in both domains, programming and advertising. New technologies like 360 Video, (considered the first generation mobile VR/AR that doesn’t need a headset), will lead to a “revolution” in the space.

In this session, our moderator Seth Shapiro, governor of interactive media for the Emmy’s (TV academy of arts and sciences) was a no-show, so Paramount Pictures Corp.’s Ted Schilowitz took his place with a free form discussion on the topic.

Here, Tom Vance, studio co-head of Jaunt Studios sees the technology co-existing with current media formats rather than displacing it. Schilowitz agreed, but said what we are experiencing today is content that doesn’t really take full advantage of the technology. It’s kind of like the early days of TV where programming consisted of radio programs put on TV. It is not being done with any real thought of how to take full advantage of the medium.

In a revealing part of the session, Schilowitz polled the conference audience of 150 or so CES attendees on how many in the group currently own a tethered VR system? Next, how many in the group expect to purchase one this year. Surprisingly, (and to Schilowitz point) less than 25% responded positively to either question.

In a revealing part of the session, Schilowitz polled the conference audience of 150 or so CES attendees on how many in the group currently own a tethered VR system? Next, how many in the group expect to purchase one this year. Surprisingly, (and to Schilowitz point) less than 25% responded positively to either question.

“To really understand AR and VR you need to use it on a regular basis”, Schilowitz said.

The Augmented Reality Experience

The afternoon session on Augmented Reality looks at the advent of mobile AR development tools (Apple’s ARKit as an example)

With the release of Apple’s ARKit and Google’s ARCore, “AR has finally arrived…” In the form of millions of mobile consumers can readily access AR apps. The session notes reports this as a “…harbinger of things to come,” – we’ll see. At least the potential for the killer app is greatly enhanced so this year may indeed see the space really take off.

As expected it’s B2B that seems to offer the best case for ROI and early adoption. Panel speaker Natascha French, chief marketing officer at Vntana spoke of public sector adoption including military, plus in-house training given as an example. She cited 25% growth in both B2B and B2C in the space in 2018.

Mike Hildebrandt, VP corp development and partnerships at Daqri sees the entertainment value in AR as being much more easily created as you can use the real world as a backdrop. No high end graphics or precision optics are needed, he said, so the core technology gets to entertainment quicker. This can help justify investment with faster ROI and should make a significant impact on the space. He also sees large enterprise customers extending their workflow using VR.

ROI examples were also discussed by the panel including reducing a locomotive inspection turn-around from 48 hours down to 16 hours, (that’s a three day savings per inspection in both hardware down time and labor efficiency. Caterpillar was also mentioned with similar service reductions in heavy machinery service. Even when AR glasses cost up to $2750 each, and well out of reach of the average consumer, the technology investment is hard for industry to pass up.

On the B2C (business to consumer) front, Patrick Aluise, senior vp at Moviebill said he sees the moviegoer “going into the the world of the movie, …It’s evolved story telling,” according to Kevin Cornish, CEO of Conversive.

Conclusion

Each CES seems to feature a transformational technology or two that captures the imagination of show, remember Media center PC’s, 3D TV, HD DVD and Blu Ray players? Even HD was the darling of CES many moons ago. More recently we’ve seen initiatives like IoT, AI and self driving cars all dominating significant portions of the show floor while capturing a high level of journalistic attention and ink.

This year was no different from past focus technologies with AR / VR in full force. We are perhaps entering a benchmark year with new tools available on the most prolific mobile platforms from Apple, Google and Facebook. But all this takes time, yes, more time for developers to get things right, and just perhaps stumble on one killer app (or two) that will serve as a break-out technology for the AR / VR space. To that end, investors are looking to mobile AR and VR to drive the future investment cycle in the space with an added focus on both computer vision and machine learning. Mid to long term, look to retail to drive the AR B2B space with measurable return on investment expected.

On the back side, the conference session helped fill out the marketing numbers with real world experiences that confirmed (justified) what we saw in the benchmark market studies and even provided some guesses as to what may really gain traction going forward.

One last point, the conference sessions on AR and VR at CES brought a good group of panelists, but required little from them in the way of deliverables beyond talking heads. Even five key slides from each panelist would have greatly enhanced the conference for participants with some solid take-away’s from the diverse industries represented. Next year perhaps? — Stephen Sechrist