The UK was the largest market for detachable tablets in Western Europe in Q1’16, says IDC, overtaking Germany. More than 300,000 units were shipped in the UK last quarter: 23% of the overall market in Europe.

IDC expects the UK to remain Europe’s leading detachable market in the short term. The launch of Apple’s iPad Pro will provide an additional boost to detachables and extend the form factor’s customer base. Apple is expected to reach a 21% market share.

Commercial demand for detachables has been fuelled by fast adoption of mobility solutions. Microsoft’s Surface Pro leads this segment, with a market share about 33%. Demand for mobile products, such as detachables and slate tablets, by UK businesses is ‘clearly outperforming’ their European counterparts, said IDC.

The iPad Pro was a significant boost to the consumer detachable market. It both marked Apple’s entrance to the market, and secured the vendor consumer leadership. However, the introduction of the smaller iPad Pro had limited impact on Q1 results, as it was only released in the closing weeks of the quarter. The price difference with the iPad Air will have a ‘limited impact’ at first, but eventually the 9.7″ iPad Pro will convince current iPad owners to upgrade – especially as Apple discontinues higher-specified iPad models without a keyboard.

Customers in the UK continue to favour phablets, as well, with sales up 35.4% YoY in Q1’16, to 1.6 million units. Although Samsung’s Galaxy Note created the category, it was Apple’s iPhone 6 Plus that brought it to mainstream awareness, says IDC’s Francisco Jeronimo. Apple currently holds about a 44% share of the European phablet market.

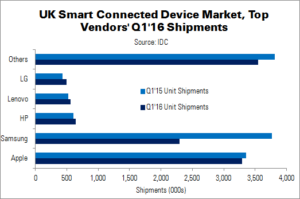

For the UK’s overall smart connected device market in the UK, Apple led with almost a 33% shipment share in Q1. Samsung came second – suffering from weak demand for regular smartphones and tablets. Together, these two vendors account for more than 50% of the UK’s SCD market.

HP, despite not having a mobile phone product, came third, recording single-digit YoY growth. This was largely thanks to good PC performance and strong results in the detachable and convertible space. Lenovo, in fourth, continued to grow in the consumer market, but did not perform as well with commercial customers – partly due to a poor YoY comparison. LG, in fifth, enjoyed triple-digit annual growth for its regular smartphones. Despite a fall in phablet shipments, the vendor still managed to gain some market share from Q4’15.

| UK Smart Connected Device Market, Top Five Vendors Q1’16 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’16 Unit Shipments | Q1’15 Unit Shipments | Q1’16 Share | Q1’15 Share | YoY Change |

| Apple | 3,287 | 3,357 | 30.4% | 26.9% | -2.1% |

| Samsung | 2,294 | 3,763 | 21.2% | 30.1% | -39.0% |

| HP | 642 | 606 | 5.9% | 4.8% | 6.0% |

| Lenovo | 558 | 524 | 5.2% | 4.2% | 6.5% |

| LG | 498 | 436 | 4.6% | 3.5% | 14.2% |

| Others | 3,543 | 3,808 | 32.7% | 30.5% | -6.9% |

| Total | 10,822 | 12,493 | 100.0% | 100.0% | -13.4% |

| Source: IDC | |||||