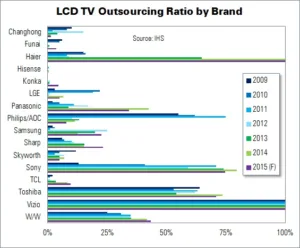

TV outsourcing will reach a record high this year, says IHS DisplaySearch. TV sets made by outsourcing specialists will represent 43% of LCD TVs shipped worldwide in 2015. Outsourcing is now one of the most important strategies for TV brands; it can improve both supply chain cost management and time-to-market business opportunities.

Constraints in TV panel supply are a major driver towards TV outsourcing, says Deborah Yang of IHS. Such a constraint “can cause TV brands to increase their outsourcing from vendors who are able to secure a stable and competitive panel supply”.

LCD TV panel supply was tight last year, especially for the popular 32″ size. This led brands to subcontract manufacturers, particularly in China. BOE and TCL were chosen for their semi-set outsourcing and OEM TV production in Q1’15. Both companies have direct access to 32″ panel supplies from their captive panel makers (such as CSOT).

Leading Korean TV brands (i.e., Samsung and LG Electronics) will maintain or lower in-house backlight module system (BMS) capacity, as well as production at overseas facilities (OEMs/ODMs). Capacity at ‘captive’ makers will be used for more mainstream products. UltraHD, curved, wide colour gamut and other high-end models will also be produced in these facilities.

According to Yang, most TV brands selling low-cost products plan to increase their outsourcing from vendors in Taiwan and China. Japanese brands’ businesses models are more complex, as they also license their own brands to subcontract manufacturers. “It is likely that other struggling TV brands may copy Japanese business models, in order to survive in the market”, she said.

Leading global brands have been lowering TV retail prices since late Q3’14, to capture more market share. They therefore have greater influence over TV panel supply; panel makers list them as first-priority customers.

Leading brands with a captive panel supply – such as Samsung, Sony and LGE – continuously gained share last year. There have been concerns over short panel supply this year, but leading brands have secured the allocations that they need to meet their (ambitious) annual targets.

“This situation has put pressure on profit margins throughout the TV supply chain, which will also stimulate the LCD TV subcontract manufacturing business”, said Yang.

Analyst Comment

The big TV brands have been using their purchasing power to gain competitive advantage – by buying a lot of panel capacity, they deny it to others. There is a risk in this strategy, if demand is too weak. However, in the end, this can be solved by cutting prices. It has never been easy to be a small TV brand, but this year it will be especially tough. (BR)