According to Counterpoint, UMC anticipates a positive demand outlook for OLED display driver ICs, contributing to a gradual improvement in the utilization rate of its 28nm node. By the end of 2023, the rate is expected to exceed 90%, supported by demand from OLED display driver ICs, digital TVs, and Wi-Fi 6/6E technologies.

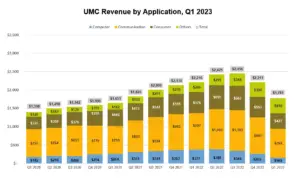

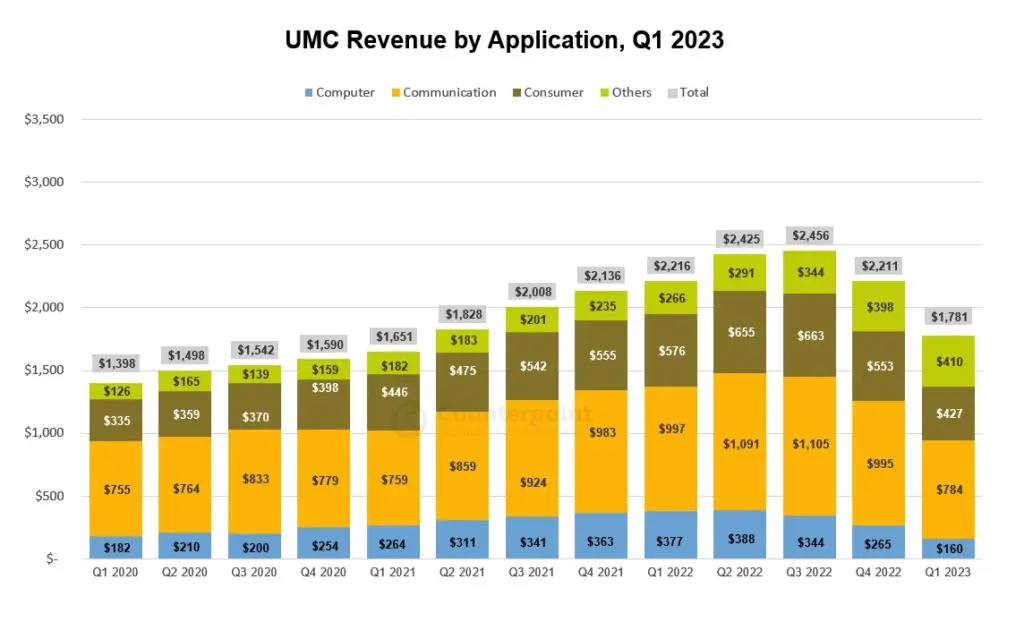

In other financial aspects, UMC reported a revenue of $1.78 billion in Q1’23, a decline of 14.5% YoY and 20.1% QoQ, attributed to weak wafer demand and ongoing customer inventory digestion. Although the automotive business segment showed growth and contributed 17% of the total revenue in Q1’23, it may have reached its peak in the same quarter. UMC plans to spend $3 billion on capital investments in 2023, allocating 90% for 12-inch wafers and 10% for 8-inch wafers. For Q2’23, UMC anticipates wafer shipment and ASP to remain flat, while retaining an optimistic outlook on 28nm demand and long-term growth trends in automotive applications.